Market and portfolio commentary from institutional investor Nuveen, as part of their quarterly Global Investment Committee Outlook.

Current market environment:

Overall growth in the U.S. and many other countries has either slowed, turned negative or been subject to greater instability amid a variety of economic obstacles.

Divergent monetary policy around...

Scott Solomon, Co-Portfolio Manager of the T. Rowe Price Dynamic Global Bond Strategy shares his comments on why rate cuts may not help the RBA.

A lot can change seemingly overnight in the world of central banks. Looking ahead, we think the second half of 2024 is poised to have...

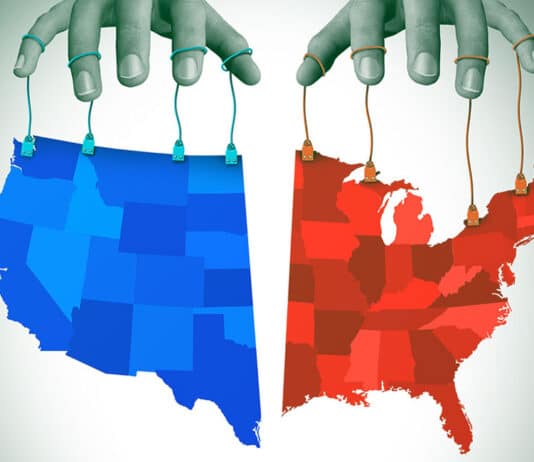

Anna Dryer, a portfolio manager in the Fixed Income Division at T. Rowe Price shares her views on the upcoming US election and its potential impact on the long-term Treasury yields as follows:

Our research indicates that this is the closest presidential election in over 60 years, with a high likelihood...

US monthly inflation reached 7% last week, the fastest rise since the early 1980s, and the FED came out and said it may have to raise interest rates faster than expected. The first US interest rate rise is expected in March and recent consensus is for three rate rises...

Amundi’s Global Investment Committee recently published an excellent paper on investing in second half 2022. Here we republish its Top Convictions, as well as its central and possible alternative economic scenarios. While covering multiple asset classes, we focus on the fixed income elements, including their Fixed Income suggestions.

Top Convictions

...

Elizabeth Moran takes a look at BetaShares' new Interest Rate Hedged Australian Investment Grade Corporate Bond ETF (HCRD) and suggests some advantages and disadvantages.

It’s always exciting to see new fixed income products come to market and last week, BetaShares’ announced its new fixed income ETF, HCRD, which hedges a...

Amundi Asset Management has provided commentary on the recent market and banking sector uncertainty in Europe.

Uncertainty in markets continued at the end of last week, with additional volatility in the banking sector and Deutsche Bank experiencing pressure in particular. In an attempt to calm markets down, ECB President Christine...

Private credit in the investing space is a growing market where senior secured debt, asset-backed lending, structured and project finance, mezzanine debt and other forms of unsecured debt happen and exist across a wide range of underlying asset classes.

Attractive returns are available in private markets through simply providing the...

I was delighted when Peter Sheahan from Curve Securities emailed me last week after we published the ‘Has BBSW Peaked?’ article.

BBSW is calculated using market volumes known as volume weighted average (VWAP) calculation method. If there isn’t enough trading volume to calculate BBSW then there’s a waterfall where BBSW...

ETF investors continue to show strong interest in personalization; Familiarity with direct indexing grows - A report from Schwab Asset Management in the U.S.

Fixed income has been in focus this year and surprisingly, Millennial ETF investors are gravitating toward this asset class more than their older peers, according to...