Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 31 January 2025.

MARKET PERSPECTIVE

We have a more cautious view as broadly resilient global growth and receding inflation trends could be at risk to increased policy uncertainty, particularly around trade threats.

U.S. growth exceptionalism leaves it better positioned should trade disputes escalate, with other major economies, particularly Europe and China, more exposed with growth already tepid. In Australia, economic activity remains more resilient than feared but we expect a slowdown in the coming months due to weaker domestic support.

Central bank divergence could widen on impacts of trade, with the Fed in a position to wait on impacts, while other central banks, including Europe Central Bank (ECB) and Bank of Canada (BoC), advance easing as risk tilts toward slower growth. The Reserve Bank of Australia (RBA) is expected to start its easing cycle soon.

Key risks to global markets include elevated threat of trade wars impacting growth and reaccelerating inflation, central bank missteps, and geopolitical tensions.

MARKET THEMES

Big Bet!

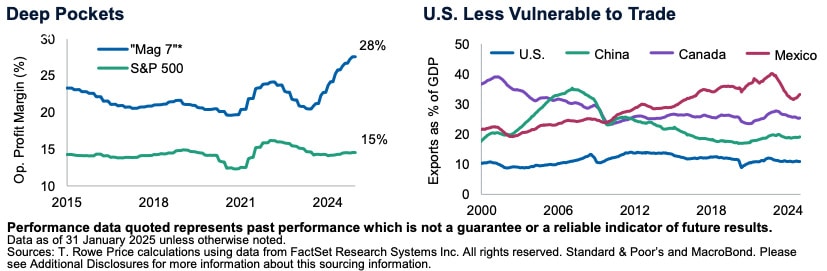

What do digital advertising, online retail, electric vehicles, and software have in common? Seemingly not a lot, other than a combined $20 trillion. The “Mag 7,” as they are known, are a heterogenous group of companies that have dominated global equity markets. Their combined market cap is now multiple times larger than other parts of the market and any other country outside the U.S. While eye catching, their profitability has also been unprecedented in helping justify valuations. However, the recent news around Deepseek, the Chinese AI startup, highlighted a common thread across this otherwise disparate group, billions in capex spending. Their enormous bet on AI technology to sustain their dominance will be increasingly scrutinized by investors looking for assurance these big bets pay off. Against this backdrop, we favor better priced value stocks that should benefit from a broadening market and improving earnings.

Also read: How US Immigration Changes Could Impact Inflation and the Fed

Deal or No Deal?

As promised, President Trump acted swiftly on using tariffs as a negotiating tool to draw counterparties to the table. The tariffs have been introduced largely on the premise of creating fairer trade policies and gaining border security protections. For the most part, the more aggressive stance has worked with trade partners acting quickly to make a deal, or at least delay tariffs. The stakes are high for those targeted whose economies rely more heavily on trade. And while the U.S. comes at these on a stronger economic footing and less trade vulnerability, it will not be immune to potential consequence if this turns into a prolonged trade war, particularly with inflation at higher levels this time around. With the increased uncertainty, we moderated our equity exposure as risk is increasingly tilted to the downside at current valuations.

We are leaning more cautious on equities as extended valuations amid increased policy uncertainty leave markets vulnerable to downside risk, although economic and earnings growth remain broadly supportive. We maintained our overweight for now supported by solid earning reports.

Within equities, we favor more attractively valued, cyclical sectors as we anticipate a broadening of the market. We initiated an underweight position in REITs to account for the higher for longer yield environment.

Within regions, we have an overweight to the U.S. markets versus Europe due to more modest growth expectations and uncertainty around potential headwinds from tariffs. We initiated an overweight position in Emerging market equity on the view that Chinese stocks present an asymmetric return profile in the short term. We reduced our underweight Australian equity to reflect the solid momentum in earnings revision.

We maintain an underweight position in bonds as yields could remain elevated on resilient growth and potential for higher inflation resulting from global trade disruption. We added some US short term TIPs position to hedge for this.

Despite rich valuations, all-in yield levels for high yield bonds remain compelling and provide a buffer should yields widen. Fundamentals remain attractive, with still modest default expectations.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.