Janus Henderson Investors’ Credit Risk Monitor tracks key indicators which impact credit portfolios

- An increased number of corporate defaults is expected in light of high yields and reduced access to affordable capital – though this impact will be lagged.

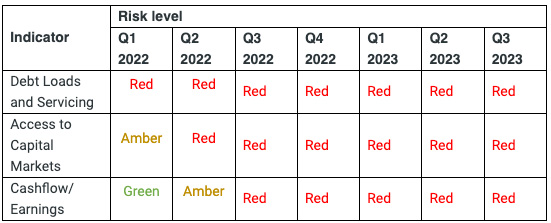

- All three traffic lights monitored by Janus Henderson Investors’ credit risk team have flashed red for over 12 months.

- As inflation cools, a shift from supply-led to demand-led deflation will cool nominal growth and borrowing costs could considerably outpace revenues – creating additional risk for investors in corporate credit.

- Opportunities exist but careful credit selection remains key for investors in this environment.

The signposts for a turn in the credit cycle remain in place, just as they have for the last year, with high interest rates and high debt loads contributing to the downward trajectory, according to the latest analysis from Janus Henderson Investors.

Although the impact will be lagged, the staggering rise in interest rates is expected to have a domino effect on the current credit cycle: refinancing debt loads at higher rates can lead to decreased interest coverage ratios and ultimately more defaults in the years ahead.

Janus Henderson Investors’ latest Credit Risk Monitor tracks corporate fundamental and macroeconomic indicators on a traffic light system to indicate where we are in the credit cycle and how to position portfolios accordingly. The key indicators tracked (‘Cashflow and Earnings’, ‘Debt Loads and Servicing’, and ‘Access to Capital Markets’) all remain red for the fourth quarter in a row.

Jim Cielinski, Global Head of Fixed Income at Janus Henderson Investors, said: “The credit cycle tends to turn only if three conditions are present: high debt loads, lack of access to capital, and an exogenous shock to cash flow. These conditions – which are the three indicators in our Credit Risk Monitor – are all present today: the yield curve is inverted, lending standards are tightening, and central bank policy globally has been aggressively moving tighter. Each cycle is different, but a combination of high debt levels and a higher for longer interest rate environment is putting pressure on companies to service that debt while cutting off access to capital at a reasonable price. In such an environment, active security selection is critical.”

Also read: The Bond Market Stabilises or the World Ends

Debt loads and servicing

Interest coverage ratios under pressure

A lot of companies have a lot of debt to refinance. Higher rates will force interest coverage ratios to deteriorate precipitously in the coming years and lead to an escalation of defaults. This will, in turn, further tighten lending standards, restricting access to affordable capital. However, the result will be lagged. The maturity wall for most companies will not hit for another 12 to 18 months. This delay might protect the corporate market in the short term, but valuations offer little reward for absorbing high recession risk at current levels.

Access to capital markets

Mixed picture for companies of all sizes

The more robust, large-cap companies can, and will continue to, refinance with relative ease, although the rise in borrowing costs is set to be felt more heavily in the coming quarters.

However, small and medium enterprises – which typically rely more heavily on the banking system for financing – will continue to struggle to borrow, and defaults in this space will be more pronounced. The price of capital, in both nominal and real terms, presents another challenge. The real cost of borrowing is higher than it has been for almost a decade. This will have a significant impact on companies, particularly if revenues slow down.

Cashflow and earnings

Reasons for previous optimism are fading

Higher inflation has not been negative for most companies. High nominal growth has lifted revenues for corporations and benefitted those which had previously locked in lower borrowing rates. Higher rates are likely to start crimping consumption and, in turn, earnings. The resiliency of the consumer has been underestimated, but the headwinds are growing.

Inflation is now falling and will be supportive of a pause for central banks. But if supply-led deflation turns into demand-led deflation, nominal growth will be dramatically slower and borrowing costs could considerably outpace revenue growth.

Asset allocation implications

Careful selection remains key. Corporate spreads, or the relationship between government and non-government bonds, do not appear to fully reflect the risks in the global economy. The current attractive levels of yield should become increasingly compelling to long-term investors and start to produce strong total returns. Relative returns of risky assets, however, may suffer when compared to quality segments of the market. Defensive sectors in the bond market, such as investment grade credit, should begin to not only offer attractive total returns, but also robust diversification benefits.

Jim Cielinski added: “This is a time in the cycle to focus on the difference between total returns and excess returns. Interest rates have skyrocketed, producing some of the highest levels of yield in more than a decade. Only 18 months ago, central banks were indiscriminate buyers of bonds, but have now become price-insensitive sellers. Budget deficits are ballooning, hitting 7% of GDP in the US. The supply-demand rebalance is catching investors off guard as they view these fiscal trends as unsustainable. Bond investors are demanding additional compensation.”