I’m not sure how others remember the first Trump presidency.

For me, I felt like I needed to be prepared for anything. And like anyone in financial markets, checked Twitter constantly to see what crazy thing Trump may have said that may have moved markets.

It was usually an initial shock and awe at what Trump tweeted or said, which tended to be something extreme. Recall the alarm from pressuring the Fed to lower interest rates, which for good reason is supposed to main independence from government and threatening to start a nuclear war with North Korea.

Later on, there would be a period of rationalisation – either thinking that Trump is exaggerating, what he’s saying isn’t possible or that the policy in question be more toned down than initially suggested.

It’s already looking like a similar story for Trump 2.0. Just think of some of Trump’s decisions, such as deporting as many as 1 million people a year or cutting government spending by $2 trillion.

After grabbing all the media headlines, the experts then weigh in and highlight the difficulty in realistically achieving that outcome.

This pattern of shock and awe and then later rationalisation, provides some predictability of what the Trump presidency is going to look like, even though markets are set to become a whole lot more volatile.

Also read: Markets Embrace Prospect of Smaller Government

Additionally, we have also been here before – we have a blueprint. In a nutshell, Trump’s first presidency was characterized by tax cuts, anti-immigration and protectionist policies.

That suggests a strong US dollar, optimism over short-term economic growth and a potential inflationary impact.

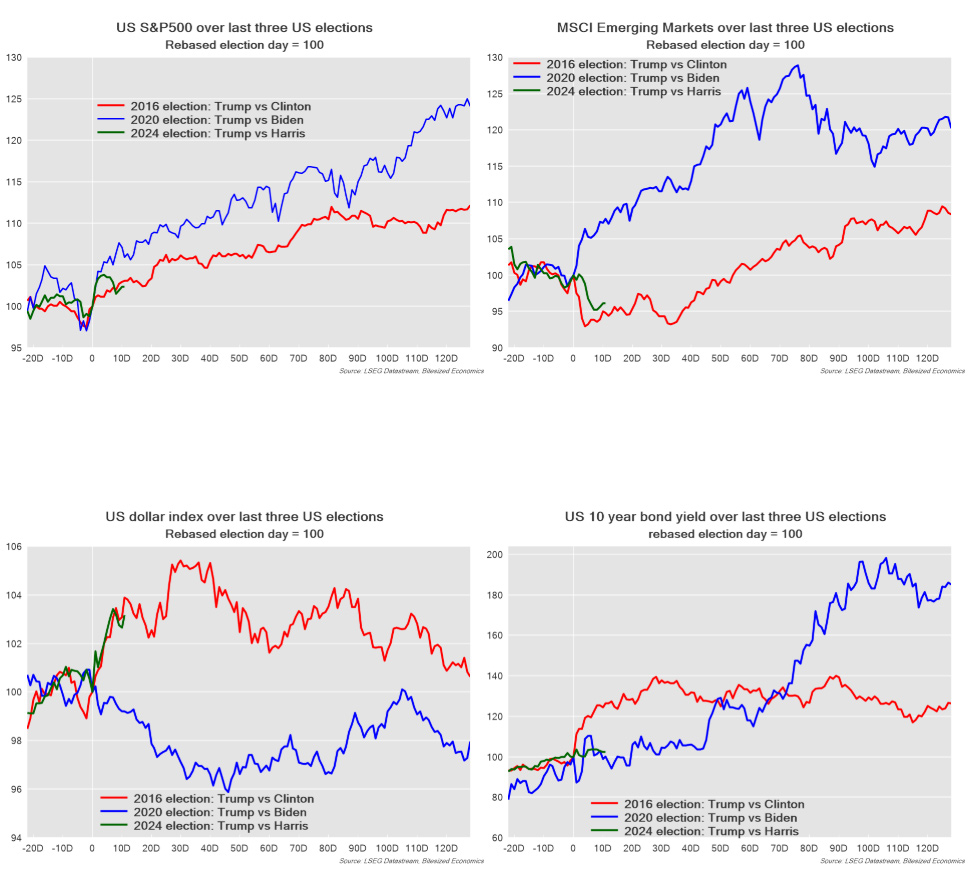

It’s uncanny how similar financial markets have moved in comparison to the 2016 election:

The US dollar, US equities and emerging market equities have all moved in a similar trajectory to post the 2016 election. The exception appears to be US bond yields, although yields are still higher despite 75 basis points of rate cuts from the Fed in the last few months.

So, should we treat Trump 2.0 differently?

Like the first presidency, we’ve had promises of tax cuts, anti-immigration and protectionist policies.

Tariffs are set to feature heavily. It is the impact of tariffs which has the world outside the US, on edge. And when it comes to trade policy, it would be fair to expect that more tariffs will be imposed.

Indeed, the tariffs in Trump 2.0, particularly the up to 20% blanket tariff on all imports, would have a much larger impact than Trump’s first round of tariffs, although how it would impact that is more contentious.

When it comes to US inflation, there may not be a substantial impact on overall prices from tariffs, because any tariff increase would be offset by a stronger US dollar. This is especially the case if Trump imposes tariffs across all imports.

Additionally, tariffs would also have a negative impact on economic growth, as they create uncertainty for businesses. There is also a damaging impact of tariffs on the economy over the longer-term as tariffs, like most protectionist policies, diminishes productivity.

That tends to be the case for government policy decisions. The impact of which tends to occur over a longer period, well beyond office terms.

Nonetheless, some observers highlight that the proposed tariffs would be used more as a negotiating tool with other countries and so might be scaled back at a later date.

Trump’s tax cuts are also adding to inflation concerns but large-scale spending cuts, if imposed, would work in the other direction.

Much like the first Trump presidency, the protectionist policies are seen as being inflationary and tax cuts are expected to support short-term growth. But the inflationary impact is likely to be overplayed given pressures to rein in the US budget and talk of spending cuts. Moreover, price hikes due to tariffs would tend to be offset by a rising US dollar.

Investment Implications

With Trump making tariffs the centrepiece of his administration, and possibly imposed on a much larger scale than they were with Trump 1.0, US dollar strength could have further to run. That might suggest further outperformance of US equities compared to elsewhere around the world, including emerging markets at least in the near-term.

We also may me see a more muted impact on growth and inflation because of some emphasis on spending cuts. That suggests that US bonds could be oversold, especially at the longer end.

Of course, be prepared for policy reversals so make volatility your friend.

But the unpredictability of what a Trump presidency may bring may not be so unpredictable after all.