By Seema Shah, Chief Global Strategist, Principal Global Investors

U.S. inflation continues to rise at a blistering pace, reaching a fresh four-decade high at 9.1% y/y. Stubborn prices means the Federal Reserve (Fed) will need to hike even more aggressively—raising recession risk for early 2023 and exacerbating challenges for risk assets.

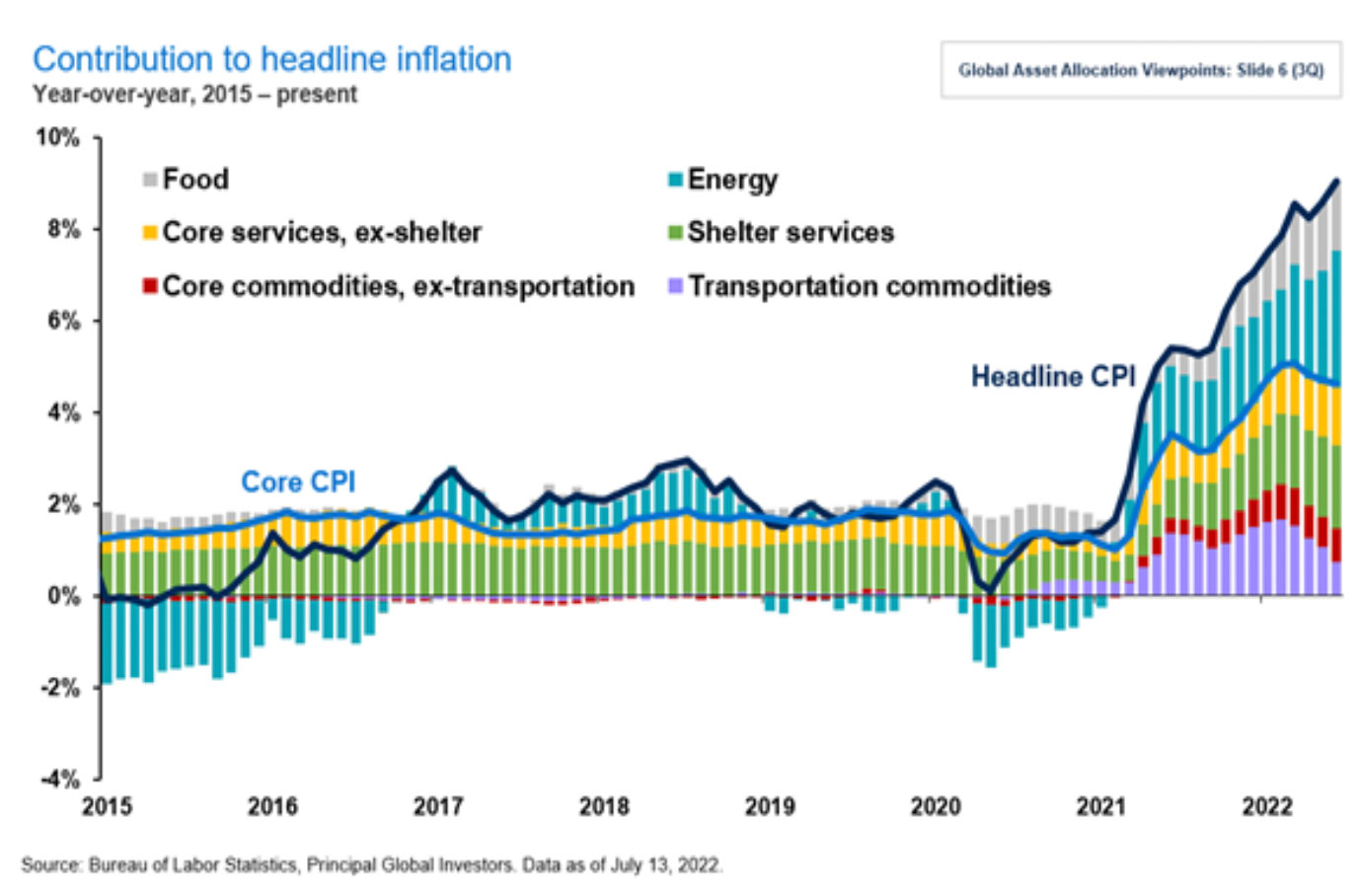

Headline U.S. CPI reached a fresh four-decade high at 9.1% y/y in June, surpassing even elevated expectations and firmly dispelling any lingering hopes that the Federal Reserve (Fed) could soon end its hiking cycle.While recent easing in commodity prices should provide some relief for the next few CPI readings, core CPI, which excludes food and energy, will likely remain uncomfortably high.

Also read: Inflation Now Versus 1960s/1970s Experience

- Worth around 40% of the core CPI basket, shelter inflation is particularly sticky. Since house price appreciation has yet to peak and typically takes around 18 months to flow into shelter inflation, this important component will likely be elevated for some time.

- Core services (ex-shelter) inflation is currently being bolstered by summer vacation spending. Although pressures may reduce in the autumn, a spending shift from goods to services is also characteristic of the post-COVID lifting of restrictions.

- Durable goods prices have shown surprising resilience to weakening economic growth. However, as households start to cut discretionary spending as recession approaches, the category is vulnerable to deflationary pressures.

Fed policy cannot directly impact food or energy inflation, while rate hikes so far have done little to slow core CPI components which are, traditionally, more responsive to monetary policy. As such, the Fed must continue hiking aggressively if it wants to get a handle on the inflation problem, even if it means speeding up a recession problem.