Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Market Review

The US Federal Reserve (Fed) created some volatility through December. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose +0.51%.

Central Banks generating volatility as data leads the way.

Australia’s three-year government bond yields ended the month 9 basis points (bps) lower at 3.82%, while 10-year government bond yields were 2bps higher at 4.36%. Against the current cash target rate of 4.35%, three-month bank bills were down 1bp at 4.42%. Six-month bank bill yields ended 17bps lower at 4.49%. The Australian yield curve steepened.

The first half of the month saw the continuation of lower yields seen in the prior month, before volatility spiked, and yields surged. Much of this was unwound into month end. This epitomises the higher degree of volatility and uncertainty in the current economic and market environment. A hot Australian labour market report, helped by the Fed which wound back interest rate cutting expectations, precipitated the higher yields. The late month decline was based on a more balanced Reserve Bank of Australia (RBA) outlook and moderating economic data. This highlights the high degree of data dependence that central banks are currently basing their policy outlook on, with very little future guidance to go on.

The RBA has removed its upside inflation concerns and moved to factor in the next move in interest rates will be lower. The timing remains less clear, but they now see the domestic economy allowing lower policy rates. This was underpinned by the weaker than expected third quarter GDP outcome, at 0.3%qoq and a paltry 0.8% over the year, with almost all the growth continuing to come from the public sector. The loss of growth momentum, despite a stabilising household consumer, was a surprise to the RBA and allowed them to reassess the outlook, even with a still strong labour market.

The Australian labour market remains surprisingly resilient, defying the forward indicators. The unemployment rate dropped back below 4% for November. Despite this, wages growth continues to moderate from its highs, suggesting that the level of the unemployment rate consistent with full employment is lower than the RBA believe. The NAB business survey showed further deterioration in December, and consumer sentiment pulled back a little. Household spending appears to be slowly picking up as real wages recover. However, the RBA were cautious about the changing nature of the discounting environment and will await further evidence of improvement.

Also read: Thematic Investment Ideas: The Big Five For 2025

Market outlook

The Australian economy is sluggish, and while no recession is forecast, the pressure of higher interest rates is broadening out across sectors of the economy. Core inflation is moderating slowly from high levels. The RBA needs to balance these risks along their so-called narrow path. The extended period of policy at restrictive levels will slow growth further, rebalance the labour market and subdue inflation. The global economic backdrop remains soft, although there are a myriad of risks which generate volatility.

Our base case is for the RBA to remain on hold at current rates before commencing an easing cycle in Q1 2025. We price a more modest than the historically average easing cycle, of around 110bps, spread across 2025. We presently have no tilt to the high or low case. The low case is for more easing over the whole cycle. The high case looks for just 85bps of easing. The market has built in an RBA easing cycle, with 85bps priced over ten months. We believe there is some value in targeted parts of the curve which outperform into easing cycles. We continue to hold a long duration position and look to adjust the position through market volatility.

Monthly focus – The Five Ds

It wouldn’t be the turn of the year without a list. This year we think about the structural influences on the economy, themes which stretch further than the cyclical, but will have an influence on the here and now. The current crop of thematic forces can be termed the five Ds: Decarbonisation, deglobalisation, debt, digitisation, and demography. All are factors which will have long term impacts on the way we do things and how policy evolves, but are also starting to hit their straps in the present rather than be just a theoretical construct to be thought about later.

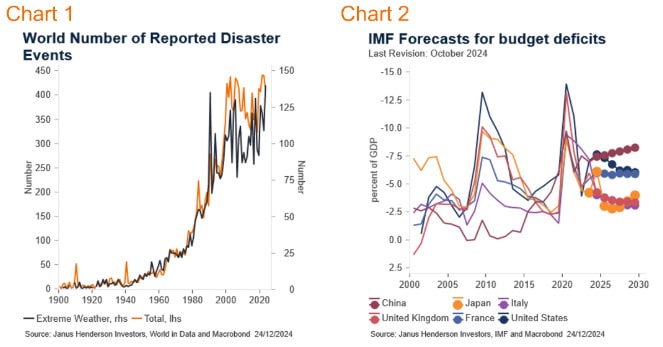

Decarbonisation: Climate change’s impact on the global economy will be, and already is, significant. We can assess it through various channels including transition impacts such as investment in renewables. However, there are also the impacts of climate events (Chart 1), such as drought, fires and flooding, as well as warming factors, which are already influencing the patterns of Australia’s inflation.

Deglobalisation: We wrote about higher trade barriers last month, and these are part of a transition away from the free trade era. The changing global political landscape influences trade patterns. We also see evidence of what is termed “friendshoring” or aligning international investment with strategic partners, rather than on traditional economic fundamentals, such as cheap labour or comparative advantage.

Debt: Rising government debt is a pattern seen in many of the G10 economies and elsewhere. A lack of significant fiscal prudence since the global financial crisis profligacy, compounded by the global pandemic, is now coming home to roost. Financial markets are taking a less tolerant approach to a lack of fiscal containment, as the interest rate on government debt starts to rise above nominal GDP growth rates.

Digitisation: The artificial intelligence (AI) era is upon us. We have already seen the pricing of the potential gains in equity markets, but the productivity gains of its implementation have yet to arrive. This next fundamental step of productivity gains may take time, as the wholesale roll out of AI through the economy requires the necessary capital investment to utilise it to its full potential. Investment in data centres and warehousing has already begun, and the first stages of the roll-out for everyday tasks is underway.

Demography: We know populations are ageing, and this has fundamental implications for both inflation and economic growth. However, the last few years have been influenced by population changes of a different nature, namely migration. The next phase will be a slowing in migration, as policies in many countries are swung towards limiting the surge seen in the post pandemic period.

All these influences will ebb and flow through the economy, each with a distinct implication for the economy, policy and financial markets. They will enhance the current economic cycle in some cases, push back on it in others. It will be an interesting year.

Views as at 31 December 2024.