Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 31 May 2024.

MARKET PERSPECTIVE

Global growth outlook remains positive against a backdrop of gradually easing inflationary pressures across most economies.

While resilient, recent evidence suggests some cooling in U.S. growth. European growth stabilizing helped by services, with manufacturing still a laggard. Japanese growth remains stagnant, while Chinese growth shows signs of improvement supported by recent stimulus measures. Australian growth remains positive due to solid population growth and upcoming fiscal stimulus, despite some early signs of weakness from the consumer side.

U.S. Fed rate cuts look to be still in play later this year with recent signs of moderating growth and inflation. The European Central Bank appears likely to lead on cuts amongst major central banks. After hiking in March, Bank of Japan (BoJ) is still expected to take additional steps toward tightening. Markets now expect a status quo from the Reserve Bank of Australia.

Key risks to global markets include a steeper decline in growth, stubborn inflation, central bank policy divergence, election calendar, geopolitical tensions, and trajectory of Chinese growth.

MARKET THEMES

Home Improvement

Also read: Nine Implications For A New Investment Landscape

Big Spenders

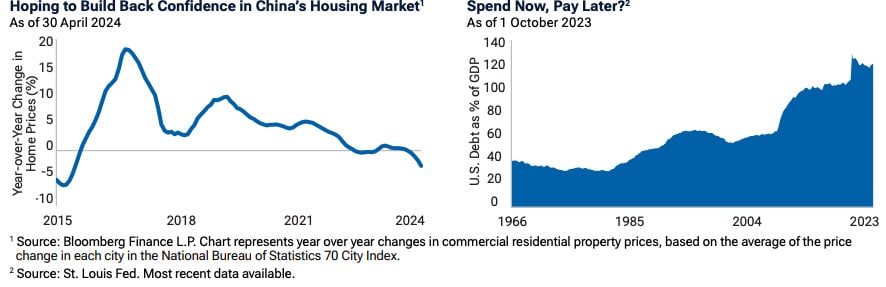

While the Fed’s battle with inflation has been the leading driver in the direction of yields, the move higher over recent weeks was attributed to weaker treasury auction demand as buyers became wary of even more supply ahead. With the U.S. election looming in the back half of the year, few are expecting either political party to significantly rein in spending or address U.S. debt, now above 120% of GDP. The unbridled spending has been flagged by the ratings agencies and is causing investors, particularly foreign investors, to demand higher yields to compensate for the risk of more supply. While some argue the big spending in Washington is growth supportive and nothing to worry about, its spillover effects on the private sector can crowd out demand and raise everyone’s cost of borrowing. So for those hoping for lower rates ahead as the Fed finally reins in inflation, it could be the big spenders in Washington that end up keeping rates higher-formuch-longer.

PORTFOLIO POSITIONING

We remain modestly overweight equities, supported by resilient economic growth, positive earnings trends, and areas with more reasonable valuations.

Within equities, we tilt the portfolio to markets more sensitive to the upturn in economic momentum, such as value oriented sectors and Japan. When appropriate, we added to small caps for the same reasons. We upgraded Europe due to earnings forecasts showing signs of bottoming. We continue to like the US due to the AI tailwind.

Within fixed income, we continue to underweight duration as yields move higher on a repricing of future central bank policies. However, we mitigated the underweight for risk management purposes. We remain overweight high yield and emerging markets bonds on still attractive absolute yield levels and reasonably supportive fundamentals.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.