From Adam Hetts, Global Head of Multi-Asset and Portfolio Manager, with Oliver Blackbourn, Portfolio Manager, at Janus Henderson Investors.

The merits of a diversified portfolio were on display in early 2025 as international stocks outperformed U.S. markets.

While a pro-growth agenda premised on U.S. deregulation and EU and China stimulus initially underpinned market broadening, a trade war should exacerbate this trend as countries enact measures supporting domestic industries.

Higher inflation pushing down real wages could mean a slowdown in hard consumption data following the initial soft data trend showing negative sentiment. And despite tariff-induced volatility, duration may have upside if slowing growth turns into outright recession risk.

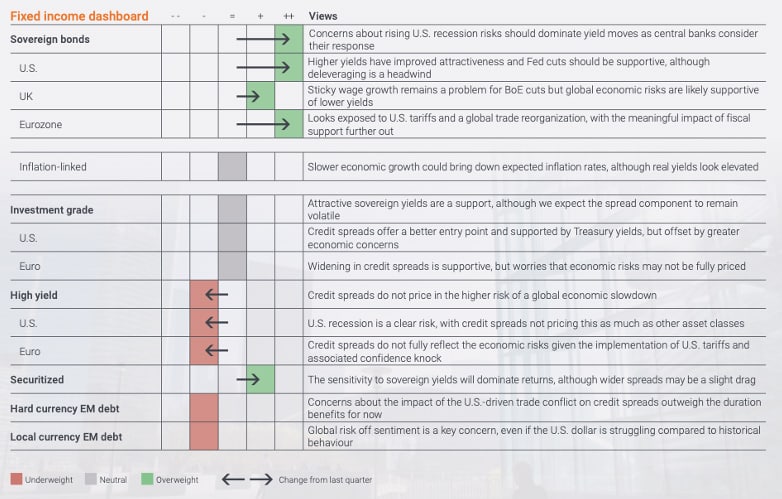

Fixed income

Central banks must reassess how they balance inflation and growth risks as tariffs could negatively impact both. The Fed in particular faces a tough balancing act of easing rates in the face of persistent core services inflation and a potential return of goods inflation. Within credit, although corporate maturities are well distributed and delinquencies are not yet flashing caution, higher quality is a priority in a post-tariff environment.

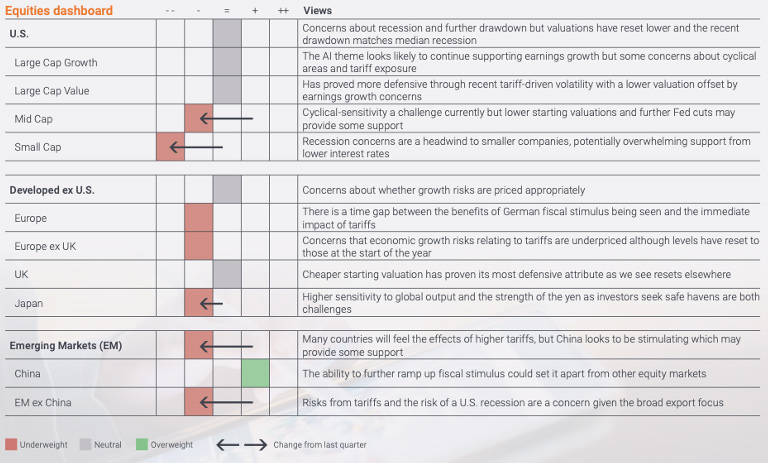

Equities

Tariffs’ potential impact on consumption, business investment and ultimately the economic cycle causes us to be cautious within global equities.

Also read: USD Down But Not Out; Going Global a Defensive Strategy; Goldilocks Alive in Europe

On the optimistic side, China has capacity to stimulate its economy, and perhaps Europe may finally institute aggressive pro-growth reforms. U.S. tech continues to generate ample cash, making certain areas an attractive defensive play should market sentiment sour further. Large-cap multinationals have greater ability to shift production and absorb tariffs than smaller U.S. companies.

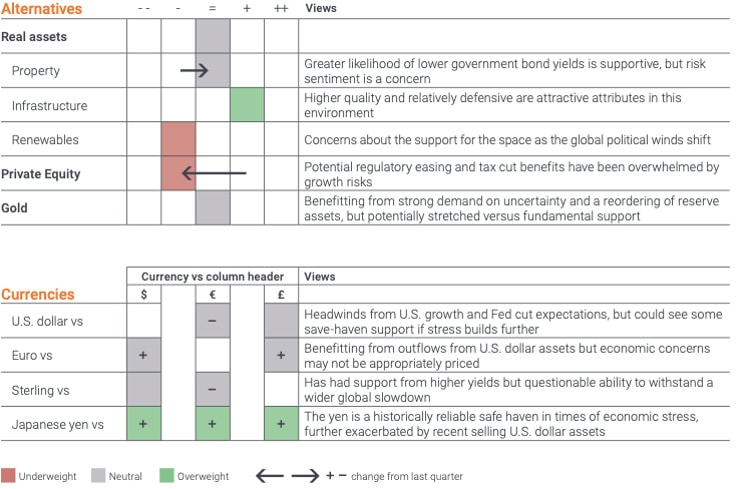

Alternatives

It’s too early to solidify the U.S. dollar’s outlook as investors balance the competing forces of unwinding dollar-denominated positions and its role as a safe haven. Currencies on the receiving end of tariffs tend to depreciate but other factors may be at play as countries recalibrate their trade and investment strategies. While gold doesn’t always behave like a safe haven, central banks will likely keep up purchases and other investors may jump aboard should real yields sink further.