Commentary on key market themes for Q4 2024 from Seema Shah, Chief Global Strategist at Principal Asset Management.

A globally synchronised downturn produces a globally synchronised policy easing. As global growth has weakened, policymakers have started to respond. The U.S. Federal Reserve is committed to avoiding recession, while China’s recent policy measures also raise the odds of a global soft landing.

The U.S. economy: Slowdown does not imply recession. Labour market cooling has triggered recession concerns, but the continued strength of consumer and corporate balance sheets implies that job layoffs, and therefore recession, can be avoided. A moderation to trend growth is likely.

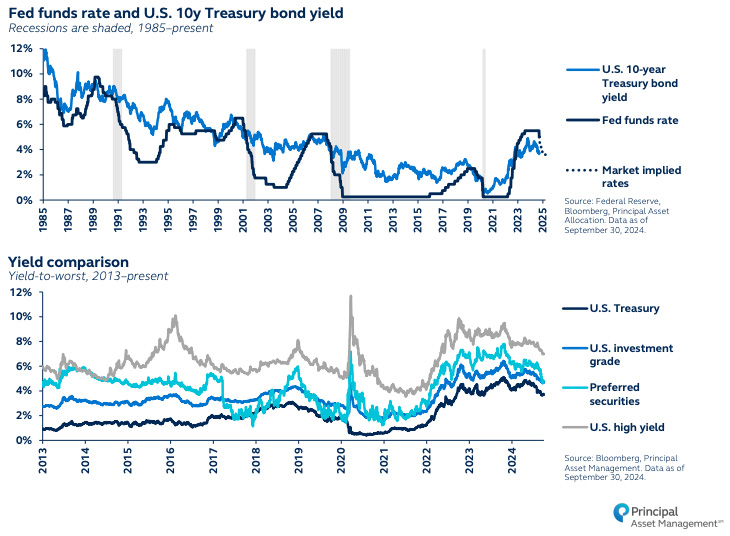

Central banks are determined to secure soft landings. The Fed is set to lower rates toward 3% and may frontload rate cuts if there are further signs of labour market weakness. The Fed’s commitment to a soft landing will be mirrored by other central banks keen to avoid overly strong currencies.

Equity markets confront valuation challenges, but Fed cuts should support continued gains. Historically, a Fed cutting cycle without recession has resulted in a strong equity market performance. While stretched valuations suggest gains may be more limited this time, a broadening of gains beyond just tech presents opportunities.

Also read: High Yield Investment Is About Avoiding Losers

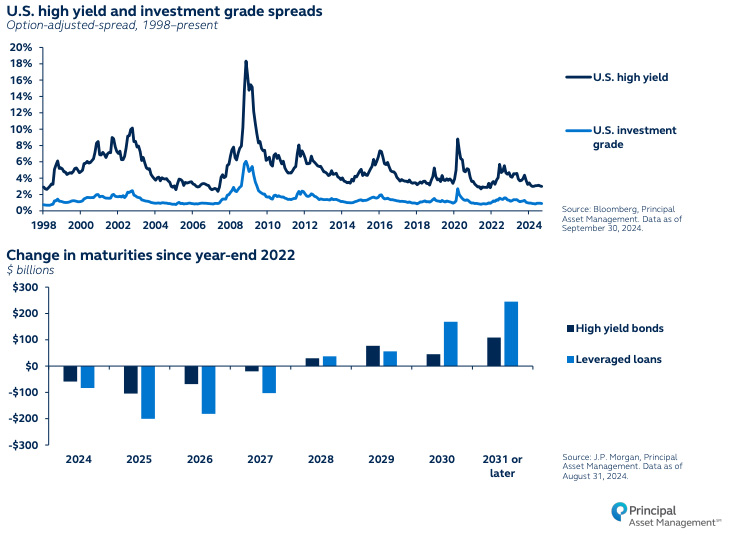

Fixed income typically shines in a late cycle slowdown. Fixed income spreads are tight, but elevated yields continue to draw investor interest. Combined with strong growth, Fed cuts should reduce default risk, extending the credit cycle.

With potential gains across asset classes, staying in cash is the leading risk. With the Fed’s rate cutting cycle now underway, the attractiveness of cash is rapidly diminishing. As global stimulus lifts prospects for risk assets across the globe, investors should be optimizing this constructive environment.