Phil Strano, Portfolio Manager at Yarra Capital, explains why he thinks Australian corporate floating rate bonds will continue to perform, even if the equity market correction continues.

The current state of markets could well resemble the quote attributed to American writer Mark Twain: “history doesn’t repeat itself, but it often rhymes.” With interest rates moving upwards and central banks at a range of more hawkish stances, many market commentators are projecting a broader correction in risk assets.

So far in 2022 we’ve witnessed 10% declines in major equity indices, with the prospect of further adjustments as real yields look to move higher on higher inflation and the end of quantitative easing. In equities, some of this selloff appears to be a rotation from growth (weaker profitability/lower dividends) to value (stronger profitability/higher dividends) sectors.

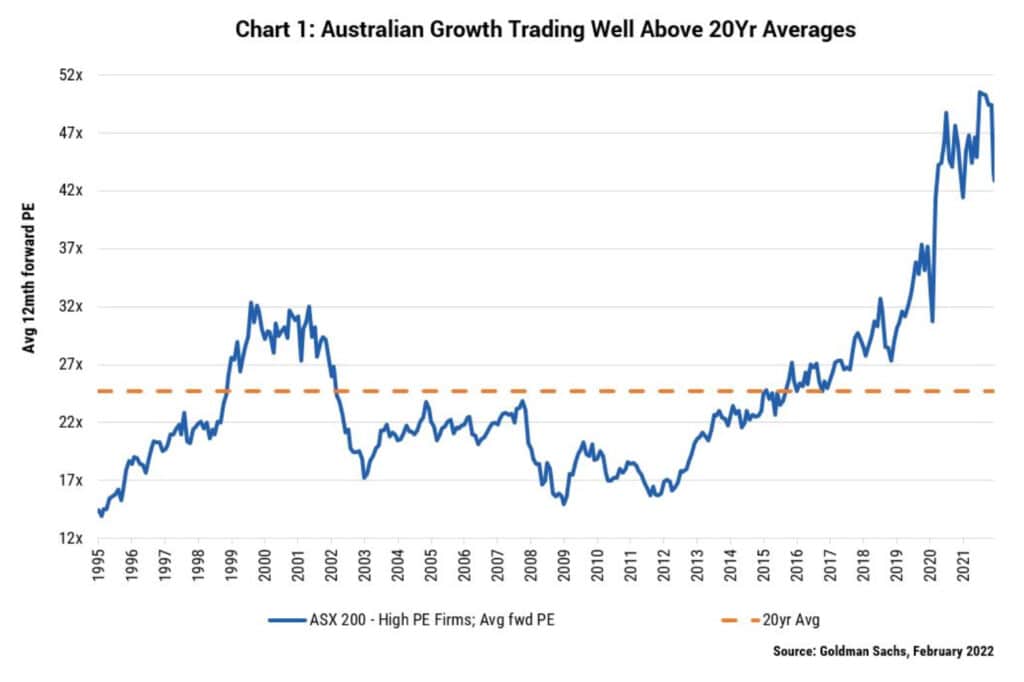

In the Australian context, we recently saw a great chart from Goldman Sachs illustrating the extent of the growth sector’s higher valuations compared to 20-year averages and the dotcom boom/bust at the turn of the 2000s (refer Chart 1). While some of these higher valuations are warranted given the growing role of technology in our lives compared to two decades ago, the high prevalence of loss makers suggests the correction may have further to go.

Also Read: Why Australian Corporate Bonds Look Appealing: Franklin Templeton

Thus far, despite a mild expansion in credit margins generally, the selloff in equities has had little impact on floating rate credit returns. While growth plays a role in the equities market, it barely exists in the Australian corporate bond market given the local market is largely dominated by financials, mortgage-backed securities and high-quality corporates with strong balance sheets and asset coverage.

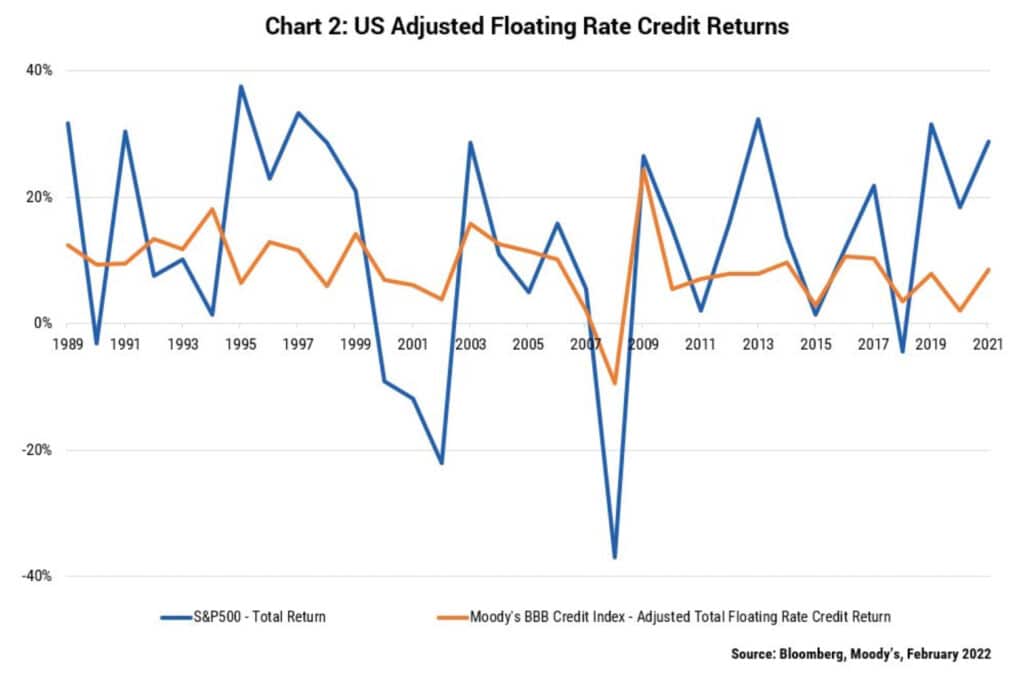

Moreover, looking at the rhymes of history provides us with confidence that this rotation doesn’t spell doom for Australian credit investors. The last time we saw a major rotation from growth to value – the dotcom correction of 2000-2002 – the S&P500 was down more than 20% from its highs in 1999, but floating rate credit continued to perform (Chart 2).

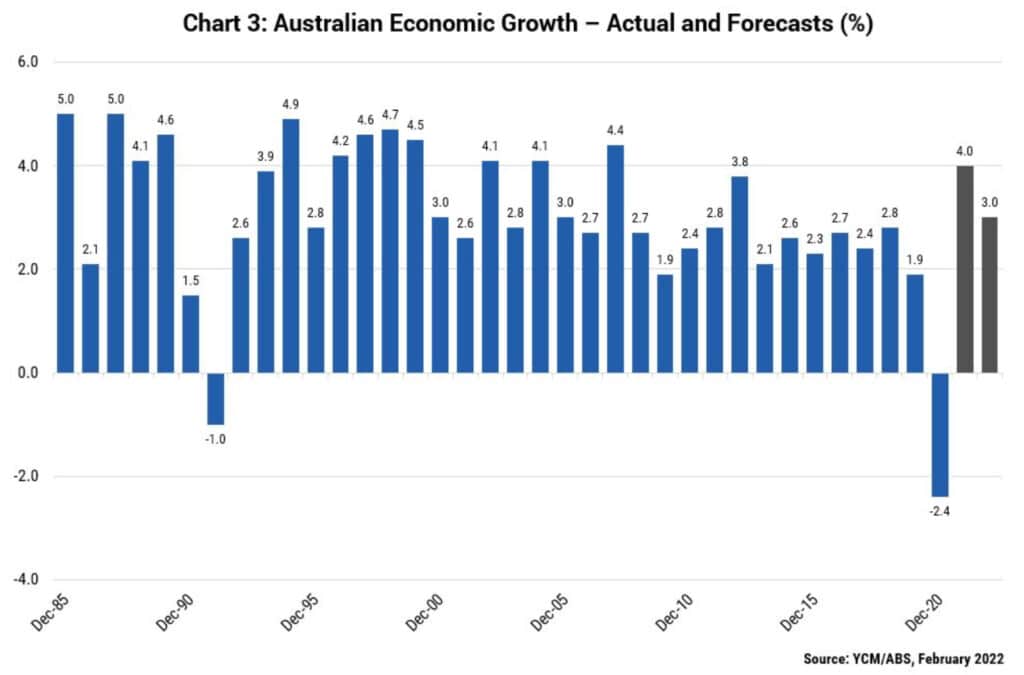

We see potential for a similar scenario to play out this time around, with floating rate credit protected from the negative returns associated with higher interest rates. Further, the maintenance of a strong economic backdrop should preserve credit quality across Australian corporate, financial and mortgage-backed sectors. Overall, Australian economic growth is forecast to be buoyant (i.e., 4% in 2022 followed by 3% in 2023) (refer Chart 3). Of course, this is dependent on central banks not raising rates to unsustainable levels and/or other geopolitical forces coming into play.

In the last two months we have observed a mild repricing of risk and with it a swathe of attractive opportunities, with bank and mortgage-backed issuance across senior and subordinated structures coming to market at more attractive levels than the second half of 2021. For instance, 5-year bank senior risk is now fairly priced at a credit margin of ~75bps. New major bank Tier 1 paper looks to also be rebasing higher, with the coming ANZ 7-year Capital Notes being issued at a 270bps credit margin.

So while legendary NZ band Split Enz confidently predicted in 1981 that “History Never Repeats”, we do suspect the near to medium term for floating rate credit is more likely to rhyme with the benign 2000-02 period. At least, that’s what we tell ourselves before we go to sleep!