Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 30 June 2024.

MARKET PERSPECTIVE

Global growth remains broadly resilient with some signs of cooling along with easing inflationary pressures.

Recent data across consumer, labour, and businesses point to a moderation in U.S. growth. Similar picture from Australia where the strong government support and housing market are dampening the headwinds from higher rates. European growth stable helped largely by services. Improving growth outlook in Japan, albeit still muted, while stimulus measures in China targeted at the housing market help underpin growth outlook.

U.S. Fed remains patient as recent data suggests tight policy may finally be weighing on growth. The European Central Bank (ECB) has taken the lead on easing policy, with more cuts likely. Despite weaker recent growth, Bank of Japan is still expected to take additional steps toward tightening. The Reserve Bank of Australia (RBA) may already be behind the curve and will have to hike as the next move.

Key risks to global markets include a steeper decline in growth, stubborn inflation, election calendar, central bank policy divergence, geopolitical tensions, and trajectory of Chinese growth.

MARKET THEMES

Oh Snap!

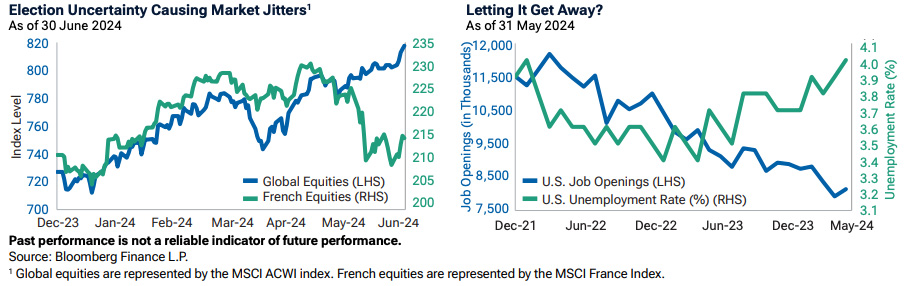

While investors were already expecting the possibility for heightened volatility around a packed global election calendar, those risks have only been amplified with the recent snap elections in France and the U.K. Discontent with incumbent leaders has been a common theme leading to several opposition party wins, with economic, trade, and immigration policies and corruption also contributing to voter dissatisfaction. The uncertainty associated with these elections could aggravate an already fragile global economic environment on the cusp of finally reigning in inflation and skirting a more severe downturn. With the potential for abrupt changes in fiscal policies, trade, and tariffs on the horizon, markets could become increasingly volatile as they weigh the impacts. Some of this is already playing out across European markets, which appeared to be turning the corner economically just weeks before recent snap elections were announced. With more elections to come and the increasing uncertainty around the U.S. elections that are still months out, the uncertainty itself could become an increasing downside risk to growth and one leading to central bankers regretting not snapping at the opportunity when they had it.

Also read: Trading Fixed Income’s “Fallen Angels” Using A Systematic Approach

Up-Tight

While other major central banks have taken the leap in cutting rates, including the ECB and Canada this past month, the Fed remains patient despite mounting evidence of slowing U.S. economic growth. With cracks in the data starting to form across the ever-resilient U.S. consumer, particularly among lower incomes, and the large pandemic savings buffer now depleted, consumer spending that had helped underpin inflation may finally be waning. The business sector, too, is starting to show cracks with recent declines in new orders and shipments. This weakness among consumers and businesses could quickly turn on the tight labor market, that itself has shown recent signs of cooling, as quit rates and job openings have fallen. And while the Fed’s preferred gauge of inflation, core personal consumption expenditures (PCE), remains above their 2% target, incoming data may soon become hard to ignore as it tilts the balance of risk away from sticky inflation and toward weaker growth. Let’s hope the Fed isn’t too “uptight” about getting it wrong on inflation for a second time and won’t end up being the party crashers for the economy.

PORTFOLIO POSITIONING

We remain overweight equities, as valuations beyond narrow leadership remain reasonable and economic growth, while slowing, still supportive for earnings.

Within equities, our preference goes to cyclical markets like Japan and value sectors and to markets exposed to the AI theme like the US.

Within fixed income, we added to cash at the expense of Australian bonds as we think the RBA will have to tighten more to bring inflation down. We also added a long Aussie dollar versus the Euro position to benefit from the divergence in monetary policy.

We continue to favour higher-yielding sectors including high yield, floating rate loans, and emerging markets bonds as fundamentals remain broadly supportive.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.