It’s been a busy week for two of Australia's big insurers.

IAG announced it had successfully raised A$450m in a 16 year, non-call six-year (16NC6),...

As investors move through life, their appetite for risk and reward changes. It’s common for older investors to choose lower risk investments as they...

Australian investors are largely denied the same range of investment choices as investors in other developed nations and should be outraged.

Corporate bonds mostly remain...

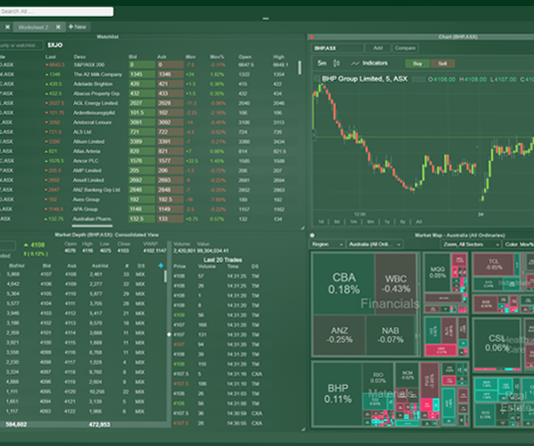

IRESS Clients Get Access To Australian Bond Exchange (ABE) Platform To Digitally Trade Corporate Bonds

Ben Ready

A new partnership between bond broker Australian Bond Exchange (ABE) and financial markets software and services group Iress will enable Australian investors to digitally...

Australia's retail corporate bond market requires much further simplification and more equitable tax treatment if it is to become more attractive to retail investors,...

Online jobs site SEEK, has been busy in the bond market over the last few weeks:

Offering to redeem the $175m senior floating rate...

As published in The Weekend Australian on 26 June 2020

In the frenzied final days of the sale of Virgin Australia, more than 5000 local...

Global investment manager Blackrock has introduced two new fixed income corporate bond ETFs to investors as part of their iShares ETF portfolio.

The two new...

As published in The Australian on Saturday 15 June 2020

Virgin Australia’s administration is a recent low point for Australian financial markets, with mums and...

Today, the U.S. Federal Reserve will begin purchasing up to US$250 billion in individual corporate bonds as part of its previously announced measures to...