By Gareth Abley, Co-head of Alternative Strategies, MLC Asset Management

A perennial challenge for most investors is that the vast majority of the risk in their diversified portfolio derives from equities and bonds. This can work over most long-term periods and is a good basis for many portfolios however, after a strong decade of returns, it’s easy to lose sight of the value of adding complementary, diversifying return streams into a portfolio. One niche asset class that we think is worthy of consideration is natural catastrophe reinsurance which can be accessed via private markets and via publicly traded catastrophe or ‘cat bonds’.

For those unfamiliar with the asset class, the easiest way to think about ‘cat bonds’ is as a type of insurance that transfers the risk of catastrophic events such as hurricanes or earthquakes from insurers and reinsurers to investors. In the same way that reinsurance allows insurance companies to transfer some of their risk to reinsurers, cat bonds allow insurers and reinsurers to transfer the risk of catastrophic events to investors through the insurance-linked securities (ILS) market.

Cat bonds are a distinct, and growing, asset class within the alternative investment space. They possess risk and return characteristics that have made them attractive investments for institutional investors, hedge funds, and high-net-worth investors. Some investors may already have exposure to this asset class via sophisticated super funds. In Europe, investors are able to access cat bonds through the UCITS (Undertakings for Collective Investment in Transferable Securities) market and as a result, can more readily buy and sell their cat bond investments on a more liquid basis.

MLC Asset Management has been invested in the natural catastrophe reinsurance asset class, including cat bonds, for 17 years. During that time, we have seen the market expand to encompass billions of dollars in issuance annually. Year to date issuance (to June 2024) has exceeded US$12 billion, already ahead of the previous record H1 issuance of US$10.3bn set in 20231. This growth is reflective of the rising popularity of the category as a means of achieving diversification and attractive, non-correlated yields in investment portfolios.

Also read: Private Credit Market Requires Additional Scrutiny and Transparency

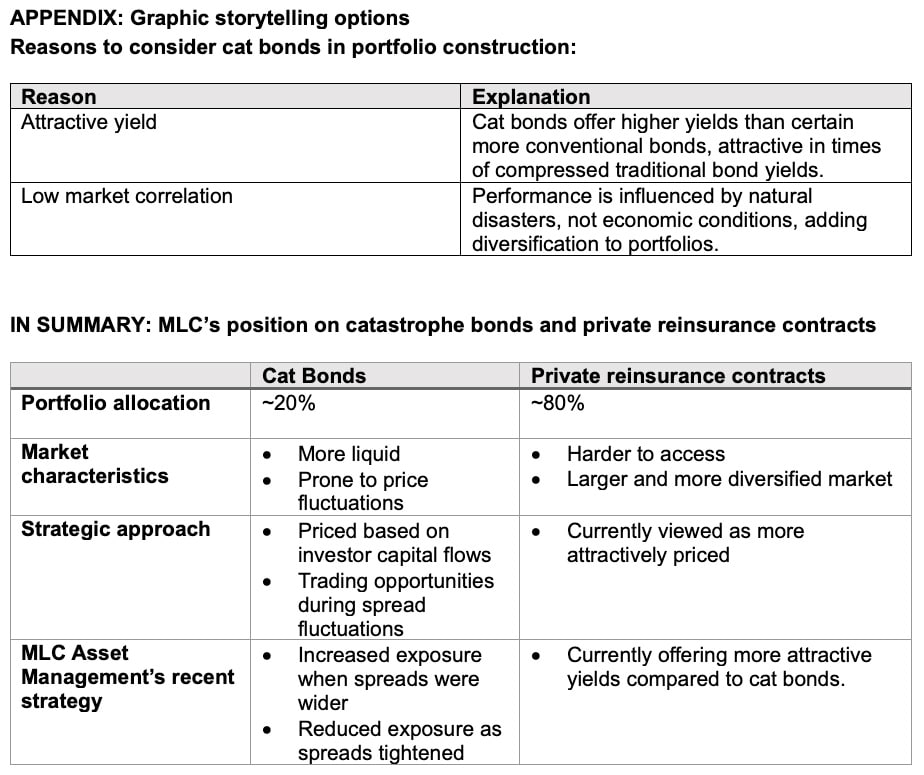

Cat bonds are floating rate instruments, which means their return is driven by a combination of the cash rate and the ‘spread’ for taking reinsurance risk. This means performance is largely decoupled from the macro factors – such as PE ratios, economic growth, geopolitical risk – that drive mainstream asset classes. As well as earning an attractive yield, Cat bonds are uncorrelated with traditional equity and fixed income markets. This makes them a very complementary addition to most diversified portfolios.

Some of the most important features of cat bonds include:

1. Performance is not tied to economic cycles or market sentiment

This non-correlation provides clear diversification benefits. In addition, the floating rate nature of these instruments, which includes a spread over the cash rate for providing insurance, makes them particularly appealing in a rising interest rate environment. Additionally, with recent upward repricing in the reinsurance markets due to increased natural catastrophe events, cat bonds currently offer higher yields. This combination of diversification, attractive returns, and unique risk profile makes them a valuable addition to a well-rounded investment portfolio.

2. Attractive yields

In the years between 2007 and 2016, there was a relatively calm period for natural catastrophes, but that changed between 2017 and 2023 when a significant rise in events led to substantial insurance losses. This led to higher yields in the natural catastrophe reinsurance markets and on cat bonds.

After reaching extremely wide levels in early 2023, cat bond spreads have come down somewhat in 2024, but still remain attractive –currently yielding ~13-14% (before expected losses of ~2.5%) 2 3. So, as well as being a very logical strategic allocation, tactically, now is an excellent time to invest.

3. Unique Risk and Return Profile

As a type of bond issued by insurance companies to cover specific catastrophic events, cat bonds have a unique risk-return profile. With cat bonds, the primary risk is explicit: whether natural disasters will cause losses exceeding the threshold specified in the contract. Climate change, and the risks of increased natural catastrophes is a common and valid concern to be factored into this assessment. It’s important to note, while cat bonds typically have three-year maturities, private reinsurance market contracts reprice annually – allowing constant adjustment to reflect the latest information on climate change.

4. Investing in the dynamic reinsurance market

It’s worth noting cat bonds are a very small part of the broader reinsurance market. Recent estimates value the broader reinsurance market at US$461 billion of which includes US$41 billion of issued cat bonds4. MLC Asset Management has been investing in the cat bonds space since 2007, making a positive return each of those 16 years.

MLC invests via multiple specialist partners (as returns can vary meaningfully between managers even with a similar risk profile), and predominantly via the private reinsurance market. While our portfolio includes cat bonds, it is not solely reliant on them as spreads can sometimes be more attractive in the private reinsurance markets, as is currently the case. This portfolio design means we have more levers to pull to target where the risk-return is most attractive across the asset class ecosystem. For example, we dialled up exposure to cat bonds in early 2023 when spreads were very wide and rotated more capital into private markets as yields here became relatively more attractive.

Over the 16 years, MLC’s portfolio has averaged returns of cash +5 per cent, with a zero beta to equities5. What’s also been noteworthy, over that period, is the huge growth of the sector, and its increasing sophistication and maturity. This evolution has made cat bonds an even more attractive option for diversifying investment portfolios. Holding an investment whose performance is not influenced by the stock market’s ups and downs is a powerful way to build more robust, resilient portfolios.

[1] Source: www.Artemis.bm.

[2] Source: Artemis, Cat bond market yield in USD, 30/6/2024.

[3] Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

[4] Guy Carpenter, January 2024.

[5] Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.