Opinion piece taken from Nuveen’s Global Investment Committee mid-year outlook.

The following outlook includes directions to investment destinations where the water may prove warmer and...

Key Insights

Global high yield bonds offer potentially attractive yields, with better value and opportunities in Europe.

Default rates are not expected to return...

Inflation has been kind of an enigma for the world over the past few years.

Policymakers dismissed rapidly rising inflation early on and viewed it...

In Brief

Equities tend to wake up late to recession risks.

A buildup of short-term corporate debt should weigh on profits as borrowing costs...

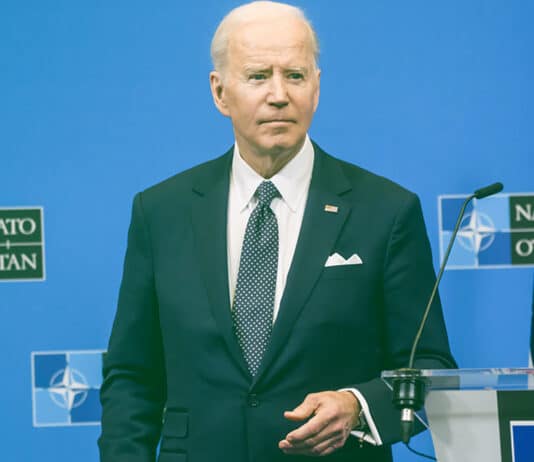

As the US President Joe Biden and House Speaker Kevin McCarthy reach an in-principle agreement to finalise a budget agreement to raise the $US31.4...

Andrew Canobi, Director and Portfolio Manager Franklin Templeton Fixed Income, argues that the debate over the US debt ceiling is a timely reminder of...

The global financial system nearly collapsed in September 2008 when “globally significant” bank Lehman Bros failed, insurance company AIG (which insured many securities) had...

Readers of the financial press recently will have noted the term “US debt ceiling” popping up frequently in the market narrative. It is one...

Inflation continues to be a key theme and despite its recent peak, may stick around for longer than expected. In the second installment of...

Pursuing social and environmental impact alongside financial returns

A joint paper from T. Rowe Price by:

Matthew Lawton, Portfolio Manager, Global Impact Credit Strategy

Hari...