Jerome Powell, the FOMC and most investors must be feeling a bit like this after the latest US inflation data:

Fears of an inflation resurgence earlier in the year have been allayed somewhat. Annual inflation edged back down from 3.5% to 3.4% in April, and core inflation (which strips out food and energy prices) is resuming its decline.

Here is a chart to illustrate:

Hooray, inflation doesn’t look like it is re-accelerating.

But there was another less watched and still important piece of data that was released. That was retail sales, which was flat in April, and weaker than an expected 0.4% rise.

Retail sales data is not as important as the CPI data in determining the outlook for inflation and interest rates, and it is only one month’s data. But it provided an early signal of weakness in consumer spending.

It has been the resilience of consumer demand is likely one factor propping up inflation.

LISTEN: PODCAST: Is 2024 the year of the bond? with Janu Chan from Bite-Sized Economics

Indeed, at the press conference of the last FOMC meeting, Chair Powell downplayed the recent weakness in GDP in the first quarter (which slowed from an annualized 3.4% to 1.6%) and noted that private domestic demand and consumer spending were still strong.

Some weaker consumer spending could be that missing piece which helps to bring down inflation.

That being said, it is still too early to say that there is enough confidence that inflation is coming down.

Near-term indicators continue to point to sticky inflation:

We’ve seen higher oil prices:

Respondents in surveys are reporting higher prices:

Risks are that inflation could stay elevated, at least in the near-term.

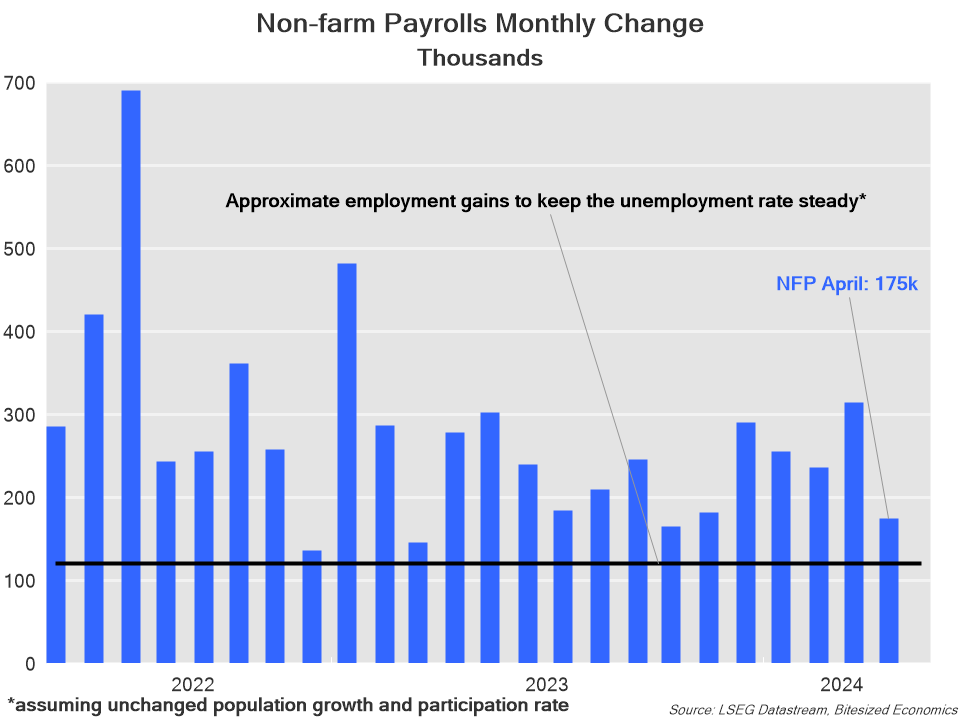

Moreover, while the labour market has weakened, it still has not weakened sufficiently:

Employment gains are still above the sort of gains which are consistent with a steady unemployment rate, which is estimated at around 110k to 120k per month.

It also makes sense why Jerome Powell and other members of the FOMC would still not have sufficient confidence to reduce interest rates any time soon, even though inflation appears to be on the right track.

In this newsletter, I have highlighted the likelihood that there were two components to inflation. One part of inflation which would come down because of supply constraints during the pandemic. However, the other part of inflation, was more related to the strength of demand in the economy, and harder to come down. This is the more sticky part of inflation which appears to be lingering today.

It is becoming clearer that we will need to see weaker growth and employment, in order for inflation to come down. It’s a theme that is being recognised by FOMC members more recently. We are starting to see those signs, but not enough to say it will bring inflation back to 2%.

For now, it appears as though the majority of the FOMC is willing to wait, and there is good reason to do so. The labour market and prices do tend to lag overall economic activity, so it might just be a matter of time before that “confidence” is gained, and without needing to tighten policy further.

Investment Implications

The narrative of “higher for longer” (interest rates) remains intact with a likelihood of Fed rate cuts beginning later this year. But there continues to be a risk of inflation overshooting expectations further in coming months, especially with only tentative signs of weaker domestic demand and the labour market. The data dependence of the Fed means that inflation bumps could be buying opportunities for bonds and risk-based assets, and vice versa for inflation dips.