A new partnership between bond broker Australian Bond Exchange (ABE) and financial markets software and services group Iress will enable Australian investors to digitally invest directly in Australian corporate bonds.

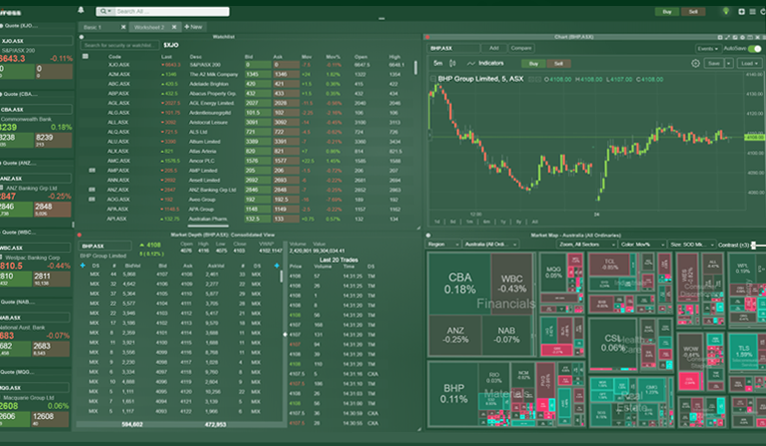

Under the agreement users of certain Iress products will be able to access all the bonds admitted to trading status on the Australian Bond Exchange platform through integration with Iress’ software.

The new electronic interface will remove inefficient, manual data entry processes, and provide the ability to view real-time pricing data, subscribe to data feeds and directly place execution orders.

Founded in 2015, the Australian Bond Exchange enables private investors to buy and sell corporate bonds in parcels as small as A$10,000 without the fees of managed funds or exchange-traded funds or the high costs of the over-the-counter market.

Chief Executive Officer and Managing Director of the Australian Bond Exchange Bradley McCosker said the ABE was giving investors access to opportunities previously the domain of large institutions.

“As the recent coronavirus-driven market volatility and the preceding Global Financial Crisis showed, the fact that private investors’ portfolios are dominated by equities exposes them to significant risks of loss of capital and income,” he said.

“During the GFC, bonds outperformed most other asset classes and that is also proving to be the case now.

“Increasing numbers of Australians are now entering retirement, and their ability to generate sustainable retirement income is severely compromised by substantial falls in their superannuation balances as a result of recent sharemarket volatility.

“By investing directly in bonds, Australians can now diversify their sources of income, reduce portfolio risks, and benefit from the security and peace of mind that bond investors enjoy,” McCosker said.

IRESS Managing Director, Financial Markets Kirsty Gross said the new electronic interface removed inefficient, manual data entry processes, making it easier for brokers to see their clients’ total position as well as place orders and receive execution messages from the Australian Bond Exchange.

“Driven by demand from users across our client base, we’re excited to have built a simpler, more efficient way to access the corporate bond market,” she said.