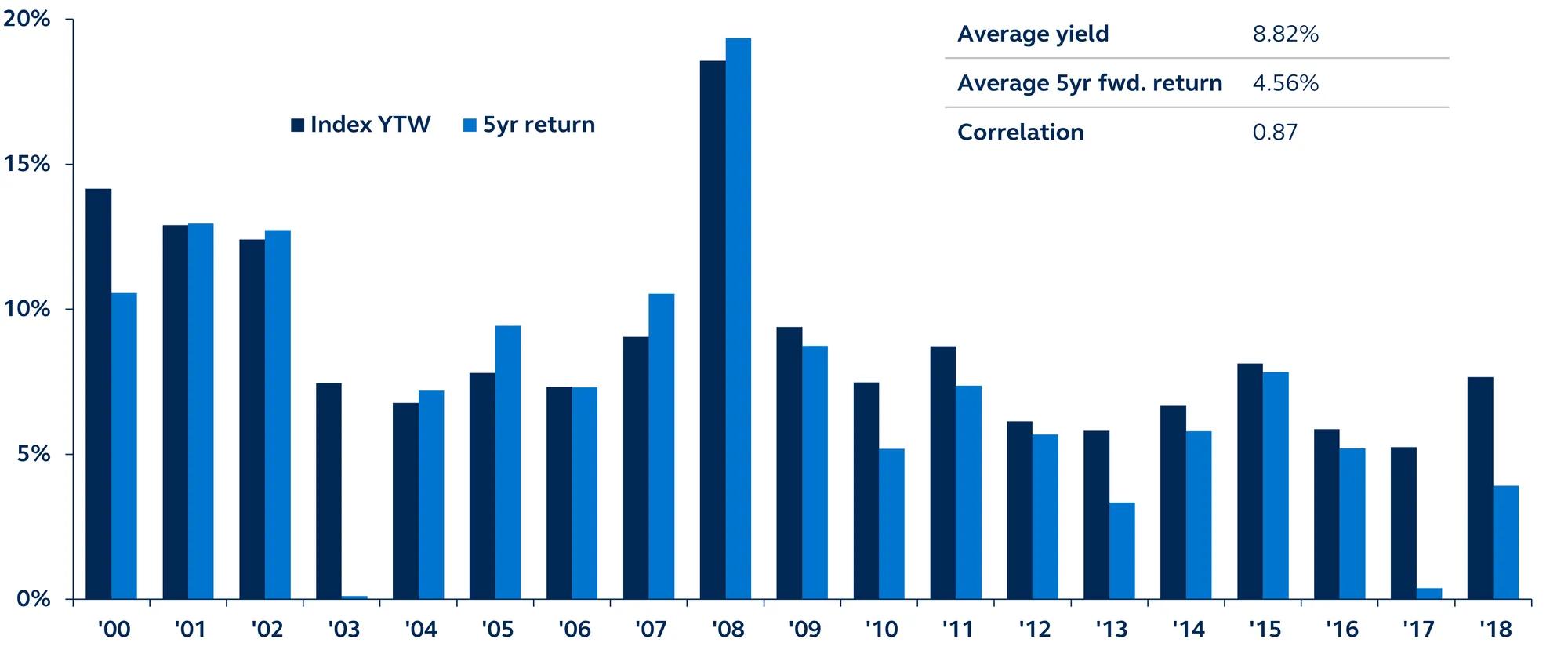

Despite the focus on credit spreads, yield has proven to be a more reliable indicator of high yield market attractiveness. With a strong correlation between starting yield and five-year forward returns, and a historically high-yielding environment coupled with low projected default rates, the high yield asset class is well-positioned to potentially deliver attractive long-term returns.

High yield index yield and five-year forward return comparison

Bloomberg U.S. Corporate High Yield Bond Index

Never mind spread; it’s yield that matters. Many investors look at credit spreads (the difference in yield between a security relative to a risk-free security with the same maturity) as the hallmark indicator for when to enter or exit credit markets. However, history suggests that tactically timing spread movements can be incredibly challenging, especially in high yield credit markets. Though spread levels are important, we believe yield is a more powerful gauge of HY’s attractiveness.

When charting the asset class’s starting yield against its corresponding five-year forward annualized returns, it produces a correlation of 0.87—higher than the correlation between the starting spread and corresponding five-year forward annualized returns. The substantial income produced by the yield should continue to deliver attractive returns in the asset class for investors. The shrinking default rate of high yield offers confidence that starting yields should translate into attractive returns. With high yield today in a historically higher-yielding environment, and defaults projected to be below historical averages (Moody’s 12-month forecast of 2.95% vs. historical average of ~4%), investors may be in the midst of a particularly strong high yield market.

Investors’ ability to maximize their portfolios’ income generation will be the key driver of forward-looking investment returns. The asset class continues to be positioned to potentially deliver long-term returns at these yield levels.

Read more about additional themes impacting fixed income markets and portfolios in the quarter ahead in our 3Q Fixed Income Perspectives.