Interest rate duration is a key fixed income concept, as it measures the sensitivity of a bond’s price to changes in interest rates (or bond yields).

Duration risk stems from the fact that a bond investor makes a payment today in exchange for a series of future interest payments.

At the time of purchase, the bond’s price reflects the present value of that future stream of interest payments, which are fixed in advance. However, the next day if the general level of market interest rates (or bond yields) rises, that fixed stream of interest payments is no longer as valuable, as it is now below current market rates. Therefore, the bond needs to be discounted to attract new buyers, and the bond price drops accordingly. The opposite happens when bond yields fall.

The longer dated the bond (i.e. longer duration), the more future interest payments need to be discounted and therefore the more pronounced this effect. Hence, duration measures the sensitivity of a bond’s price to those fluctuations.

As an example, the bond indices can comprise a large number of individual bonds, each with their own interest rate duration risk, which is averaged to calculate the index duration. As the individual bond yields fluctuate, their prices move, causing the index value to also move. In the case of the AusBond Composite index, which has a duration of c. 6.2, if average bond yields fall by 1%, the index value increases by 6.2%, and vice versa if yields rise.

[Also Read: A Closer Look at Subordinated Debt]

Longer dated bonds carry more duration risk because their prices are more sensitive to changes in yield than shorter dated bonds. For example, a 10-year Australian government bond has a duration of 9.5 vs. a 3-year bond’s duration of 3.2, which makes the former three times more sensitive to interest rate movements than the latter.

A fixed income portfolio can therefore take more duration risk by holding a larger proportion of longer dated bonds. There are then two mechanisms by which increasing duration may increase the returns of a conventional fixed income portfolio:

1. Higher Yields

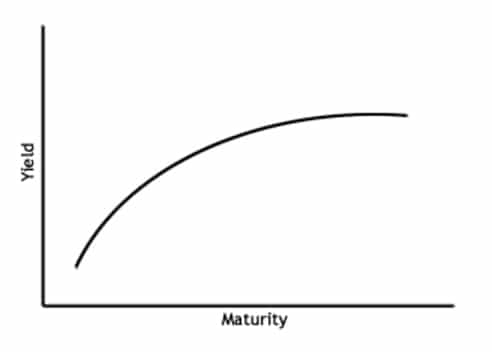

Bond yield curves are typically upward sloping, meaning longer dated bonds offer higher yields. Therefore, the yield of a portfolio can be increased by holding a higher proportion of longer dated bonds.

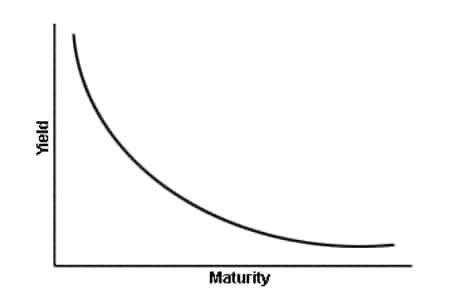

However, yield curves can be flat or even inverted, as in the US in 2019, meaning even long dated bonds that carry a lot of duration risk don’t offer much higher yields.

2. Price Movement

More duration exposure means more sensitivity to changes in bond yields and therefore greater profits (or losses) from bond price movements, depending on which way yields move.

As bond yields declined last year, duration was a strong tailwind for performance. However, that same duration risk can quickly reverse to cause losses if yields rise again.

With perfect foresight it would be easy to simply dial up or down interest rate risk to profit from fluctuations in bond yields. In reality, predicting the direction of interest rates is very hard to get consistently right because there are so many subjective variables and complex feedback loops involved.

Irrespective of which way you think yields may go from here, one inescapable fact is that as yields get close to zero, the risk vs. return trade-off from taking interest rate risk becomes asymmetrically poor.

When comparing fixed income investments, the amount of interest rate risk being taken can be assessed by the portfolio’s duration, which is a common metric disclosed in fund portfolio reports.

When evaluating performance of a bond or a fund ask yourself:

- Was interest rate risk a dominant driver of past performance?

- Is interest rate risk likely to be a headwind or tailwind for future performance?

- Where there is a heavy reliance on duration to drive performance, can a similar outcome be achieved more cheaply using a passive fixed income index?

To read more please see ‘Long Term Bonds – relative value and risk in a low yield world’

Article supplied by Ardea Investment Management