Thomas Poullaouec, Head of Multi-Asset Solutions APAC at T. Rowe Price, and his team have published their latest insights on global asset allocation and the investment environment for Australia. March 2025.

OUTLOOK

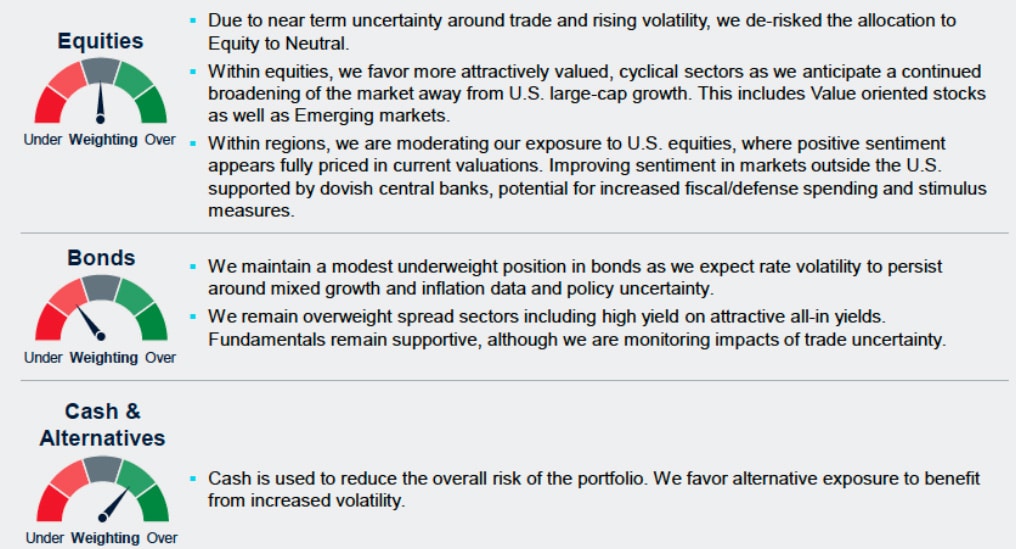

We are generally cautious as broadly resilient global growth and receding inflation trends could be at risk to increased policy uncertainty, particularly with the potential for escalating trade wars.

U.S. growth showing some signs of softening, while sentiment toward Europe and China improving on fiscal spending hopes, despite tariff threats. While not directly impacted by tariffs, Australian economy is expected to slowdown in the coming months due to weaker domestic support.

With monetary policy remaining broadly accommodative, disruptive trade policies could force more decisive action by central banks to support growth with the impacts on inflation uncertain. The Reserve Bank of Australia (RBA) started its easing cycle and is likely to continue with more rate cuts until the end of 2025.

Key risks to global markets include escalating trade wars’ impact on growth and reaccelerating inflation, central bank missteps, and geopolitical tensions.

THEMES DRIVING POSITIONING

Dethroned

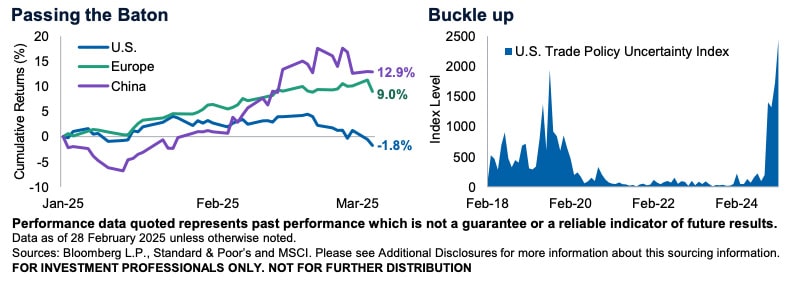

It has been a surprising start to the year with U.S. markets’ reign being challenged after two strong years of outperforming on uplifted sentiment toward Europe and China. Optimism for a resolution in the Russia-Ukraine war, ECB easing, talk of increased defense spending and hopes for less punitive tariffs have helped improve sentiment across Europe. Meanwhile Chinese markets accelerated, led by depressed tech names, following news out on Deepseek, an AI start-up company whose technology called into question U.S. dominance in the space. And while long-term structural issues linger and tariffs could pose downside risk to these markets, valuations remain compelling versus those in the U.S., particularly amid narrowing growth differentials. Against this backdrop, we are tilting our regional exposure to markets outside the U.S.

Also read: Fixed Income ETF Listings Jump to Meet Investor Demand

A Means to an End?

Following the post-election “Trump Bump” where markets seemed to focus on potential impacts of pro-growth policies, including deregulation and lower taxes, things have quickly shifted as the focus has turned to trade and geopolitical policies. The on-and-off tariff threats have upended markets trying to weigh the impacts on growth and inflation. Geopolitical tensions surrounding the Ukraine-Russia war have also caused upheaval across Europe as they recalibrate U.S. support in the region. This comes at a fragile time when inflation was just coming into control and growth was still holding up. Recent data, however, shows growing concerns and softening economic data in the U.S., largely attributable to increased uncertainty around policy. Intended or not, prolonged uncertainty will begin to have real impacts on policymaker, corporate and consumer behavior leaving us more cautious near-term, and watching for opportunities amid expected higher volatility.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.