Globally, central banks are starting to cut interest rates, New Zealand and UK have both cut and cuts look imminent in the US. Our cash rate, currently 4.35%, never reached the same highs as those three countries and a rate cut looks a long way off. In case interest rates unexpectedly rise and for diversification, floating rate bonds are worth exploring.

This article updates Three Floating Rate Bond ETFs – FLOT, QPON, SUBD, published in September 2022 and compares three floating rate ETFs.

Each of the three ETFs offers exposure to floating rate bonds, where income is revised quarterly and linked to the Bank Bill Swap Rate (BBSW). Depending on interest rate expectations, BBSW will rise and fall, so too will your income.

VanEck Australian Floating Rate ETF – (ASX:FLOT)

FLOT invests in investment grade, floating rate bonds and each security must have an investment grade credit rating from either S&P, Moody’s or Fitch and have a minimum outstanding value of $100m. Bonds must have at least one month to maturity.

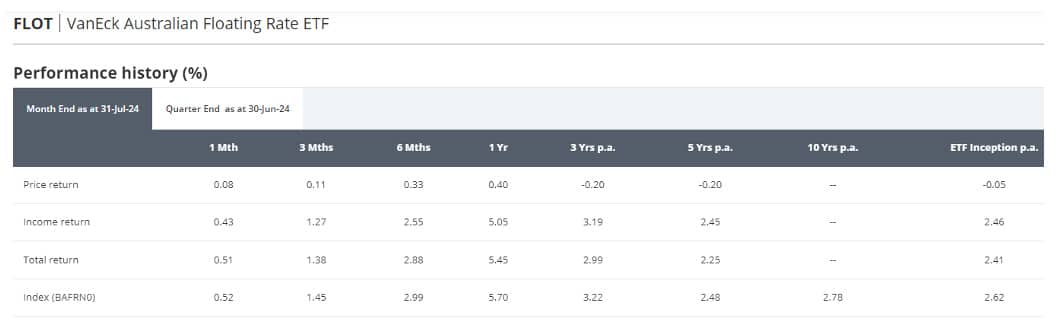

FLOT aims to provide returns that closely track the Bloomberg AusBond Credit FRN 0+ Yr Index (BAFRN0).

The fund is concentrated, with 93% of investment in financial services bonds. While all the bonds are issued in Australian dollars, some of the companies are domiciled overseas. Australian companies dominate with 86.8% of securities, 4.2% from Canadian companies and a range of other countries make up the remainder, including France 1.8%, South Korea 1.4% and UK 1.3%.

Yield to maturity, that is the expected yield if all the bonds are held to maturity, is 4.48%pa as at 26 August 2024. Remember that floating rate bond yields recalculate on each coupon payment date every 90 days, so this yield is not absolute, but projected.

Also read: BlackRock Launches iShares 20+ Year U.S. Treasury Bond ETF

Running yield, the expected yield if you buy and hold the bond for the next 12 months, is 5.29%pa.

Positively, the average maturity term in years is 2.28 years. Modified duration, which tells us exposure to interest rate risk, is very low at 0.13 years.

Key points to note, as at 26 August 2024:

- Inception date – 5 July 2017

- Net assets – $771.3m

- Number of holdings 202

- Management costs – 0.22%

- Average Credit rating AA-

- Income frequency – Monthly.

Betashares Australian Bank Senior Floating Rate Bond ETF – (ASX:QPON)

QPON differs from FLOT in its requirements to be included in the fund.

Eligible bonds must have at least $500m outstanding and a term to maturity of 1 to 5 years. Up to 80% of the portfolio is allocated to ‘big 4’ Australian banks (equal-weighted) and 20% of the portfolio allocated to other major Australian banks. Current eligible banks are classified into two bands:

- Band 1: ANZ Bank, Commonwealth Bank of Australia, National Australia Bank, Westpac

- Band 2: AMP Bank, Bank of Queensland, Bendigo & Adelaide Bank, Macquarie Bank, Members Equity Bank, Suncorp-Metway

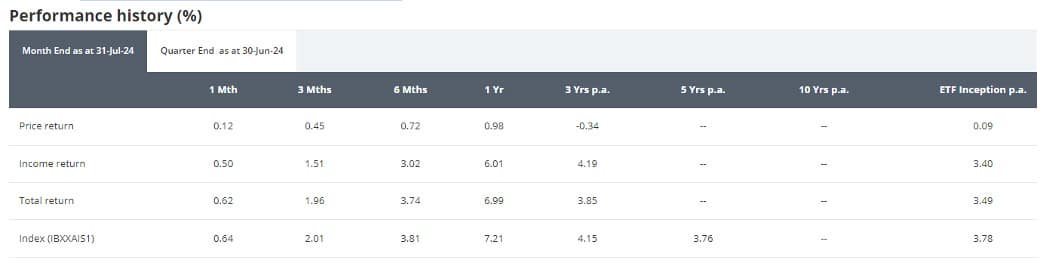

QPON is very low risk and has a high AA- credit rating, the same as FLOT, so the yields should be similar. Yield to maturity is 4.38%pa, as at 27 August 2024, while running yield is 5.27%pa. However, average maturity is close to double FLOTs at 4.09 years.

QPON is highly concentrated being 100% in Australian banks, tracks the Solactive Australian Bank Senior Floating Rate Bond Index and invests in just 14 securities.

Key points to note as at 27 August 2024:

- Inception date – 1 June 2017

- Net assets – $1.49 billion

- Number of holdings 14

- Management costs – 0.22%

- Average Credit rating AA-

- Income frequency – Monthly.

VanEck Australian Subordinated Debt ETF – (ASX:SUBD)

SUBD invests in higher risk, subordinated floating rate bonds, so has the most attractive yields. As at 26 August 2024, the running yield was 6.20%pa and yield to worst was 5.10%pa. Yield to worst is used for callable bonds where the issuer can repay investors on a range of dates. It assumes the bond is called at the worst possible time.

Like FLOT the fund is concentrated in the banking services sector with an 83.7% allocation and like QPON has a relatively small number of holdings. However, 3.3% of holdings are domiciled in UK, giving the ETF some geographical diversification.

The average maturity is 8.15 years, much longer than FLOT and QPON, another reason investors would expect higher returns.

SUBD tracks the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index. The index only includes AUD denominated floating rate bonds issued by financial institutions that qualify as Tier 2 Capital under APRA’s Rules (or equivalent foreign rules), and which hold an iBoxx credit rating of investment grade. These securities rank ahead of hybrids.

Key points to note:

- Inception date – 28 October 2019

- Net assets – $1.83 billion

- Number of holdings 30

- Management costs – 0.29%

- Average Credit rating A-

- Income frequency – Monthly.

What has changed in the last two years?

All three ETFs have experienced significant cash inflows. SUBD is the most notable rising by more than 6 times from $283 million to $1.83 billion, QPON by almost 3 times from $577m to $1.49 billion and FLOT, by almost 2 times, from $392m to $771m. Combined, funds invested in the three ‘floaters’ has risen by more than 3 times or 326%.

Commonly, the ETFs have improved yield to maturity and running yields, so are more attractive than what they were, while they have also increased the number of holdings.

Both QPON and SUBD have had credit rating upgrades, so perceived market risk is lower than what it was two years ago.

Summary

Floating rate bonds can help protect your portfolio from rising interest rates and inflation, as well as diversifying your portfolio. Importantly, these three ETFs offer access to bonds that are not readily available to retail investors. There is no minimum amount to invest and any investor can buy the ETFs through the ASX.

Note: This article is for educational purposes only and none of the funds mentioned are recommendations.