One of the key reasons investors chose to invest in the fixed income asset class is for diversification, they are seeking investments that are not aligned to existing investments such as shares or property.

The fixed income asset class has plenty of opportunity for diversification with lots of sub sectors as discussed in the webinar with Anthony Kirkham from Western Asset Management. Further, a growing number of more specialised ETFs now allows access to specific sub sectors with low upfront commitments.

Here are five ETF investment themes and examples to help you diversify your portfolio:

1. Invest in a diversified fixed income ETF with many investments

These two funds have at least 400 investments in Australian denominated bonds.

The iShares Core Composite Bond ETF (ASX:IAF) and the Vanguard Australian Corporate Fixed Interest Fund (ASX:VACF).

IAF has a high allocation of around 90% to fixed rate government bonds and treasury securities and with government bond yields rising, the price of the bonds has been declining, resulting in existing holders losing value. Depending on your view of interest rates, you may not want the high allocation, or the current lower entry price to the fund may be a more attractive proposition. IAF is a very high quality ETF.

In contrast, VACF is predominantly a corporate bond ETF with almost 70% invested in corporate bonds and a small allocation to securitised assets. It too has seen price declines, but lower than IAF. VACF is also a high quality portfolio.

Also read: Can An Active ETF Strategy Make A Difference? VACF Versus TACT

2. Invest in a global ETF

There are more global ETFs than ever before. Fixed Income News classifies 13 as global and two of these are sustainable funds (see below for more information).

Of the 13 on our list the most diverse fund, the Vanguard Global Aggregate Bond Index Fund (ASX:VBND) invests in 9,508 securities.

Two others with large holdings include, the Vanguard International Credit Securities ETF (ASX:VCF) and the Schroders Absolute Return Fund (CHI-X:PAYS) with 5,585 and 2,767 securities respectively.

VBND is a multi sector fund that primarily invests in an underlying fund that has more than $7 billion in assets. The fund’s allocation is 65% government and related securities, 22% corporate and 10% securitised investments. VBND is showing a small loss for YTD of just over 2%. Average credit quality is very high.

With similar portfolio allocations to VACF, VCF is like the global alternative, over 60% is allocated to corporate bonds and the rest to government and related securities. Credit quality is still high. Global VCF has experienced lower losses than VACF, its comparable Australian fund up to 31 October 2021 and its YTD return is positive.

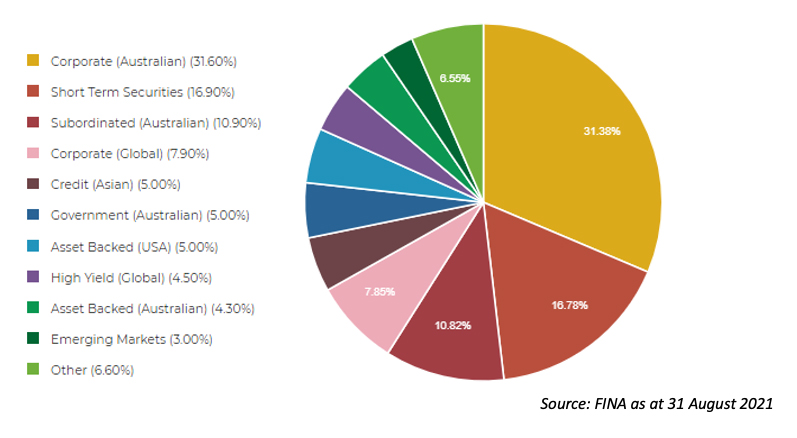

PAYS is a very diverse fund with its highest allocation to Australian Corporate bonds of around 30%. This fund has very low interest rate risk with many floating rate investments. Recent performance is very slightly negative but positive over the last year at 1.32% to 31 October 2021.

PAYS Asset Allocation

3. Invest in a sustainable ETF

More and more investors want their funds to do more than just earn a return. If you want to add ESG investments to your portfolio than have a look at Vanguard Ethically Conscious Global Aggregate Bond Index Fund (AUD Hedged) (ASX:VEFI) and BetaShares Sustainability Leaders Diversified Bond ETF (Currency Hedged) (ASX:GBND).

Both funds are new. If you are interested in ESG, please take a closer look at the respective indices and how the funds qualify suitable investments.

4. Invest in a high yield ETF

This very low interest rate environment persists. One of the good things about cheap money and the search for yield is that many higher credit risk companies (sub investment grade) have borrowed at low rates for longer, so they are less likely to default in the short term. Consider adding one of these ETFs for higher yield – iShares Global High Yield Bond (AUD Hedged) ETF (ASX:IHHY) or the BetaShares Active Australian Hybrids Fund (ASX:HBRD).

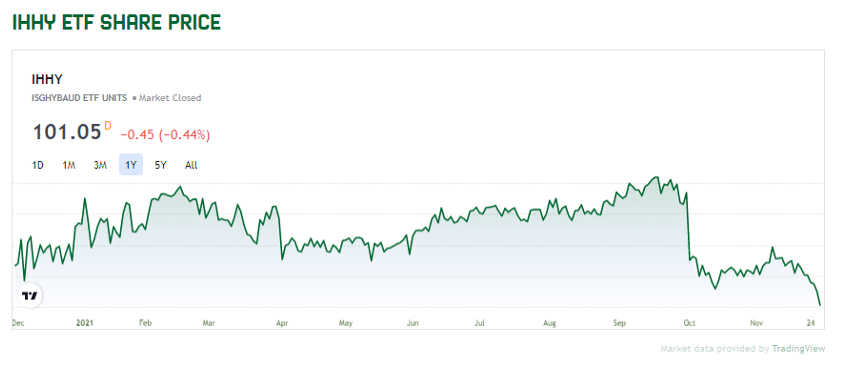

IHHY gives access to high yield bonds issued in developed markets. It has many underlying securities, although principally invests in another iShares fund. It’s one year return to 31 October 2021 was 8.44% and since inception in 2015, 5.61%. However, the fund has seen a significant price decline since the end of October 2021, as the graph shows. Practically all of the investments are sub investment grade.

HBRD is not strictly a ‘high yield’ fund as such, as many of the Australian hybrid securities in the fund would be investment grade. However, its net one year return to 29 October 2021 was 4.34%, a high yield in this environment. Its return since inception in 2017 is just over 4%.

A word of warning, if you are investing in global high yield you may want to check any exposure to the Chinese property sector, particularly Evergrande. For more information, see Evergrande, One Of The World’s Largest Property Developers, Struggles To Meet Debt Obligations.

5. Invest in an emerging market ETF

Portfolio managers are adding emerging market bonds to their portfolios to add yield and this is another strategy you could add to your fixed income allocation using an ETF.

There are just two emerging market ETFs in the market at the moment are the iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF (ASX:IHEB), and VanEck Emerging Income Opportunities Active ETF (Managed Fund) (ASX:EBND), but watch this space!

IHEB provides exposure to the global, US denominated high yield market and was launched in 2015. Since inception it’s had a return of 4.86%p.a. More recently, the lowest annual return was -5.92% in 2018 and the highest 14.75% in 2019.

EBND has a high allocation to fixed rate government bonds and so has exposure to interest rate risk. Average maturity is over 10 years but the fund has a yield to maturity approaching 5% as at 31 October 2021. The average credit rating is BB+.

One last suggestion, but it’s not an ETF

ETFs are great for the ease of investment and the low minimum investments amounts to access a diversified portfolio. Earlier this year I interviewed Gaby Rosenberg who started the Blossom App, especially for millennials and young women. The app invests in a fund run by Fortlake Asset Management. While it’s not an ETF, it has ETF qualities, low minimum investments and a diversified portfolio amongst other attributes. Find out more by listening to the podcast or go to the Blossom app website.