According to BetaShares, the Australian ETF industry ended 2023 at an all time high with total market capitalisation of $177.5 billion, representing 33% year on year growth. Most of the growth was due to an increase in market value, with $15 billion in new funds, up 12% on $13.5 billion inflows in 2022.

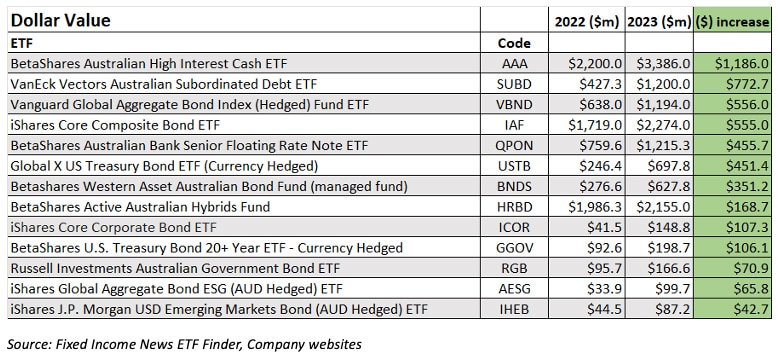

Fixed income received the largest inflows with $5.3 billion versus $3.6 billion in 2022. Where exactly did those funds go?

It might surprise you to learn that more than $1 billion or 22% went to the BetaShares Australian High Interest Cash ETF (ASX:AAA), taking funds under management (FUM) to $3,386 million. That’s a big number.

There would be some corporate funds in this ETF as banks often give reduced rates to companies where deposit values are less ‘sticky’ compared to personal investors that don’t tend to move funds around so much.

Three other ETFs increased by more than $500 million:

- VanEck Vectors Australian Subordinated Debt ETF (ASX:SUBD), up by $772.7 million

- Vanguard Global Aggregate Bond Index ETF (ASX:VBND) up $556 million

- iShares Core Composite Bond ETF (ASX:IAF) up $555 million.

BetaShares’ SUBD invests primarily in bank subordinated debt which late last year was identified as offering good relative value for high yields but low risk, investment grade credit ratings. The yield to maturity as at 31 December 2023 was 5.97% and the average fund credit rating BBB.

Also read: Global Asset Allocation: The View From Australia

Vanguard’s VBND is a global, diversified and hedged ETF with more than 50% of the fund invested in treasury bonds, along with exposure to corporate, government related and securitised investments. It’s a very high quality portfolio with a AA- average credit quality. It invests in more than 11,000 securities and has a yield to maturity as at 31 December 2023 of 3.48%.

iShares’ IAF is another diverse ETF with close to 600 investments. Like VBND, it’s a high quality portfolio but invests in Australian dollar denominated bonds. Treasury and government related securities make up more than 90% of the ETF, with a small circa 8% invested in corporate bonds. More than 70% of the portfolio is rated as AAA and the yield to maturity was 4.1% at 31 December 2023.

One other observations about the table. More than $550 million or circa 10% of total fixed income inflows was invested in US Treasury ETFs, presumably as investors thought interest rates had peaked and future lower rates would provide a lift to bond prices (see Eight Reasons to Invest in Fixed Income for an explanation).

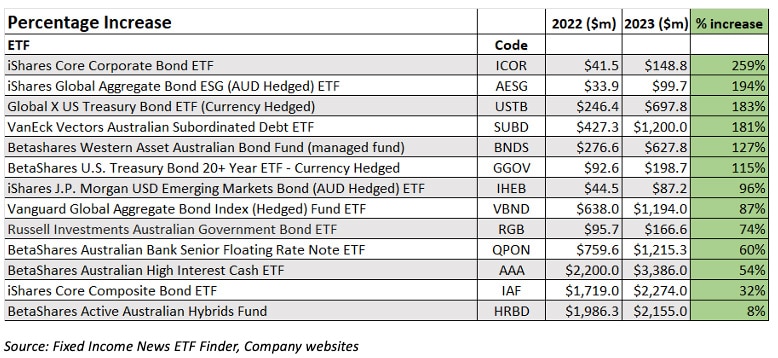

In percentage terms, some of the smaller, newer funds out performed in 2023. It’s interesting to note the SUBD ranks 4th on the list below, even though its much larger in dollar terms than the first three funds.

Note: Past performance has no correlation to future returns. None of these funds are recommendations, this article is for educational purposes only.