Professional fixed income investors are increasingly turning their attention to emerging markets as they chase more attractive yields and greater diversification, according a new survey by Invesco.

The third annual Invesco Global Fixed Income Study captures the views 159 CIOs and fixed income asset owners globally with combined AUM totalling USD $20 trillion (as of 31 December, 2019).

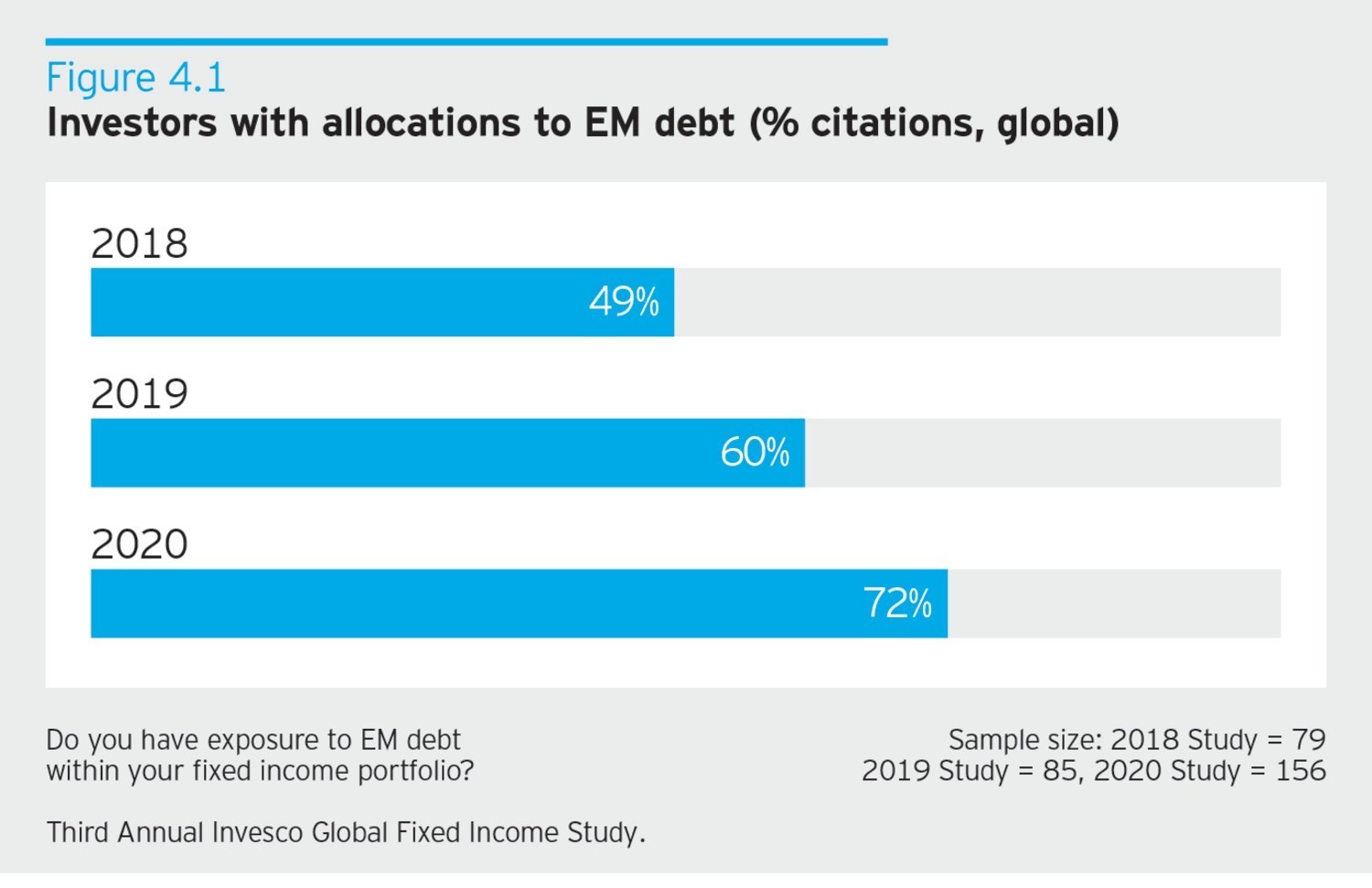

The survey showed 72% of investors now have an allocation to emerging markets versus the 49% surveyed in the previous study – a 47% increase. Specialisation is also on the rise, especially among investors attracted by returns (rather than diversification), who prefer country-specific allocations (63%).

China is of interest to the 42% of investors who now have an allocation, encouraged by the belief that the Chinese economy and political system offers unique diversification benefits and the lowering of barriers to investment

“Investors are no longer thinking of emerging market debt as a monolithic asset class. We’re now seeing increased interest in specific markets, like China. We see this a long-term trend. It’s notable that Chinese fixed income in particular is one of the best performing asset classes this year, beaten only by US treasuries,” said Rob Waldner, Chief Fixed Income Strategist and Head of Macro Research, Invesco.

“For North American investors, our survey shows the majority see their EMD allocations as motivated primarily by diversification, with 68% viewing these allocations as core investments, rather than satellite, suggesting that they fulfilled long-term stable objectives.”

ESG cements its place in fixed income

Investors continue to move beyond performance concerns relating to ESG, instead recognsing that managing issuer-related ESG risks have the potential to enhance returns. Specifically, issuers who fail to address environmental – the “E” – and governance – the “G” – concerns may face higher borrowing and refinancing costs, with clear implications for the valuation of these securities for investors.

More than half (54%) of respondents now believe ESG analysis can unlock hidden value within fixed income with 50% of investors that have incorporated ESG within their fixed income portfolios citing return enhancement as a key driver.

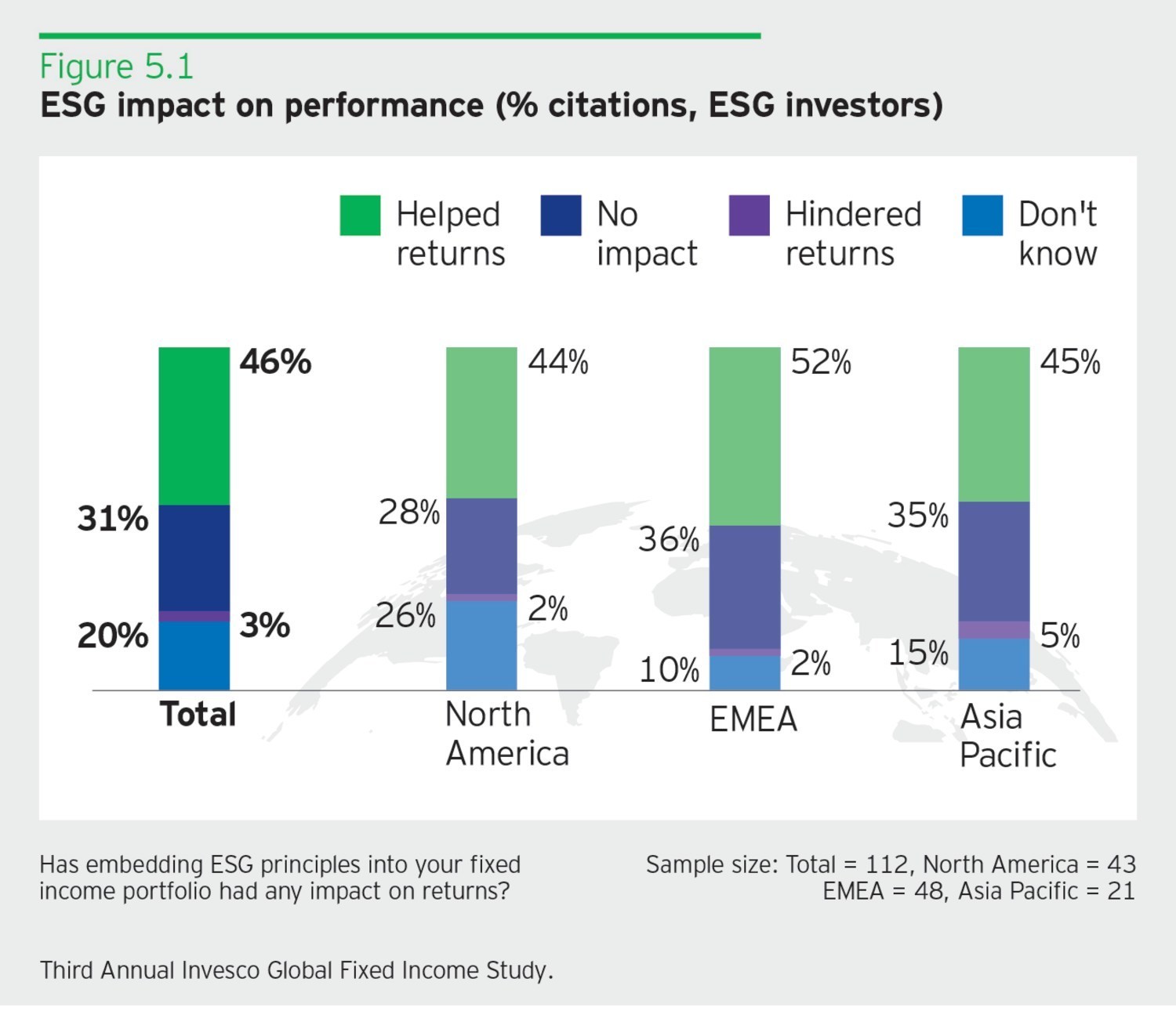

Just under half (46%) of investors who have incorporated ESG within fixed income believe that it has been beneficial to their returns, with just 3% seeing a negative impact.

“There has been a shift among investors who saw the value of ESG in equities, but did not see how the approach could be applied to fixed income; they now view ESG as a significant fixed income strategy. Our research shows that about a quarter of fixed income assets are currently ESG-integrated. It’s table stakes when advising on overall investment strategies,” Mr Waldner said.

“Amid the current market volatility, we’ve seen continued interest in the analysis of non-financial risks as part of the due diligence process. This is especially true given the connection between credit impairment, and risks associated with issuers that can be uncovered by a robust ESG process.”

Greater caution in advance of market turmoil

The survey showed fixed income investors were becoming increasingly risk averse prior to the market turmoil unleashed by COVID-19 in Q1 2020. Almost half (43%) believed the end of the record-long economic cycle was a year or less away, with the consensus for a soft landing. 23% identified a bond market bubble with just 29% fearing a major collapse in bond prices. Central bank easing led to low and negative yields, driving some to take on additional risk to bolster returns and meet objectives. The research shows a market that was plagued by fear: fear of losing, but also fear of losing out. Despite some late cycle risk-taking, the confluence of end of cycle concerns and fears of trade wars may have translated into portfolios that were better protected from the current, unprecedented exogenous shock impacting markets today.

“One factor that may have driven this caution was investors’ view that spreads were tightening. Given the appearance of COVID-19 and its impact on the markets, respondents who took precautionary actions in expectations of economic deterioration may now be relieved they did,” Mr Waldner said.

“But caution wasn’t universal, causing some investors to navigate the very large swings we’re now seeing in what were previously considered high-quality assets like consumer goods, autos, oil and gas, and travel.”

Invesco Fixed Income (IFI) is one of the world’s leading fixed income managers with offices in all global financial centers, singularly focused on uncovering and delivering value for clients.