From Global X ETFs Product and Investment Strategist, Marc Jocum.

Investors today face a challenging economic landscape. In the wake of the Covid-19 pandemic, central banks attempted to curb inflation by raising interest rates at a pace unseen in decades. The resulting decline in real incomes – the fastest ever recorded1 – is adding financial strain and cost-of-living pressures to households across Australia and around the world.

These conditions are driving a surge in popularity in income investments such as fixed income ETFs, which offer more attractive yields and potentially a stronger value proposition for investors.

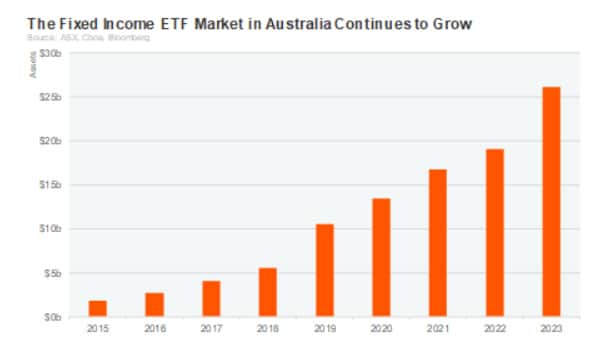

The fixed income ETF market in Australia is growing at a compound annual growth rate of 36.1% over the past five years to now be worth $26 billion, representing 15% of the ETF industry.2 Around $7 billion was allocated to fixed income ETFs in 2023 and we expect the momentum to continue in 2024 as yields have become more attractive and bonds are offering better diversification abilities.

Also read: Global Government Bond Fund Added

Market dynamics are shifting, with investors now viewing fixed income as essential ‘building blocks’ in diversified portfolios. Income ETFs can help preserve purchasing power and create a sustainable passive income stream – a key reason for their popularity with those seeking investment income to supplement current job incomes, given sluggish wage growth, and to diversify income sources.

Successfully navigating this turbulent economic landscape requires a focus on total return which encompasses both income and capital growth. Savvy investors are increasingly seeking to achieve this through a blend of growth assets like high dividend-yielding shares or covered calls, and defensive assets like U.S. bonds, to provide portfolio stability and help fill the income gap to meet cash flow needs.

As investors contemplate their financial strategies, a comprehensive approach that incorporates income, growth, and prudent diversification becomes essential for long-term financial resilience.

[1] Australian Bureau of Statistics (ABS) 2023

[2] ASX, Cboe as of December 2023