The fixed income universe incorporates an incredibly diverse range of strategies and approaches designed to deliver alpha returns. Very few target the sector’s ‘Fallen Angel’ bonds that have fallen out of favor and dropped from investment grade to sub-investment grade.

Global fixed income and risk management specialists Insight Investment has built a strong following in Australia and overseas for its systematic approach to fixed income that makes use of structured data, quant research and computing power.

Insight’s well-calibrated model can analyse the whole bond universe, quickly and repeatedly. This is a huge advantage in a market with thousands of bonds – where a traditional active manager is limited by credit analyst coverage and research time.

Insight Investment Head of Systematic Fixed Income Paul Benson is holding an exclusive Free webinar for institutional investors on July 25.

The Systematic Approach Explained

Insight Investment first developed a systematic approach to high yield bond trading back in 2012, so have more than a decade’s results to validate their approach. During this time, they have consistently seen attractive returns from ‘Fallen Angels’, bonds that were investment grade but have dropped down into sub-investment grade.

Insight reasons that while global high yield bonds are appealing for their high income, investing in both passive index funds as well as discretionary active managers has shortcomings. Passive investment tends to deliver:

- below index returns

- volatile bid/offer spreads

- expensive fees.

Active managers using a traditional, discretionary approach have generally not been able to consistently meet, let alone outperform, the broad high yield benchmark after fees.

An intelligently designed systematic approach can potentially mitigate these shortcomings and provide better exposure to the asset class.

Head of Systematic Fixed Income and Portfolio Manager at Insight Investment, Paul Benson said: “The company’s proprietary models aim to identify fundamental value and mispricing opportunities, allowing us to tilt portfolios towards the most attractively priced bonds, and away from bonds where expected returns do not justify the risks.

“We can build portfolios with numerous active ’micro positions‘, rather than the large, concentrated positions common in most traditional fundamental active strategies. We also target often fleeting alpha opportunities in less liquid bonds.

“Our systematic strategy is likely to create a uniquely-structured portfolio. For example, our High Yield Alpha strategy has an alpha correlation of less than 0.25 with 90% of the fundamental active US high yield manager universe, and a negative correlation with 60% of it.

“Key to our approach is integrating portfolio management, research, and trading disciplines within a single team to challenge conventional thinking. This helped us develop our proprietary trading protocols and create ‘implementable research’.”

Buying the Dip

Insight’s fallen angel strategy buys sub-investment grade bonds when investment grade only portfolio managers are forced sellers. While buying is counter-intuitive as prices drop quickly, the market often overreacts and excessively depressed prices can readjust quickly, providing excess return.

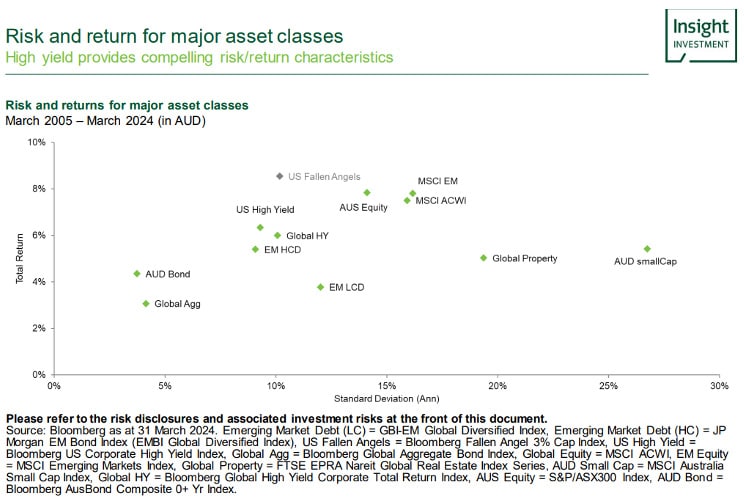

Studying a range of indices from March 2005 until March 2024, Insight found that the Fallen Angels Index total return outperformed many other investment categories, including Australian equities, even though fallen angels were lower risk (standard deviation). Risk was very similar to the Global High Yield Index, but return was improved by more than 2% p.a. as shown in the graph below.

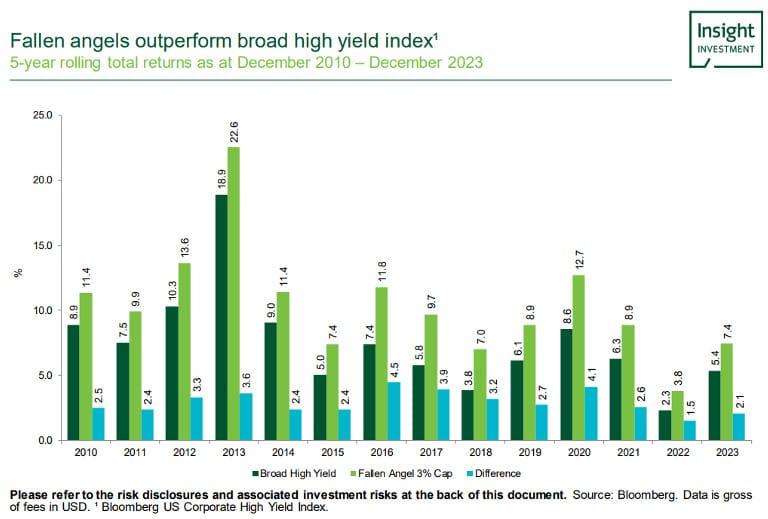

The US Fallen Angel Index began back in 2005 and this category has outperformed the Broad High Yield and Liquid High Yield categories over every five year rolling period.

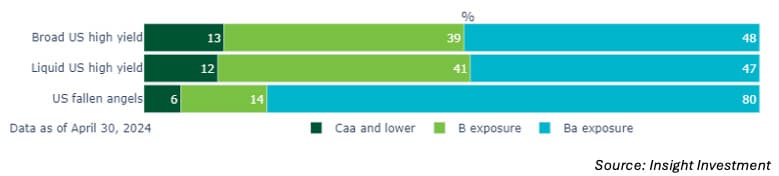

As at 30 April 2024, the Fallen Angel Index currently has higher credit ratings than either High Yield or Liquid High Yield category indices.

Insight’s US high yield strategy has a decade-plus track record of aiming to match the broad US high yield index net of costs and charges.

Benson said allocating to high yield with an emphasis on fallen angels can enhance a high yield strategy.

To learn more, register to hear Paul Benson, from Insight Investment, present a webinar next Thursday 25 July.