Franklin Templeton Fixed Income Portfolio Manager Andrew Canobi says the current strong performance of US and Australian credit markets is not likely to continue.

US investment grade spreads are hovering at or very close to all-time lows. Since the GFC, US spreads versus treasury have been as low as 76 basis points (bps). They currently sit at 82bps.

US High Yield spreads are hovering at or very close to all-time lows. Since the GFC, High yield spreads have rarely, and for a short period, stayed below 300bps. They currently sit at 298bps.

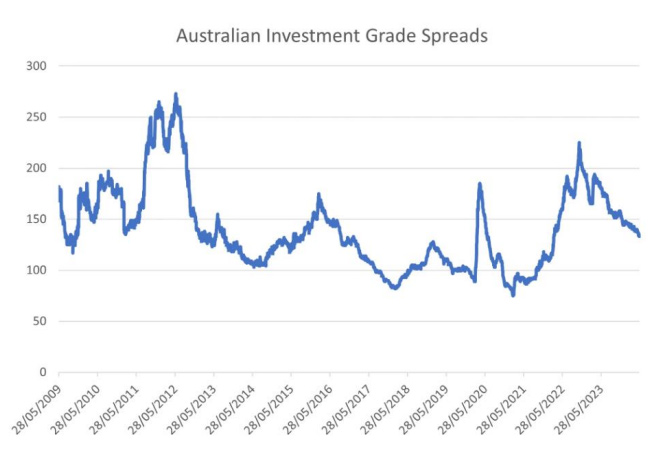

Australian Investment Grade has also performed strongly and spreads have narrowed, well off their widest levels but are not yet at their longer term lows.

Canobi says: “But a deeper analysis of sector composition within the Australian universe reveals spreads are actually fairly tight as well. The Australian market is a little different to the US in that most bonds are evaluated versus the interest rate swap curve rather than the government bond curve. Like the US, they still have a ‘spread to bond’ which is shown in the chart below, but the market focusses on credit spreads versus the swap curve. One expression of that is the Australian iTraxx CDS index, which effectively looks at floating rate spreads, or spreads versus swap.

“When we look at Australian Investment Grade through this lens, it starts to resemble global markets like the US. Not at all time tights, but again, not too far away.”

Credit stormed tighter in 2023 and has had a reasonable 2024 so far. As duration continues to be an underwhelming source of return for fixed income, the credit train has rolled on. Australian credit outperformed the broader Bloomberg Ausbond 0+yr index in 2023 by 180bps. Year-to-date in 2024, the credit index has outperformed the Bloomberg Ausbond 0+yr index, which is barely in positive territory at all with a meagre 0.04% YTD return, by ~125bps.

Also read: From Volatility to Victory: Building Resilient Fixed Income Portfolios

Canobi adds: “So where to from here? Credit has performed well because the macro environment has remained fairly benign. The hard landing/recession scenario simply hasn’t materialised. It still could. News from the US that a AAA US Commercial Mortgage-Backed Security has realised hefty losses (something that hasn’t occurred since the GFC) is a reminder that pressure points exist in a high interest rate environment. But the macro story holding together has kept demand for credit intact. The ‘everything is awesome equity market’ has also helped demand for corporate bonds.

“Credit has also performed well as markets front run the peak in rates. Everyone is clinging to the ‘peak rates is in’ view. It most likely is, but the easing cycle has been pushed out and, as we’ve argued, the rate cut cycle when it ultimately arrives will be shallow unless something seismic changes. Peak rates against a relatively benign backdrop has been positive for Investment Grade in particular because all-in yields are likely at or near their high. Even if they don’t end up declining that much, lock them in.

“Those positive drivers are the reason credit has performed, but it’s likely now in the price.

“We are staying invested but favouring shorter duration credit and saying no a lot more to overpriced new issues. The charts above are market-wide barometers. There are still great opportunities even within a tight spread environment. You just need to look harder. We are continuing to favour defensive sectors that are paying good returns and where we sleep like babies such as transport infrastructure, airports, global money centre banks and domestic AAA RMBS. We don’t own any high yield.

“We are evaluating increasing protection on our investment grade position even though we don’t own anything remotely at risk of default.

“We are being patient. 25 years of experience doing this has allowed us to observe multiple credit cycles. The downturn always comes, and its genesis is often hard to predict. We retain dry powder for such a day, preserving positions in higher quality government related sectors that can be quickly deployed if we do see a correction at some point. These positions are still delivering reasonable returns but can be quickly sold and used to access the goodies if needed.

“For now, the train is still on the tracks but it’s certainly slowing down,” says Canobi.