Investment manager Federated Hermes has been tracking the types of ESG bond supply and comparing that to previous years and noting changes.

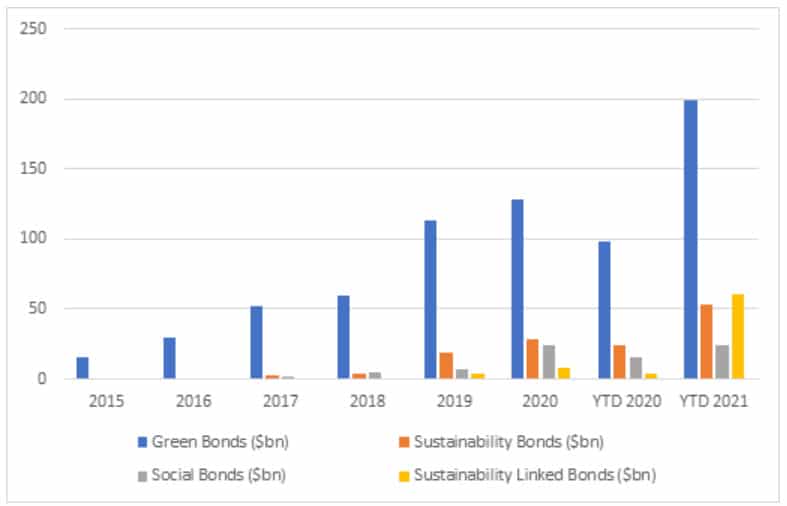

Nachu Chockalingam, Senior Credit Portfolio Manager, at the international business of Federated Hermes said that global ESG corporate bond supply totalled US$338 billion year to date to the end of September 2021. She noted that this is an almost two-and-a-half increase from the same period in 2020.

“What is interesting is that while green and sustainability-linked bond issuance has been on a tear, social bond issuance has lagged materially – the latter perhaps because growth was just too elevated in the immediate aftermath of the worst of the pandemic,” Chockalingam said.

Chockalingam commented on a slowdown in the issuance of ESG bonds in Q3 vs. Q2 and Q1 of this year.

“There is generally always a slowdown in bond issuance during the (northern) summer months, but what we perhaps did not expect was that the percentage of total issuance ESG-labelled bonds accounted for also fell marginally, particularly in euro and sterling denominated issuance.

“The key sectors that issuance has come from this year are Banking and REITs; the key currencies are euro and US dollars; the key regions have been Western Europe and Asia and we have seen more issuance from crossover issuers (those rated BBB to BB) particularly in green and SLB bonds.”