Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. April 2025.

OUTLOOK

Increased trade policy angst has threatened the resiliency of global growth while stoking fears of inflation, warranting a more cautious stance.

U.S. growth expectations slowing under weight of uncertainty, while sentiment in Europe and China improving on policy support hopes, despite tariff threats. While not a primary target of US tariffs, Australian economy is expected to slowdown in the coming months due to weaker domestic support and a more challenging global demand environment.

With monetary policy remaining broadly accommodative, disruptive trade policies could force central banks to make uneasy choices to support growth despite threats of higher inflation, which is most pronounced in the U.S. The Reserve Bank of Australia (RBA) is likely to continue with more rate cuts until the end of 2025 as labor market weakens.

Key risks to global markets include escalating trade wars’ impact on growth and reaccelerating inflation, central bank missteps, and geopolitical tensions.

THEMES DRIVING POSITIONING

Cold Feet

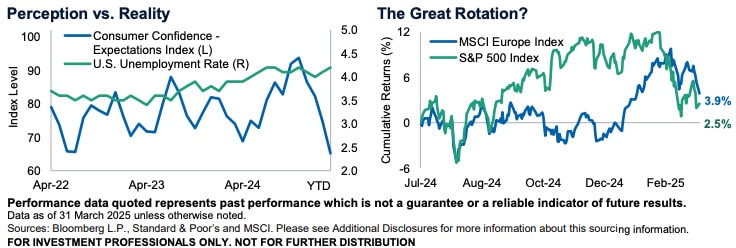

Almost every measure of consumer and business sentiment, aka “soft data,” has notably deteriorated amid rising uncertainty around trade policy. While sentiment usually lags “hard data,” like employment and spending, today’s soft data is signaling a far more dire outlook than the hard data is implying. The real concern is if businesses and consumers continue to face this level of uncertainty for a prolonged period. If this is the case, they are likely to have cold feet when it comes to investment, purchasing, and hiring decisions. With trade disputes lasting for nearly a year and a half during President Trump’s first term, the sentiment could be right this time around, foreshadowing a deeper slowdown in the economy. Given the heightened risk, we continue to lower our equity exposure.

Also read: Navigating Stagflation: Lessons for Today’s Multi-asset Portfolios

European Vacation?

For most investors, the outperformance in European equities this year has been a big surprise. The start of the year saw Europe facing a bleak economic backdrop, lingering war between Ukraine and Russia, political discord and threats of U.S. tariffs on the horizon. This follows decades of turmoil, including political instability, debt crisis and Brexit, leaving most investors skeptical in allocating to the continent. The recent outperformance, however, comes amid notable policy shifts, including increased fiscal spending from Germany on defense and infrastructure and a more unified commitment from leaders across the region on improving competitiveness. Despite tariff uncertainty, sentiment toward the region has quickly shifted and flows are following. We see this as more than a short vacation, and are adding to European equities, on upside potential to capex spending and lending.

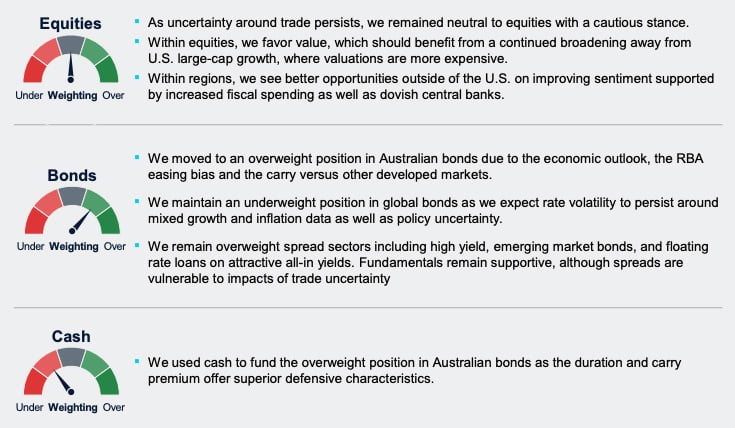

ASSET CLASS POSITIONING

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.