By Anna Chong, Deputy Head of Corporate Credit Research, Federated Hermes Limited

The new year promises to be a challenging one for highly levered corporates...

Australian Insurers Adjust Their Portfolios for Inflation and Rising Interest Rates

Contributing Author

Cautious approach to risk assets: Over 80% of insurance firms express a cautious stance towards risk assets, signalling an intent to reduce exposure over...

By Benoit Anne, Senior Managing Director, Strategy and Insights Group, MFS Investment Management & Market Insights Team, 7 April 2025, London

Last week’s US tariff...

The global financial system nearly collapsed in September 2008 when “globally significant” bank Lehman Bros failed, insurance company AIG (which insured many securities) had...

The Fed sent a strong signal that interest rates will remain higher for longer, as Franklin Templeton Fixed Income chief investment officer Sonal Desai...

With the Federal Reserve now on an easing cycle, investors are turning their attention to the performance of US long duration Treasury bonds. The...

From Fraser Lundie, Head of Fixed Income – Public Markets, Federated Hermes Limited

Amid the significant uncertainty facing corporate credit investors today, several bright spots...

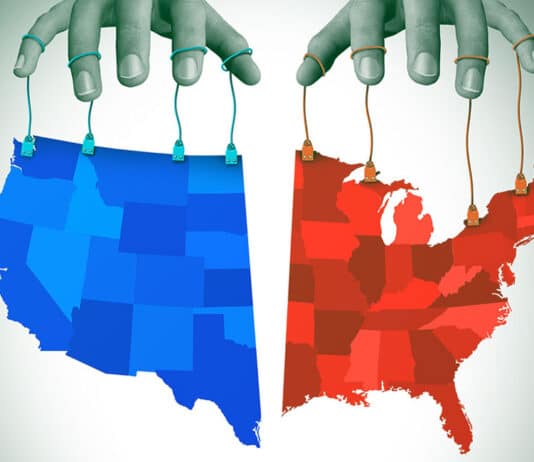

Anna Dryer, a portfolio manager in the Fixed Income Division at T. Rowe Price shares her views on the upcoming US election and its potential...

From Seema Shah, Chief Markets Strategist, Principal Asset Management

With the fruitful tandem of low central bank policy rates and muted inflation no longer carrying...

From Matt Simpson, Senior Market Analyst, City Index

The RBA held interest rates at 3.6%

This breaks a record streak of 10 consecutive hikes...