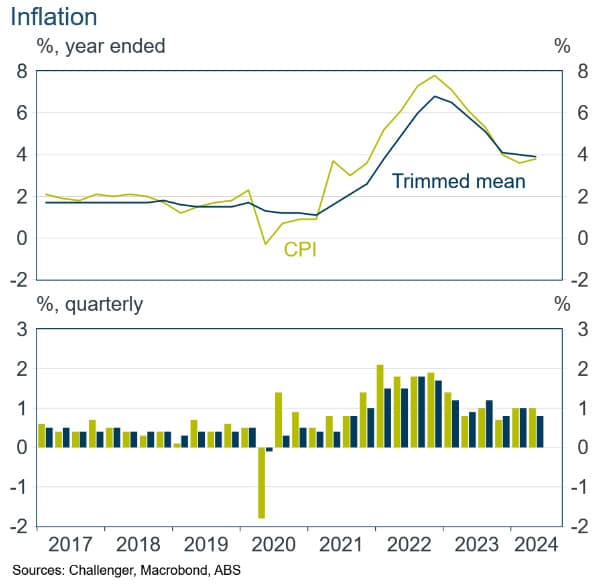

You really need to squint to see the slowing in inflation data released on Wednesday. CPI inflation for the June quarter was 1.0%, the same as the previous quarter, with the year-ended rate ticking up to 3.8%. The trimmed mean rate of inflation came in at 0.8% in the quarter, a step down from 1% in the previous quarter, with the annual rate slowing to 3.9%. (The trimmed mean removes the largest and smallest movements of components of the CPI to produce a less volatile series more indicative of price pressures.)

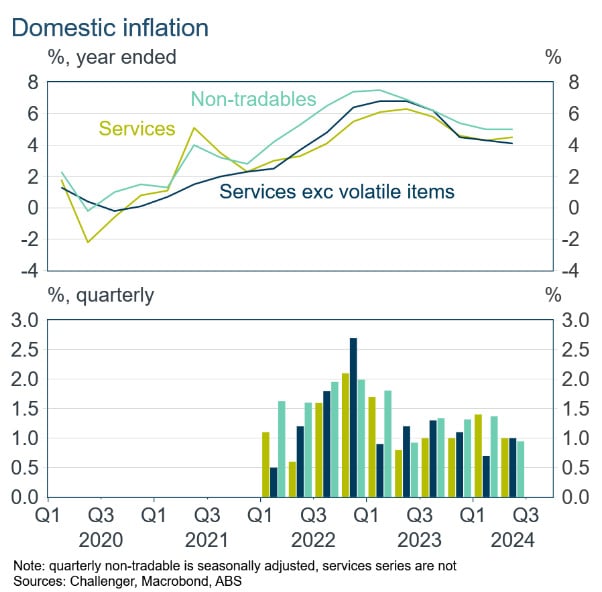

Inflation from offshore abated over 2023 as supply chain blockages were resolved and energy prices fell. That left domestically generated inflation as the problem. But domestic inflation is proving to be persistent with key measures of annual inflation around 4-5%. That needs to slow further to no more than 3% if the RBA is going to achieve its 2.5% inflation target (balanced by slower inflation for traded items which include more goods and fewer services).

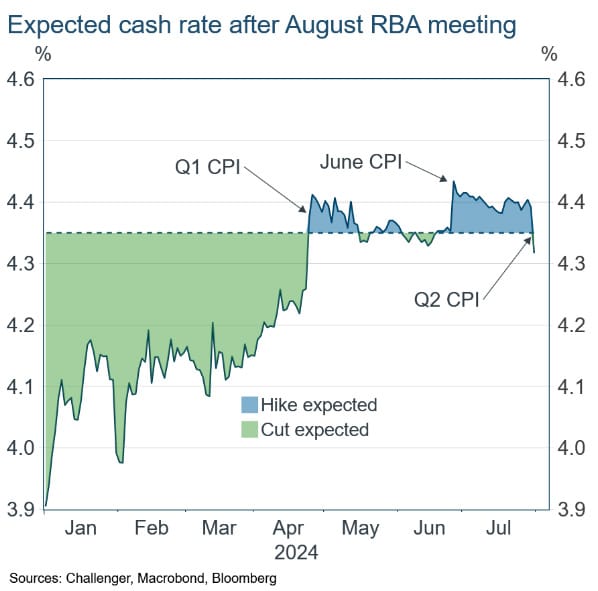

However, some of the inflation data released today were lower than expected. While quarterly CPI inflation was as expected, trimmed mean inflation at 0.8% was less than the 1.0% expected by economists. As a result, financial markets reversed their view that the RBA may increase rates at the August or September meetings, and now expect no chance of a rate rise with the first rate cut now fully priced in by February. This sharp fall with the today’s CPI release followed equally large increases in rate expectations following higher than expected inflation in the March quarter and month of June CPI releases.

Also read: Australian Credit Market Strategy – Subdebt Set to Outperform

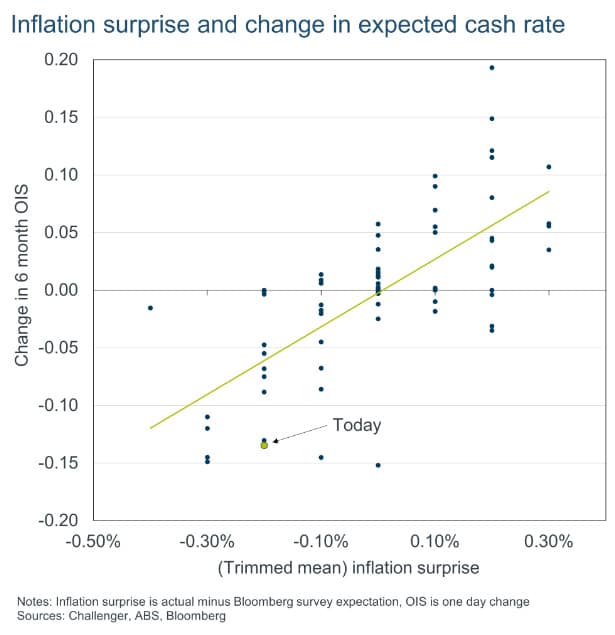

Inflation outcomes have a big impact on the RBA’s forecasts for inflation and so the market’s expectations for the cash rate. Higher than expected inflation results in an increase in expectations for the cash rate over the coming month. Conversely lower than expected inflation lowers cash rate expectations. Even given this historical relationship, the move in interest rates from today’s inflation surprise was, well, surprisingly large. Taking into account that CPI inflation was as expected, and trimmed mean inflation 0.2% less than expected, the change in the expected path for the cash rate was almost three times larger than the historical relationship would suggest.

Markets certainly were relieved by the lower than expected inflation. The RBA won’t hike next week and almost certainly the cash rate has peaked. But with domestic inflation only slowing very gradually, rate cuts are not likely to come until well into next year and will be modest when they do come.