From Michael Goosay, Chief Investment Officer, Global Fixed Income at Principal Asset Management

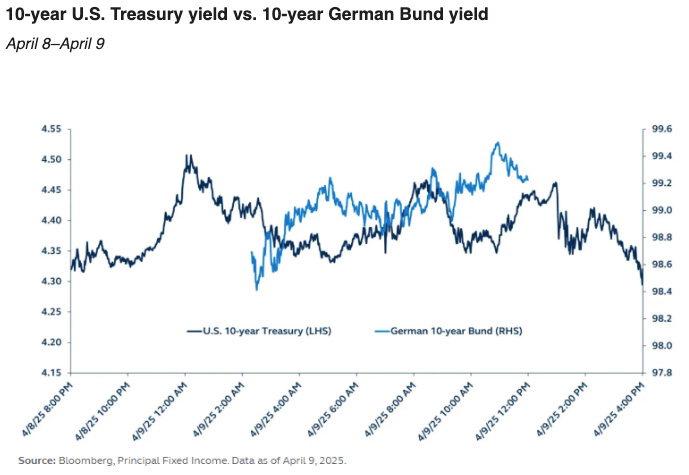

Coinciding with the overnight implementation of President Trump’s new tariffs, investors saw U.S. yields jump across the curve to start the day on Wednesday, with the 10-year peaking at 4.5% or +21 bps higher than the prior day’s close. While much of that initial move has since been reversed, following the U.S. Administration’s announcement that reciprocal tariffs would be reduced to 10% and subsequently paused for 90-days on all nations but China, markets remain on edge. It is challenging to identify a singular force behind Wednesday’s early price action, but the gradual actualization of tariffs and enactment of reciprocal countermeasures abroad has led investors to increasingly adopt the narrative that a recession and/or stagflation in the U.S. is a probable outcome. At the same time, the consideration of safe-haven assets outside of the U.S. has increased as Liberation Day led to waning of credibility for the U.S. as a reliable global market participant.

While the FOMC has acknowledged the risks to inflation and growth from the new tariffs, they have shown little urgency or willingness to act and adjust policy. With sustained market and rate volatility, there will undoubtedly be mounting pressure from investors and the Trump administration to act. The combination of escalating inflation fears and eroding growth, puts the FOMC squarely in an unenviable “Sophie’s choice” dilemma—which part of the dual mandate do they prioritize? Given current market dynamics and assuming no material capitulation on tariffs, our base case is for the FOMC to undertake a dovish shift, emphasizing the avoidance of a worst-case economic outcome over a full-throated continuation of its battle to curb elevated inflation.

Also read: Reducing Risk As Uncertainty Bites

Fixed income markets have started to show signs of stress against this backdrop, with headwinds building in higher-quality sectors. Agency mortgage-backed securities, municipal securities, and even U.S. Treasurys have exhibited strain from recent market volatility. The weakness in those markets likely reflects a loss of confidence in the U.S. as a global leader in trade and security. Further, China’s willingness to reciprocate, including threatening to sell Treasurys to fight back against U.S. tariffs continues to incite concern about the near-term stability of the Treasury market. Outside of the U.S., despite the recent growth in German Bund issuance, the Bund market has seen meaningful outperformance versus U.S. Treasurys, coinciding with an increase in the value of the Euro versus the U.S. dollar. Similarly, Japanese government bonds have held steady amid the market turmoil, and the Yen has appreciated meaningfully relative to the U.S. dollar.

Another recent notable change in the fixed income market has been the significant steepening of the U.S. yield curve. The steepening reflects a pull forward of expectations for Fed policy rate cuts and the potential for increased issuance of long-duration Treasurys. From an economic perspective, the hard data has yet to show much deterioration. Still, the dramatic sell-off in both risk as well as risk-free assets, and ongoing market pressure, could push the Fed to cut rates sooner than the economic data would otherwise warrant. There is a small but growing possibility of an intra-meeting Federal Reserve cut, and if that were to occur, a meaningful rate cutting cycle would likely ensue.

Overall, elevated market volatility will likely persist over the coming months and fixed income investors should remain patient. While the recent volatility has resulted in episodic market-to-market pain the asset class should continue to provide healthy income and downside protection relative to equities and other risk-seeking assets in the longer term. All-in yields across most fixed income sectors were attractive heading into April, and they have only become more compelling in recent days.