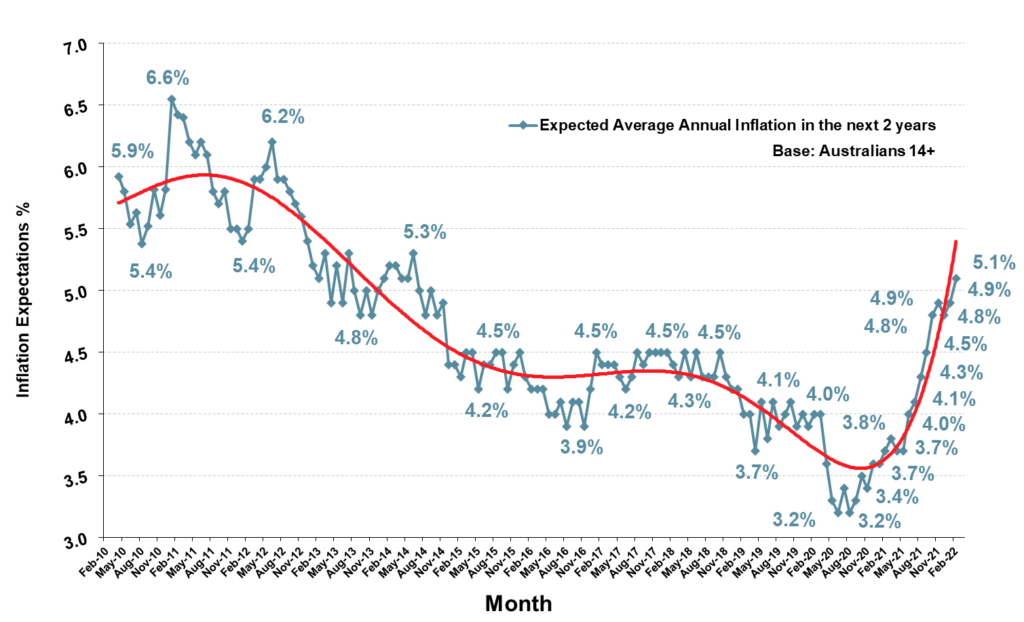

Roy Morgan research has found that in February 2022 Australians expected inflation of 5.1% annually over the next two years, up 0.2% points from January 2022.

The level of Inflation Expectations in February is the highest for nearly eight years since June 2014 (5.3%).

Inflation Expectations are now 0.4% points above the long-term average of 4.7% and a large 1.4% points higher than a year ago in February 2021 (3.7%).

Inflation Expectations Index long-term trend – Expected Annual Inflation in next 2 years

Roy Morgan CEO Michele Levine said inflation expectations reaching the highest level in nearly eight years largely before the Russian invasion of Ukraine led to rapidly increasing energy prices.

“The Russian invasion of Ukraine, which began on Thursday February 24, has caused a round of heavy sanctions against Russian exports and led to a surge in the price of key commodities including oil, gas, coal, wheat and other foodstuffs,” Levine said.

“The price of a barrel of oil has now exceeded $150 AUD since the war began and the upward pressure has already seen petrol prices increase beyond $2 per litre in many parts of Australia. If the war continues, petrol prices could well go far higher over the next few months.

“Although the latest ABS quarterly Consumer Price Index showed Australian inflation rising by only 3.5% over the 12 months to December 2021, this figure is set to rise during 2022 – and especially now with the increasing geo-political tensions in Europe and the heavy sanctioning of Russia.

“The biggest concern for the Federal Government as it faces re-election is that wage growth is not keeping up with inflation. The latest ABS Quarterly Wage Price Index shows an annual increase of 2.3% for wages over the 12 months to December 2021 – more than 1% points below the inflation rate.

“The risk of a spike in inflation in the next few months increases the likelihood the RBA will raise interest rates earlier than initially forecast. Although the RBA has consistently stated that it has no plans to raise interest rates until wage growth in Australia is ‘sustainably above an annual rate of 3%’ the new economic disruptions caused by the conflict between Russia and Ukraine will cause a reassessment if they mean prices persist at a higher-than-expected level over the next few months.

“However, although the rising inflation will cause a political headache in the run-up to the Federal Election due in mid-May they are likely to avoid the prospect of the RBA raising interest rates during the middle of an election campaign which may be of small comfort.”