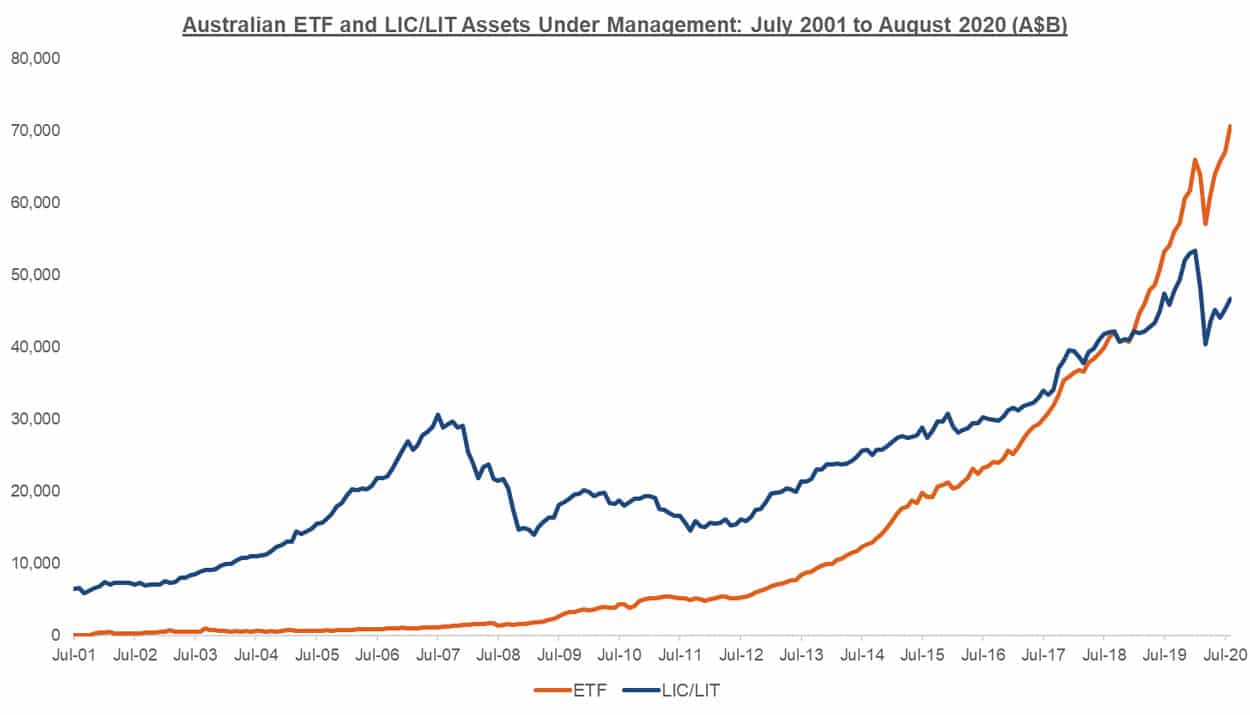

The value of the exchange traded fund (ETF) industry has surged past $70 billion for the first time, extending its strong growth run.

A report from BetaShares highlights the 45% compound annual growth rate in the value of the Australian ETF industry since inception in 2001, compared to the 11% per annum growth in the value of the listed investment companies (LIC) and listed investment trusts (LIT) industry. The Australian ETF industry is now around $25 billion bigger than the LIC/LIT industry at the end of August.

Australian ETF industry vs. LIC/LIT industry

Source: BetaShares

BetaShares reported that growth over August arose from an equal share of market movements and net new money. Industry funds under management (FUM) grew by $3.6bn, a 5.3% month-on-month increase.

There were 243 Exchange Traded Products trading on the ASX and Chi-X with one new product launching in August, a ESG-light product launched by State Street. Two single bond products matured in the month.

The report noted that flows were robust across a number of asset class categories, with international equities exposures dominating ($722m net flows). Investors however continued to diversify their portfolios away from equities with ~$370m into fixed income products and ~$200m into both cash and commodities ETFs (largely gold products). Outflows were limited to US Dollar products even as the USD fell in value vs. the AUD, with investors apparently concerned that continued AUD strength is possible.

Top 5 category inflows (by $) – August 2020

Category |

Inflow Value |

| International Equities | $722,208,857 |

| Fixed Income | $367,232,015 |

| Cash | $208,414,985 |

| Commodities | $187,614,011 |

| Australian Equities | $181,104,769 |

Top sub-category inflows (by $) – August 2020

Sub-Category |

Inflow Value |

| Australian Bonds | $297,832,585 |

| International Equities – Developed World | $242,528,414 |

| International Equities – Sector | $223,785,466 |

| Cash | $208,414,985 |

| Gold | $171,774,547 |

The top two issuers to the end of August were BetaShares and Vanguard, combined receiving over 60 per cent of all industry flows.