If there is one thing the RBA wants, it is for Australians to stop spending, easing pressure on the employment market and consumption according to Franklin Templeton.

“It is still early days, but signs are growing that the Australian consumer might finally be getting the memo. If that’s the case, it’s good news towards the task of cooling domestic demand and further adds to confidence that inflationary pressures peaked at the end of 2022 and will ease this year – a point made recently by the RBA’s Head of Economic Analysis, Marion Kohler,” said Chris Siniakov, Managing Director, Franklin Templeton Australia Fixed Income.

For the last six months, understanding the intersection of rate hikes, very poor consumer sentiment but still solid consumption has been challenging, he adds.

“Everyone knows rate hikes will work but, aside from the initial move lower in housing activity and house prices, it has been a game of waiting to see when tighter policy would actually start to bite everyday activity. Signs continue to appear that this is finally starting to happen,” said Siniakov.

Also read: Declining Fixed-Income Volatility Presents Opportunity

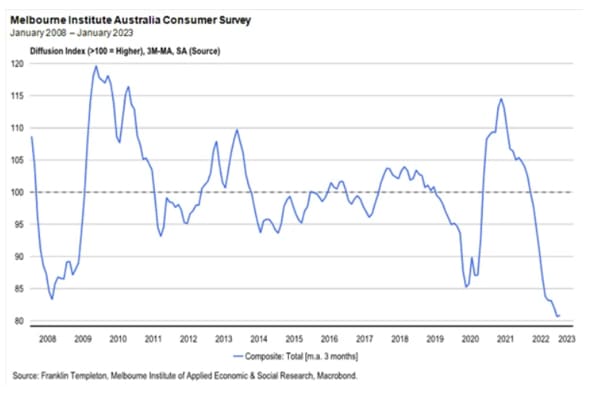

The chart below shows the Westpac-Melbourne Institute Consumer Sentiment Index which has been at or below GFC levels for several months.

“It’s not just weak, it’s deeply pessimistic and has never been so depressed outside of a recession”.

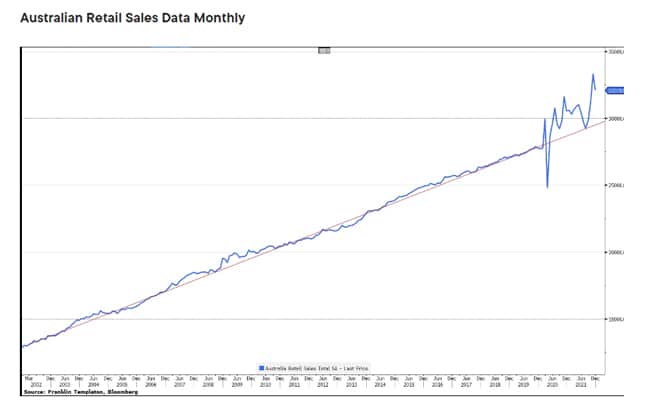

Despite this acute pessimism, Australian retail sales have been strong over 2022 as the liberated consumer has come out of lockdown and spent. The chart below shows the value of retail sales over the last twenty years with the trend. The blue line highlights how far spending surged in the pandemic lockdown. Most recently retail sales are showing welcome signs of cooling, potentially quickly. The December monthly print of -3.9% is the largest monthly fall since August 2020 when Victoria went into lockdown. It’s recognised that November saw somewhat of a pull forward in spending with the Black Friday sales promotional period but looking at the quarterly trend for retail sales, these rose by 0.9% for the entire fourth quarter, well down from 2.5% in the prior quarter. Core inflation was 1.7% over this period, suggesting that retail spending fell in inflation-adjusted or volume terms.

“In other words, take out price effects, and retail sales probably declined in the fourth quarter.”

The recent quarterly CPI however highlighted that whilst goods inflation has been slowing, spending on services has been strong. In fact, most of the upside surprise for the Dec quarter CPI is explained by Australians who went nuts on overpriced holidays. Recreation and culture boomed by 5.4% in the quarter, adding ~1/3 of the entire 1.9% CPI figure, making it the single largest contributor by a long shot.

“As of this writing, the terminal cash rate is projected to rise toward 3.75% though the timing is highly uncertain. We have and continue to argue that the current 3.1% level is already restrictive. Pausing now would still result in tighter policy as rate hikes continue to flow through and as a significant volume of fixed rate mortgages (more than 500k) mature in coming months seeing a sharp jump in borrowing costs for a significant proportion of borrowers. A recent report by Bloomberg Intelligence estimates that the impact of fixed rate mortgage maturities in 2023 alone is equivalent to 2.2% of retail sales. A significant number considering consumption still accounts for ~60% of total GDP.

“Further tightening will add to already restrictive monetary conditions, but as long as central banks remain of the view that overtightening is preferable to pausing too early, the risks of a sharper slowdown grow.

“We expect 2023 to show further evidence of a material slowing in consumption even as inflation trends down but remains above target. The ‘revenge spending’ on luxuries like travel will abate with consumers having got much of this out of their system in 2022.

“Getting the balance right without causing a more abrupt slowdown remains the difficult challenge. Granted, the December retail sales result is but one data release, but this is simply validating the forward-looking consumer sentiment data as it historically tends to do. The latest employment report which was also weak for December (-14.6k jobs) along with declining job vacancies also points to demand cooling.

“At this late stage of the cycle, it is any wonder markets continue to price rate cuts in early 2024. The extent to which the RBA decides to press on even as signs grow that hikes are biting, increases the risk that the much sought after soft landing is being bypassed for something bumpier. For those so inclined, it could soon be a terrific time to buy a second-hand jet ski,” says Siniakov.