A new global report from investment consultancy bfinance is encouraging Australian institutional investors to revisit Emerging Market Debt (EMD) allocations, with fresh data highlighting...

Twelve days ago, Israel launched a major military campaign targeting Iranian nuclear facilities, air defense, surface-to-surface missile sites, and senior military and scientific personnel....

Amid the resurgence of market volatility from US President Trump’s tariff threats, broader policy uncertainty, and elevated equity market valuations, there is a worthy...

How investors and issuers are adapting to structural changes shaping the next era of credit. From Anders Persson Chief Investment Officer, Head of Fixed...

The S&P 500 is up 11% since 9 April and the deadline for what US President Donald Trump will do with tariffs is approaching....

Hedging Geopolitical Risks & Fixed Income Regains Diversification, HY Resilience

Contributing Author

From Benoit Anne, Senior Managing Director, Head of Markets Insights Group & Erik Weisman, Chief Economist, MFS Investment Management

Market Insights

How to hedge rising...

By David Jacobs, Head of Domestic Markets, Reserve Bank of Australia

Address to Australian Government Fixed Income Forum, Tokyo, June 12, 2025

Introduction

It is a pleasure...

During recent client meetings, my outlook for higher U.S. Treasury yields in the longer term has often been high on the agenda. Clients have...

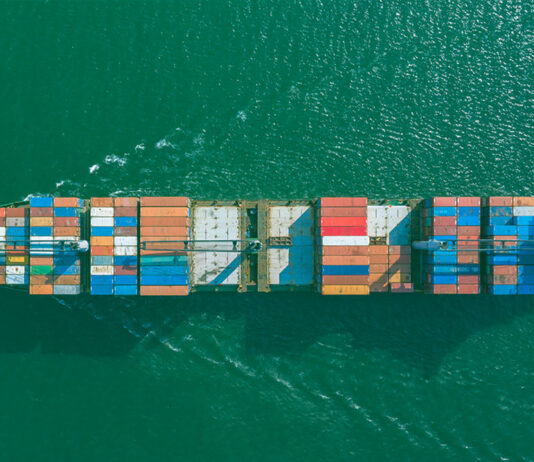

Investing in a post-globalization world with reconfigured global trade necessitates a careful assessment of market opportunities and risks.

T. Rowe Price has released its midyear...

Big section numbers, even bigger risks

The case for duration may be a bit stronger in Europe than in the US

The investor...