Despite initial concerns that the outcome of the Presidential election might remain uncertain for days or even weeks, a decisive Republican performance has made...

Gil Fortgang, Washington Associate Analyst at T. Rowe Price shares three policy developments to watch after the U.S. election:

1. Personnel is policy

Regardless of whether...

By Mitch Reznick, head of sustainable fixed income at Federated Hermes

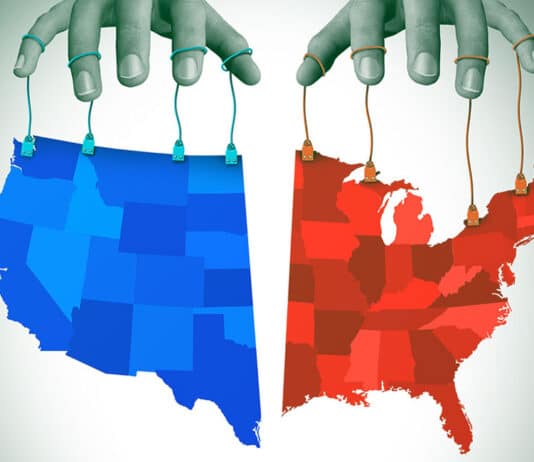

Vice President Kamala Harris and former President Donald Trump remain neck and neck in...

CPI inflation was just 0.2% in the September quarter, bringing the annual rate down to 2.8%. But don’t expect the RBA to celebrate inflation...

Authors: Andre Chinnery, William Maher, Diego May and Josh Spiller* - Reserve Bank of Australia

Abstract

Global private credit has grown rapidly over the past two...

Shopping around for the best interest rate isn’t just a smart financial move - it’s an essential one, especially for institutions and councils with...

By Sébastien Page, CIO and Head of Global Multi-Asset at T. Rowe Price

There’s no perfect historical analogy for the current environment. Fiscal and monetary...

Rallying bond yields supported fixed-coupon markets, particularly in the US, which now look particularly expensive.

Against a backdrop of rallying sovereign bond markets, credit markets...

Anna Dryer, a portfolio manager in the Fixed Income Division at T. Rowe Price shares her views on the upcoming US election and its potential...

From Chief U.S. Economist PGIM Fixed Income, Tom Porcelli.

PGIM Fixed Income conducted analysis based on the potential election scenarios and their estimated impact on...