Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 31 July 2024.

MARKET PERSPECTIVE

Global growth showing increasing signs of cooling along with easing inflationary pressures.

Recent data across labor markets, consumer and businesses pointing toward moderating U.S. growth. European growth supported by services, while manufacturing lags. Japanese growth expected to rebound from earlier in the year contraction. China extends stimulus measures to support housing and the consumer to stabilize growth. In Australia, growth is expected to slow given soft consumption and gradual loosening of the labor market.

Growing concerns Fed may be behind on rate cutting amid more evidence of slowing growth. The European Central Bank (ECB) maintains dovish stance, with further cuts expected. Bank of Japan (BoJ) rattles markets with surprise rate hike, despite soft economic growth. Market pricing of the next move from the Reserve Bank of Australia (RBA) is likely to remain volatile, flipping between hiking and cutting rates.

Key risks to global markets include a steeper decline in growth, central bank policy missteps, election calendar, geopolitical tensions, and trajectory of Chinese growth.

MARKET THEMES

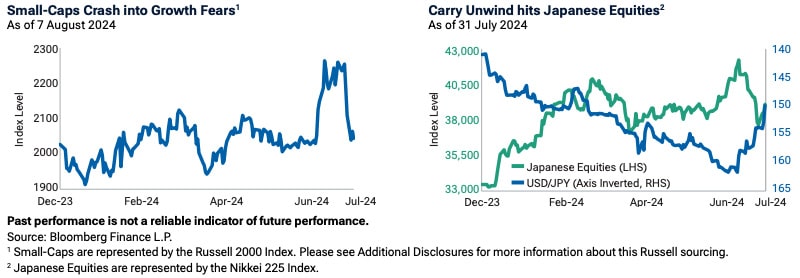

You’re Killing Me, Smalls

Going into the recent Fed meeting, anticipation for them signaling that they were nearing the start of rate cuts led small-caps to outperform large by 10% for the month. Unfortunately for those small-cap investors, who have long been waiting for a recovery in a space held captive by higher-for-longer rates, those gains were quickly killed. The next day’s weak jobs report and untimely move by the BoJ reversed the market narrative around impending rate cuts being supportive for small-caps to now being too late to help an already weakening U.S. economy. The worse-than-expected jobs number follows other recent data suggesting weakness in manufacturing and consumer finances. The view that small-caps’ vulnerability to higher interest rates would now be allayed amid lower rates has been overwhelmed by concerns about their economic sensitivity, which the market now seems to be prioritizing. With the prospects of a soft landing now in question, it’s less likely that interest rate cuts alone will be sufficient to fuel small-cap outperformance until we see clear evidence that growth is going to be stabilized.

Also read: Markets’ Consolidation Belies Fiscal Concerns

Getting Carried Away

The unfortunate timing of the BoJ’s surprise interest rate hike last week colliding with the Fed’s decision to delay the start of cutting rates the day before disappointing U.S. labor market data was released sent global risk assets plummeting. Japanese equities were among the hardest hit after having been the darlings of the developed markets since last year on improving investor sentiment and reflation hopes. The sharp move lower in Japanese equities was exacerbated by the dramatic move higher in the yen as investors scrambled to get out of carry trades where they were short the lower yielding yen and long other higher yielding currencies. The yen carry trade has been a long time favorite and crowded trade where significant leverage can be deployed, making today’s unwind concerning as investors could be taking substantial losses as they are forced to buy back yen at much higher levels. This unfortunately comes at a time when the market narrative for U.S. growth has changed just as quickly with fears the Fed may be behind the curve, and likely has made the Fed and BoJ’s jobs a lot harder than they already were.

We remain modestly overweight equities with the recent pullback broadly improving valuations. While markets remain concentrated, valuations beyond narrow leadership are reasonable with earnings growth supportive.

Within equities, we remain overweight value, based on more attractive relative valuations. Value likely to benefit from easing monetary policy, while growth faces hurdle of higher expectations.

Within fixed income, we continue to favor higher-yielding sectors including high yield, and emerging markets bonds as fundamentals remain broadly supportive.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.