Inflation continues to be a key theme and despite its recent peak, may stick around for longer than expected. In the first of a two part series, Elizabeth Moran looks at high yield ETFs and next week, high yield managed funds to beat inflation.

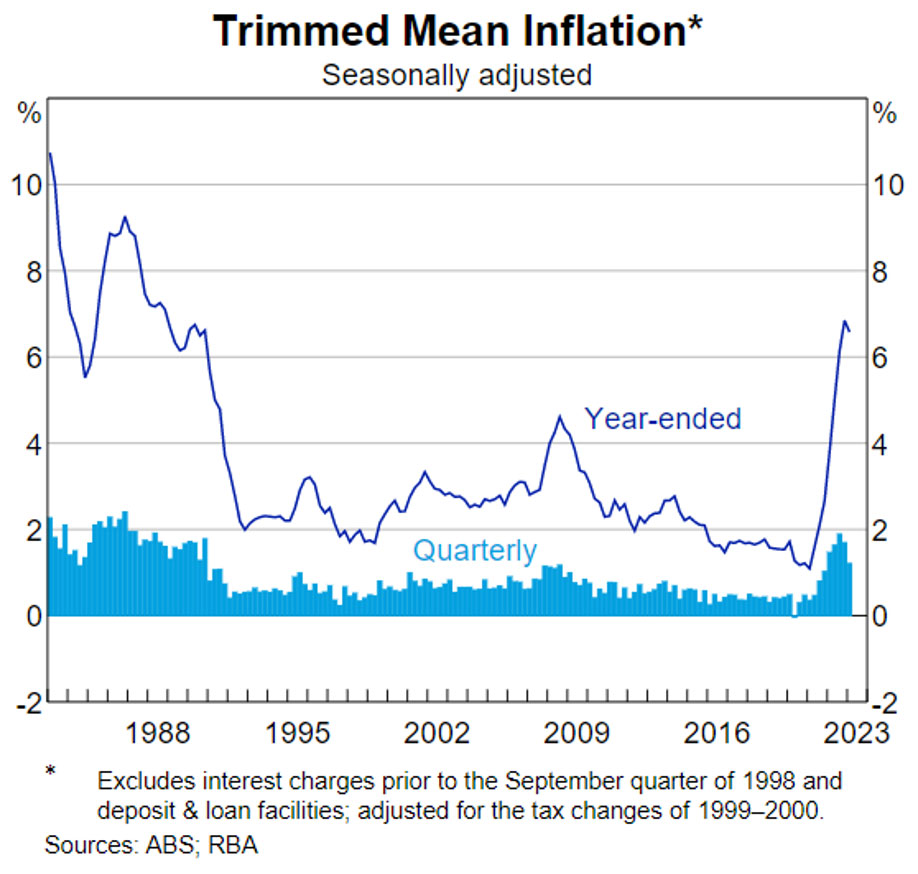

For the quarter ended 31 March 2023, annualised inflation was 7%, while monthly inflation to the same date was lower at 6.3%.

The government’s preferred indicator is the trimmed mean rate, which was 1.2% in the quarter (in seasonally adjusted terms) and 6.6% over the year to 31 March 2023, down from a peak of 6.9% in the December quarter of 2022.

Let’s have a look at funds that have the potential to beat 6.6% inflation.

This week I’ll look at ETFs and next week, managed funds.

At this high hurdle rate, the ETFs will likely be high yield, that is sub investment grade, so take high risk. You’ll need to do some additional research to determine if the funds suit your objectives and risk and return profiles, but hopefully the list below will get you started. Remember past returns are no indication of future performance.

While inflation is based on historic prices, I’m going to focus on future yields. That is one of the beauties of debt securities, they have maturity or call dates and funds can predict future yields.

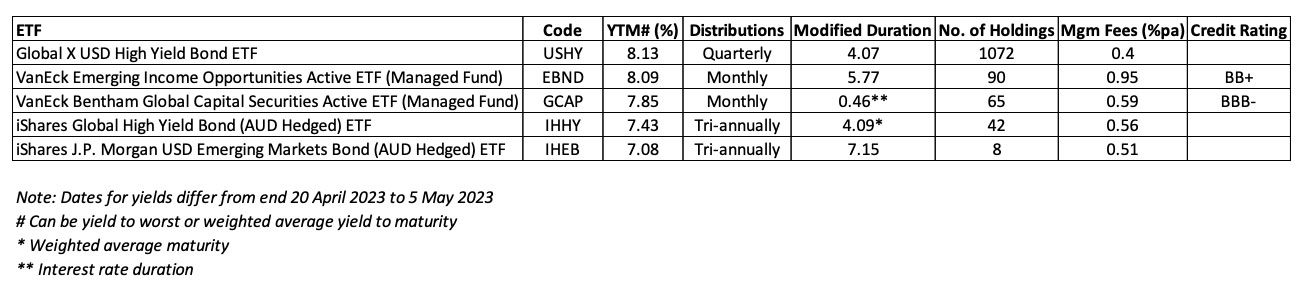

Using Fixed Income News’ updated ETF Finder list, I’ve identified five ETFs with yields to maturity or yields to worst that are higher that the 6.6% trimmed mean inflation rate.

While the yields are all attractive and the funds are all global, the underlying characteristics are quite different.

For example, some are Australian dollar hedged, taking away currency risk, some pay monthly distributions which may be attractive if you are trying to beat inflation, while there are significant ranges for number of holdings, fees and interest rate risk, known as duration.

You need to be careful when assessing these funds on yield alone. They use different measures. Some use a prudent ‘yield to worst’, while others use a weighted average yield to maturity. See the definitions below.

While all of the funds go into their holdings in detail, only two provided credit ratings for the whole portfolio.

Surprisingly, the VanEck Bentham Global Capital Securities Active ETF (ASX:GCAP) portfolio has an investment grade rating, but its investments are in additional Tier 1 securities, the same securities that were wiped out in the Credit Suisse failure and subsequent bailout by UBS. For more see our recent note Capital Notes Holders Wiped Out in Credit Suisse Debacle. While I’ve included the yield to worst in the table for this fund, the yield to call is even higher at 9.71%.

The Global X fund offers sits at the top of the list and has the best diversification, but looking at the underlying securities, just 7.3% are investment grade, 0.6% is in cash and the remaining portfolio is all sub investment grade. The fund is new and it’s small.

To find out more about these funds and what we consider as positives and things you need to be aware of, see our ETF fund finder pages as follows:

- Global X USD High Yield Bond ETF (Currency Hedged)

- VanEck Emerging Income Opportunities Active ETF (Managed Fund)

- VanEck Bentham Global Capital Securities Active ETF (Managed Fund)

- iShares Global High Yield Bond (AUD Hedged) ETF

- iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF

Yield definitions

There are four main yields quoted for fixed income securities:

- Yield to maturity (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity.

- Yield to call (YTC) used for bonds with a call date.

- Yield to worst (YTW) is commonly used for bonds with a call date, or multiple call dates where the bond can be repaid prior to final maturity and is the worst yield an investor can expect over the life of a bond.

- Running yield is the expected income if you buy the bond and hold it for a year and is dependent on the price you pay for the bond in the market. Running yield is similar to dividend yield.

This article is for educational purposes only and none of the funds mentioned are recommendations. Past returns are no indication of future performance. Please do your own research and if you are uncertain speak to a financial adviser before you invest.