From Mawer Credit Team

High yield spreads continue to tighten. As risk premiums fall, and economic and political conditions appear positive for corporates in general, it is tempting to reach for yield in credit markets. As Howard Marks of Oaktree points out, the all-in yield (benchmark yield plus risk premium) on high yield is 7.0% and who doesn’t love a 7.0% return?

What could possibly go wrong?

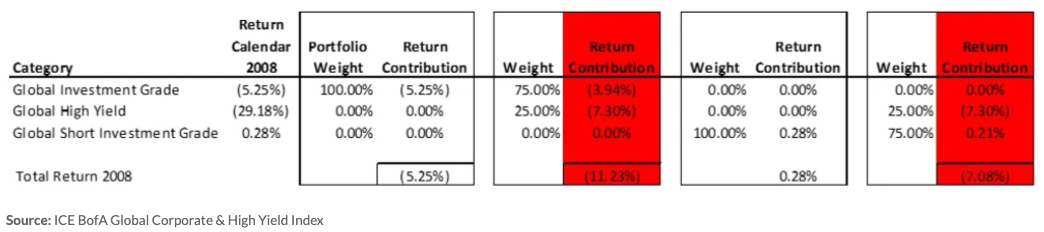

The table below illustrates the impact that just a “little” high yield can have on the return of a credit portfolio. In calendar 2008 (the teeth of the Global Financial Crisis) a portfolio of investment grade (IG) bonds produced a negative return of 5.25%. A portfolio of 75% IG and 25% high yield (HY) generated a considerably more jarring negative 11.23% return.

An investor focused on preserving capital in an expensive market could have generated a positive 0.28% return had they been invested in short IG corporates through 2008. Add 25% HY to that portfolio and the return falls to negative 7.08%.

Was the potential portfolio benefit to owning 25% HY at the start of 2008 worth it? As Jeff Probst of Survivor fame says “You wanna know what you’re playing for?” The incremental yield benefit in 2008 was 1.05% (i.e., 25% of the yield differential on HY 9.55% and IG 5.36%). Today the potential incremental yield benefit has fallen to just 59bps (HY 7.00% and IG 4.65%). We don’t believe investors are compensated for the risks inherent in HY—not were they going into 2008.

Reaching for yield in the wrong environment creates the potential for material negative portfolio impacts. Further, the opportunity cost of owning HY through the entirety of a volatile period is huge. In 2009 HY generated a positive 58.2% return. The 25% already invested in HY in the example above was unavailable to benefit from that rebound. There are periods we believe investors should be heavily invested in HY. In our view, this is arguably not one of those periods.