Moody’s Ratings says in a new report that Australian mortgage delinquency rates, which increased over the June quarter, will continue to rise moderately over the rest of this year as high interest rates and sticky inflation put financial stress on households.

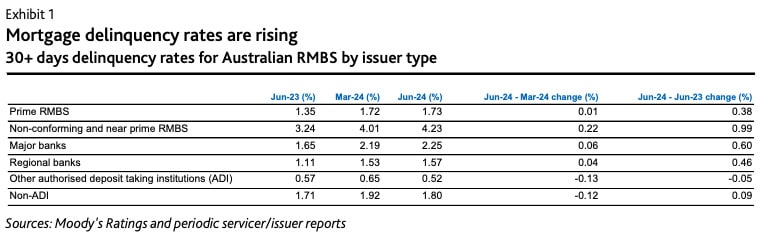

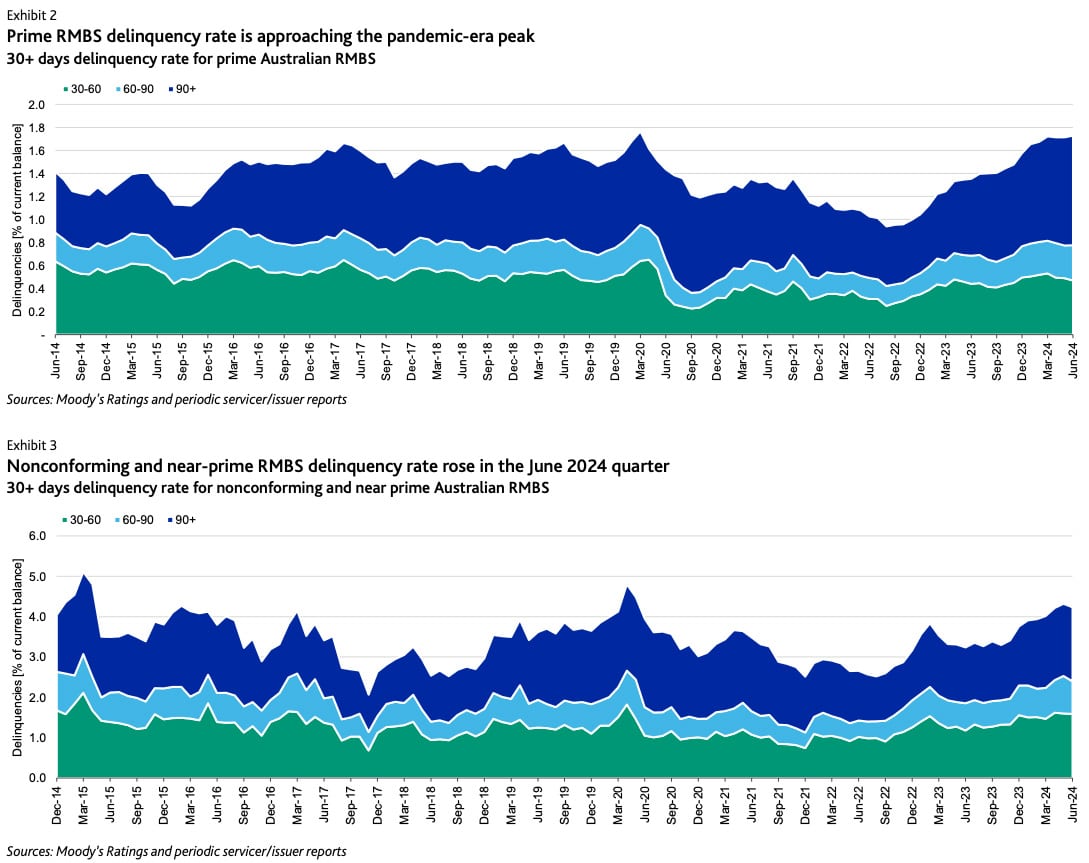

The latest data for the residential mortgage-backed securities (RMBS) we rate shows the share of prime-quality home loans that were at least 30 days in arrears (30+ days delinquency rate) increased marginally to 1.73% in June from 1.72% in March. Delinquency rates for RMBS backed by nonconforming and near-prime mortgages (like loans to borrowers with adverse credit histories or those that lenders assessed using alternative documentation) rose to 4.23% in June from 4.01% in March.

Mortgage delinquencies increased by more for nonconforming and near-prime RMBS than prime RMBS over the June quarter, because the deals include a higher share of loans to borrowers who are financially vulnerable in an environment of high interest rates and inflation. This cohort includes self-employed borrowers, low-income homeowners and those with high loan-to-value ratio mortgages.

After rising steadily for the last two years from a historically-low base, delinquency rates are now back up around long-term average levels. Exhibits 1-3 show RMBS delinquency rates by issuer and mortgage type.

We expect high interest rates and cost-of-living pressures will continue to weigh on households over the rest of this year, pushing mortgage delinquencies higher. Inflation, while easing to 3.5% over the year to July from 3.8% over the 12-months to June, remains above the Reserve Bank of Australia’s 2%-3% target band, so interest rates will remain elevated this year.

However, we expect mortgage delinquency rates will only rise moderately because of several mitigating factors. Firstly, while Australia’s unemployment rate increased to 4.2% in July from 4.1% in June, employment conditions remain sound. Also, nominal wages are rising, with average weekly household earnings growing 6.5% over the year to May. Furthermore, house prices have increased 7% over the eight months to August and are now above the pandemic peak, which will support collateral values.