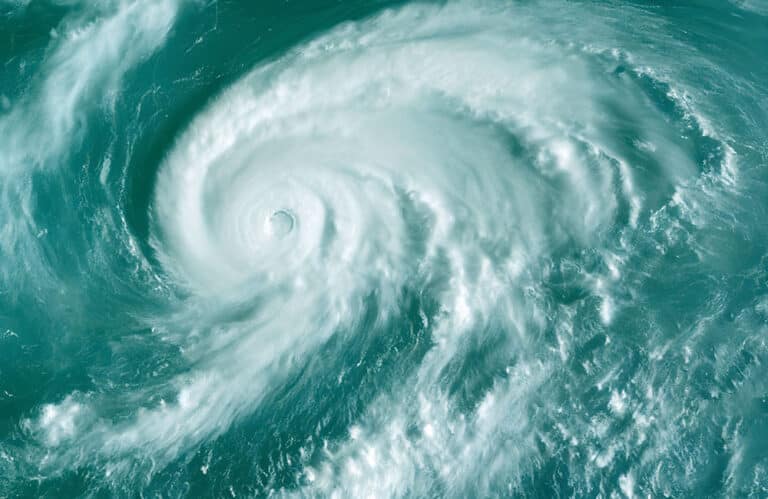

From Martin Rea, Senior Consultant, JANA Investment Advisers about the impact of Hurricane Milton on the Catastrophe Bond Market.

-

Martin Rea, JANA Investment Advisers The worst seems to be over. Hurricane Milton made landfall in central-western Florida as a Cat 3. It has caused severe wind and flood damage but has now passed into the Atlantic Ocean where it should dissipate by tomorrow.

- The damage is less than expected. Initial estimates suggested the economic cost could reach US $100bn but initial modelling suggest the loss is ~$30bn mark – with Cat Bond manager estimates ranging from US$15 – 60bn.

- The storm surge cost is less than expected, and less than Hurricane Ian so flood related damage is also expected to be lower and below most attachment points.

- The impact to the Cat Bond market is likely to be less than 5%. Cat Bond manager estimates are that the hit to the Cat Bond market is likely to be in the 1 – 3% range. It’s still very early though. By comparison Hurricane Ian losses were 9%.

- We do not expect to see significant outflows from the Cat Bond market. The hurricane season is close to an end (November), the Cat Bond market is already up 13.7% on the year and all in yields are above 11%.

Also read: Hard To Be Gloomy

- There could be ramifications from Hurricane Helene & Milton. These were two very big hurricanes in terms of size, formation, and intensity:

-

- It could impact the few remaining local Florida insurers – most private insurers have already left the region but this final few could face a difficult period potentially leaving the State (Florida Citizens) as the insurer of last resort.

- Insurance premiums will likely be increased. This may raise attachment points and possibly yields on new issue Cat Bonds.

- Climate change has been a notable discussion in the media. If there is one silver lining from these otherwise tragic events it is that it has significantly raised climate change awareness and its impact.