According to Challenger Investment Management’s December 2023 quarterly review:

- Subordinated debt was the star of 4Q23

- Australian dollar financials are expensive compared to offshore issuance, and

- Retail bank capital (ASX-listed hybrids) are prohibitively expensive.

Tier 2 subordinated bank capital was the star of the final quarter of 2023. Major bank Tier 2 tightened by around 20 basis points over the quarter strongly outperforming bank senior and additional Tier 1.

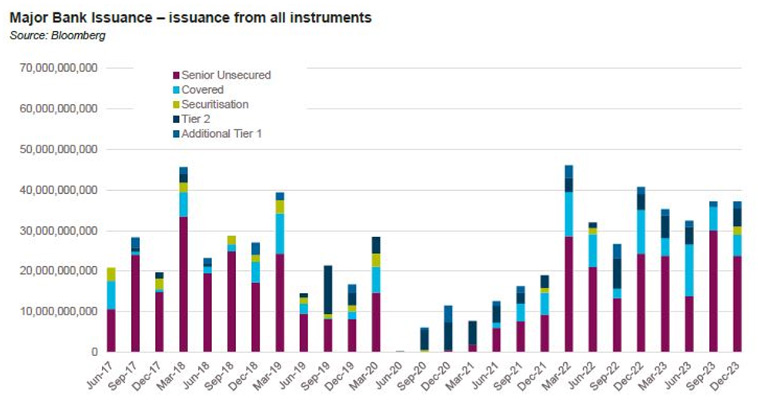

In 2023, A$11 billion in Tier 2 was issued by the major banks into the Australian market and A$17 billion in total, slightly down on 2022 and 20% down on 2021’s issuance of A$21 billion. The banks are approaching January 2026’s new TLAC targets in reasonable shape with Deutsche Bank estimating A$37 billion in gross issuance requirements over the next two years which is less than 2020/21 when the banks issued close to $41 billion.

An interesting fact in recent quarters has been the strength in demand in Australian dollars for both bank senior unsecured and Tier 2. Banks issued 55% of senior unsecured and 64% of Tier 2 in Australian dollars which are both considerably higher than historical levels. Australian dollar bonds are pricing well inside the US dollar curve with Tier 2 pricing estimated to be anything from 35-50 basis points wider in USD versus Australian dollars.

While hard to discern from public commentary we suspect superannuation funds have been the marginal buyer of Australian dollar bank paper. Superannuation funds have materially increased their holding of fixed income and commentary from fund CIOs suggests they have a positive disposition towards the bonds.

From a fundamental perspective there is nothing of note to call out either domestically or globally. Delinquencies remain low, banks are adequately capitalised and even US regional banks have seen deposit outflows subside and reverse with a US$250 billion increase in the second half of the year.

For more, see Challenger’s quarterly review which also covers non financials, asset backed securities and whole loans and real estate loans.

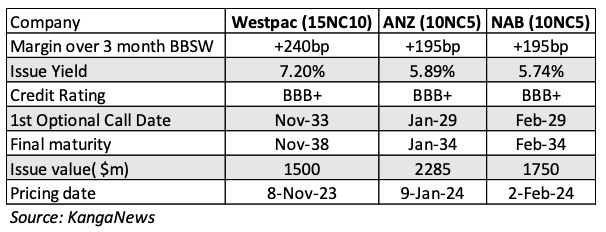

New NAB issue pays 5.74%

NAB would have been confident launching its recent new sub debt issue after ANZ issued a whopping A$2.285 billion in January. The ANZ issue was scaled down after receiving bids for $3.7 billion (including a USD tranche).

The NAB issue priced at the same margin as the ANZ sub debt, 3-month BBSW +195 basis points, although the issue yield was lower as BBSW contracted.