Janus Henderson Investors’ Credit Risk Monitor tracks key indicators which impact credit portfolios

-

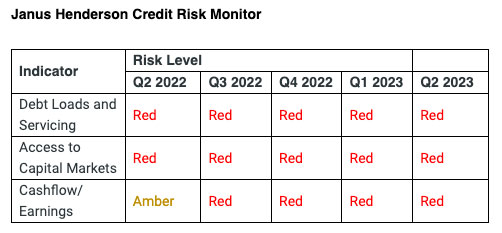

All three traffic lights monitored by Janus Henderson Investors’ credit team continued to flash red in Q2 2023.

-

Disparity between nominal growth and real growth, combined with high inflation, has allowed nominal earnings at companies to stay robust.

-

Tighter lending standards, higher refinancing costs and a slowing economy will gradually take their toll on credit quality.

-

Nimbleness and careful credit selection remains key for investors in this environment.

The quality of corporate credit issuance is weaker than the market is currently pricing in, according to the latest analysis from Janus Henderson Investors. Quarter-on-quarter metrics show a broad, albeit shallow deterioration, suggesting defaults could pick up in the second half of the year, even if the pace of defaults is slower than in previous cycles.

A seasonal lull in primary issuance could support markets near term but the research suggests that tighter lending standards, higher refinancing costs and a slowing economy will gradually take their toll on credit quality.

Janus Henderson Investors’ latest Credit Risk Monitor tracks corporate fundamental and macroeconomic indicators on a traffic light system to indicate where we are in the credit cycle and how to position portfolios accordingly. The key indicators tracked (‘Cashflow and Earnings’, ‘Debt Loads and Servicing’, and ‘Access to Capital Markets’) all remain red for the fourth quarter in a row.

Also read: Final Stages of Hikes, First Stages of New Bull Market

Jim Cielinski, Global Head of Fixed Income at Janus Henderson Investors, said: “There was something for everyone in the last quarter. Bears could point to weakness in lead economic indicators, stubborn core inflation and credit metrics deteriorating; Bulls could counter with strong labour markets, declining headline inflation and a robust consumer. As recession fears scaled back, markets have been pricing in a more muted credit default cycle. Our view is more circumspect, as we expect more “trouble credits” to emerge as the lagged impact of tighter policy takes effect. That said, the timeline could be protracted, given many companies will not refinance for the next one to four years, on average.”

Debt Loads and Servicing

Debt loads will remain high

A combination of high inflation and robust nominal growth has largely protected corporate credit quality as nominal earnings have held up. As such, highly indebted companies have been largely insulated from the pain that would normally be associated with this stage in the credit cycle. However, those with a high stock of debt may be toppled by the combination of higher financing costs in a slower growth environment.

Access to Capital Markets

Lending standards continue to tighten across the board

The new environment of falling demand, declining inflation, slower growth but elevated real rates will cause lending standards to tighten, and capital availability for higher leveraged companies will be stretched. Further liquidity withdrawal amid Quantitative Tightening will also impact access to capital.

Cashflow and Earnings

Prices and volumes are weakening

Over the previous quarter, tighter financial conditions alongside weak manufacturing PMIs contributed to earnings downgrades for some industrials. Recent bankruptcy filings for some small businesses are also likely to spread more broadly into capital markets.

The broader slowdown in consumer demand as a result of higher rates filtering into the economy will hit company earnings and expose the bottom 10-15% of highly indebted corporates which have so far managed to remain afloat. As earnings growth weakens, this could create an exogenous shock to cash flow for come companies.

Asset Allocation Implications

High yields across the credit spectrum will not last forever

Nimbleness and careful credit selection remains key. All-in yields look attractive across the credit spectrum today, relative to history, because policy rates have moved up. However, investors need to consider the extent of the upside available in higher yield issuances given considerations around default risk and liquidity concerns.

Spreads have tightened further, particularly in the higher yielding segments. Unless a soft landing materialises, yields on some sub-investment grade bonds may not offer a sufficient cushion for slowly rising default risk and liquidity declines.

Attractive yields are available in some of the safer areas of the market, such as short duration, high quality assets. However, investors might want to favour a cautious stance on highly leveraged companies with significant exposure to floating rate debt amid a higher-for-longer interest rate scenario.

Jim Cielinski added: “Seasonal technicals may support credit markets near term but we anticipate credit quality dispersion to become more material later in the year as companies address the 2025 maturity wall. A selective, nimble investment approach is paramount.”