After the worst returns for fixed income in generations in 2022, bonds are back in demand, driven by higher bond yields and volatile equity markets. But some bonds offer greater appeal than others, and ‘fallen angels,’ in particular, offer quite favourable risk-adjusted returns.

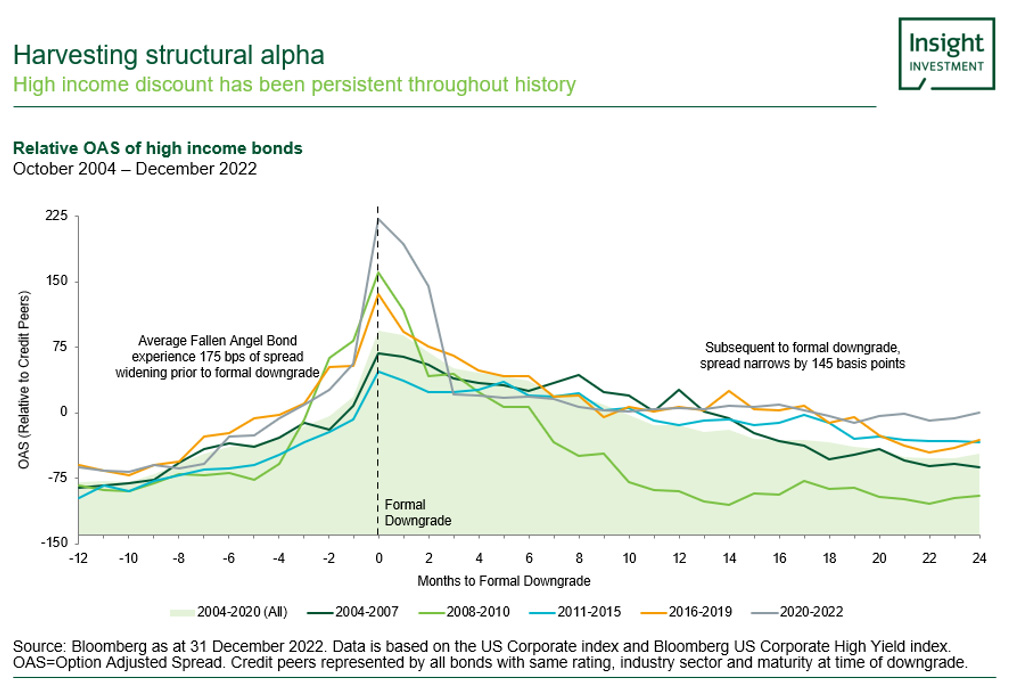

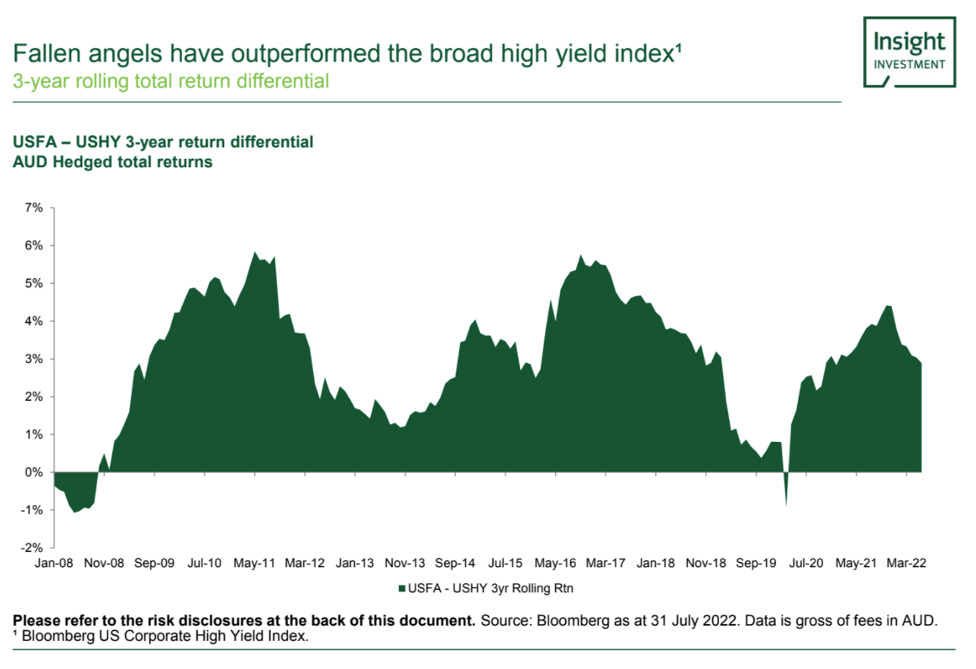

‘Fallen angels’ are bonds which have been downgraded from investment grade or BBB status and now sit at the top of the high yield market with a BB credit rating. These bonds are typically sold off heavily at the time of a rating downgrade: as they fall out of investment grade indices at month end, many institutional investors are required to sell them to ensure adherence to their investment guidelines. Given the level of forced sales, spreads widen on the bonds creating an attractive buying opportunity at supressed prices. Over the subsequent 12 – 24 months, typically many fallen angels recover in price delivering strong returns for the investor. This is what we call a ‘structural alpha’ opportunity and is part of the reason why fallen angel bonds return more than the wider high yield market.

PODCAST: Celebrating three inspirational women in finance

The below graph shows the return differential of the US Fallen Angels index against the broad US high-yield index. Despite the fact that the fallen angels have a far higher credit quality than the wider high yield market, you can see that on a rolling 3-year period, they almost always have outperformed broad high yield, and meaningfully so.

Default rates sit at a 15-year low

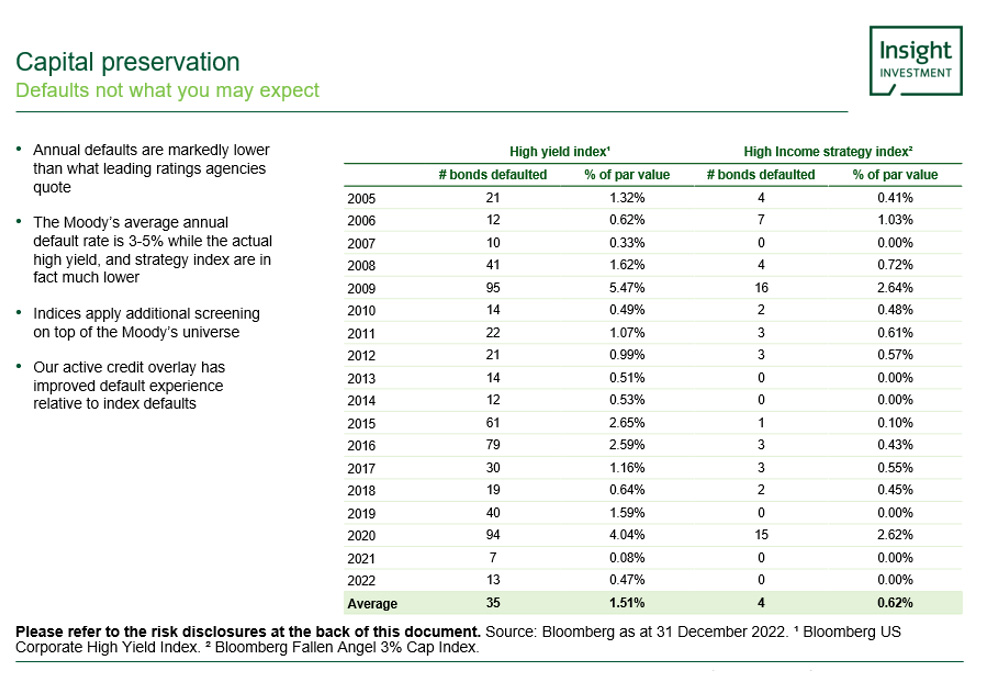

A common concern might be that these fallen angel companies are at a greater risk of defaulting on a debt repayment, relative to investment grade bonds. Looking at the wider high yield market through the lens of the Bloomberg US High Yield Corporate Index, it has only seen an average 1.5% p.a. default rate over the last 15 years. This is far lower than people might expect, and the fallen angels index, is even lower than that still at 0.62%. Additionally, while we expect default rates to remain within historical norms, even in the event of crisis-level defaults, history indicates the pain will be far less substantial than that which is currently priced into high yield credit. Assuming recovery rates of ~35%, (which is historically conservative), high yield credit spreads are overcompensating for default risks.

With the current cash rate in Australia at 3.6% and investment grade bonds yielding around 5.3%, investors are obtaining a credit spread over the risk-free cash rate of about 1.6% for investment grade risk. Moving down one notch to BB debt and the fallen angels segment, those bonds are yielding around 4.2% over the cash rate. Importantly, with bonds the yield is contractual and provides a greater element of certainty than relying wholly on company dividends for income.

Fallen Angels – worth considering in your portfolio

With increased dispersion and volatility in global share markets, demand for equities has been replaced by greater demand for fixed income in 2023. We at Insight Investment believe that the fallen angels segment, offers a particularly compelling investment case for inclusion in investor portfolios, giving them access to highly diversified, liquid bonds, offering structural alpha, with the potential for attractive income and return relative to their risk.

Source: spread data from Bloomberg and Insight as at 30 March 2023.