Ninety One’s Multi-Asset Credit team explains how the bank capital (AT1) market has staged a remarkable recovery since last year’s turmoil following the collapse of Credit Suisse. The team notes that current valuations mean selectivity is key, and credit investors should also explore other parts of the capital structure.

Having peaked in March 2023, AT1 spreads are now comfortably back to their historical range. Bargains in the AT1 market are less apparent, but there is still value to be found.

The context

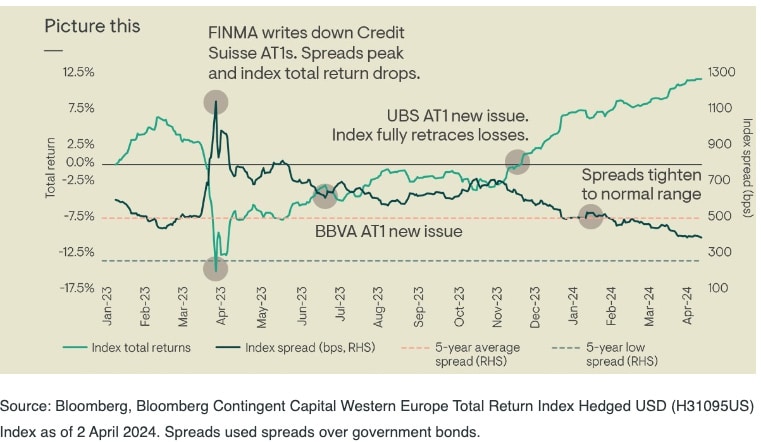

In its Bargains in bank capital piece last year, the Multi-Asset Credit team noted that bank capital debt (the AT1 market) had become one of the best-value credit markets in the wake of the turmoil that followed the collapse of Credit Suisse in March 2023. As a reminder, around US$17 billion of Credit Suisse’s AT1s were written down, accounting for around 10% of the global AT1 index at the time. This called into question the future of the asset class and drove down the Bloomberg CoCo index, which posted a total return of -14.8% between the start of 2023 and 20 March 2023, as shown in the chart.

Darpan Harar, Portfolio Manager, Ninety One said: “One year on, few could have predicted the speed of the recovery in the AT1 market, with the index taking just under eight months to fully retrace its losses.”

For example, the Spanish banking group, BBVA, was the first bank to issue an AT1 bond – just three months after the Credit Suisse debacle. But the key catalyst for a turnaround came on 8 November, with UBS’s issue of a dual tranche AT1 in a deal totalling US$3.5 billion.

Also read: It Feels Like Boom Time But What’s Really On The Cards?

Harar said: “The importance of this deal cannot be overstated: it was the first benchmark issue from a Swiss bank after the Credit Suisse event, and the US$36 billion order book (representing a whopping 19% of the overall index size) underscored a complete turnaround in investor sentiment towards the AT1 asset class. Since then, the market has seen a further US$15 billion of new AT1s issued by both large and smaller sized lenders across Europe, with very solid order books. The European Bank AT1 market ended 2023 with a healthy return of +7.6% (USD hedged), and has had a solid start to 2024, with a 1Q24 return of around 4%.”

The conclusion

Having peaked at >1000bps in March 2023, AT1 spreads are now comfortably back to their historical range. Given this, the attractiveness of valuations is less uniform, and selectivity is increasingly important. In addition, there are other parts of the capital structure relatively more appealing, such as short-dated Tier 2 and senior bonds. However, from a yield perspective, the AT1 sector still screens well, and bank fundamentals remain strong – as highlighted in the latest set of results – providing a constructive backdrop for AT1s.

As for where to invest within the AT1 market, selectivity in key.

Harar concludes: “Around a quarter (26%) of AT1s are still pricing in some extension risk – this relates to the possibility that the issuing bank won’t call (redeem) the bonds at the first call date, increasing the risk for investors. Given that we have seen the majority of the banks call their AT1s at first call and expect this to continue in FY24, we think this extension risk is often mis-priced, especially for fundamentally sound issuers.”