Global asset manager Janus Henderson has outstanding research capabilities. This article gives us insight into their thinking about investing in investment-grade BBB rated securities versus sub-investment-grade BB rated securities. It also explains some key educational terms and includes a glossary. We suggest you take your time reading the article and consider if it has implications for your current investment strategy.

This article was authored by Nick Sandford, FRM, Risk Analyst; Seth Meyer, CFA, Portfolio Manager; and Nirav Thakkar, Senior Risk Manager.

Key takeaways

- The term ‘risk’ is often unhelpfully vague, particularly as it relates to bond investments.

- Understanding the difference between interest rate risk and credit risk – and how both are measured – can be helpful when evaluating opportunities.

- By isolating credit risk, we show the potential value in BB rated bonds in a new light.

The asset management world often uses the term ‘risk’ loosely. When talking about bond investments, ‘risk’ generally refers to the volatility of the bond’s price, and thus an investor’s return over any given period. The more volatile the price, the less certain an investor can be about avoiding losses while earning the bond’s coupon1, or interest rate.

The second most common understanding of risk in bonds is ‘credit risk’, which is the risk that the issuer of the bond will have trouble repaying it. Given that all high yield bonds are issued by companies with a credit rating below investment grade, credit risk is more prominent in the high yield market than in the investment grade corporate bond market or the ‘risk-free’ US Treasury market.2

Unsurprisingly, credit risk and volatility risk tend to go hand in hand. For example, lower-rated companies tend to be more sensitive to changes in the economic environment, and thus are often more volatile.

Also read: What Is Credit And Why Is It Important?

To measure these risks, active managers use a variety of metrics. First, corporate bonds are often thought of as made up of two different, though related, risks: interest rate risk, which is the risk that Treasury rates will rise or fall; and spread risk, which is the risk that changes in the company’s outlook cause its individual credit risk to change. The latter is measured by the bond’s ‘spread’ or yield premium paid over an equivalent maturity Treasury bond.

To measure how sensitive a particular bond is to each of these risks, the industry uses the term ‘duration’. A bond’s duration – or, more precisely, its interest rate duration – measures the sensitivity of its price to changes in Treasury rates. Lastly, a bond’s ‘spread duration’ measures the sensitivity of its price to changes in the spread paid for the additional credit risk the bond contains.

Looking at the relative value among bonds with different credit ratings

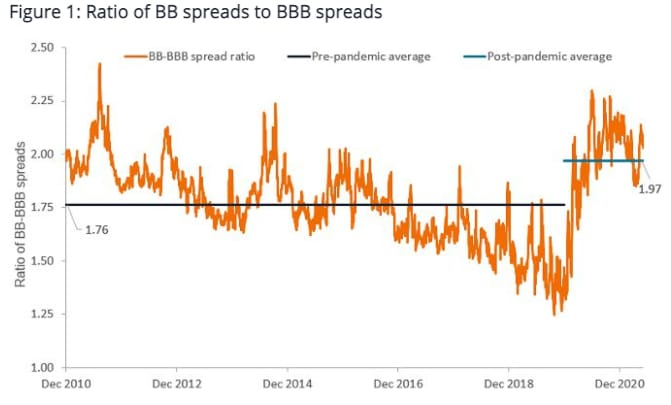

Given that BB rated high yield bonds have a lower credit rating, it is intuitive that they would offer a higher yield premium, and thus trade with a wider spread. The graph below shows the history of this spread expressed as a ratio – how many times more yield have BB rated bonds historically offered over BBB rated bonds?

The graph confirms that the spread is positive (BBs have traded at least 1.25 times as wide as BBBs over the last decade), but it also shows that the spread slowly narrowed from 2010 to 2020, only to rise sharply with the onset of COVID-19. This is intuitive insofar as the economic shock of COVID-19 clearly increased the volatility of securities and raised the volatility of lower-rated companies even more, requiring an additional yield premium.

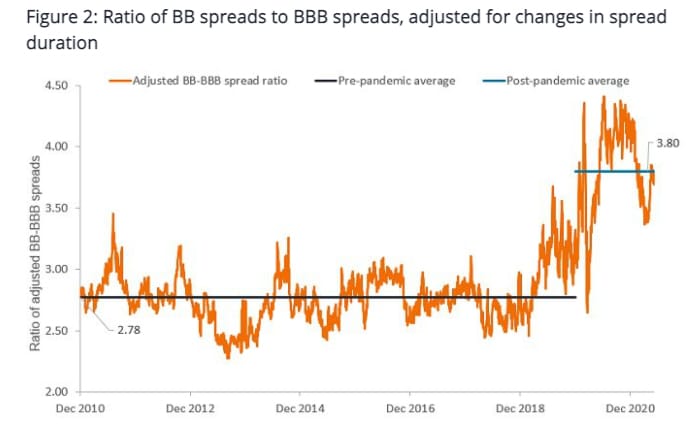

But when we consider the role that spread duration may be playing in the historical relationship between BB and BBB rated securities, we get a clearer picture. The chart below shows the same series as the chart above, but the ratio between the two rating segments is adjusted for the changes in their respective spread durations.

It appears that the steady decline in the premium paid for BB rated bonds over BBB rated bonds had less to do with changes in their credit outlook and more do with an evolution in their sensitivity to changes in their credit outlook – that is, their spread duration. When the series is adjusted for these changes, the relationship between BB and BBB spreads is remarkably constant from 2010 to 2019. And it was in 2019, not 2020, that BB spreads began to creep higher on a spread-duration adjusted basis. Indeed, the volatility in early 2020 is noticeable on the graph but is also more clearly “just” a bout of high volatility within a broader trend towards higher BB spreads.

What happened in 2019 and why does spread duration matter?

BB spreads did tighten relative to BBB spreads over the 2010-2019 period, as the first graph shows. But the second graph tells us that changes in the spread durations between BB and BBB bonds explains most of the tightening. While we have not graphed it, the spread durations of BBB bonds generally rose over the 2010-2019 period while BB bonds were more stable.

Also read: Westpac Capital Notes 8 (WBCPK) Offer Announced

The rise in BBB durations is in large part due to the trend towards lower Treasury yields over the decade. As those rates declined, it became cheaper to borrow and so companies issued increasingly longer-maturity bonds, trying to lock in the lower interest rates for longer periods of time. As longer times to repayment increase a bond’s sensitivity to changes in the company’s outlook, these longer-maturity bonds have higher spread durations. This effect was not as prominent in BB rated bonds because, being lower rated, the change in Treasury yields was not as significant a factor in their overall yields. With more credit risk than BBB bonds, the incremental decrease in the underlying Treasury yields simply was not as significant.

So what changed in 2019? On the BBB side, not much. The spread durations of BBB bonds continued to climb higher in 2019. But on the BB side, these bonds saw their aggregate spread duration fall sharply. They fell in part because Treasury yields fell, helping to raise the price of the bonds as a result of their interest rate duration, and in part because the spreads of BB bonds had been tightening, which also raised their prices. The cumulative effect of these price increases reached something of a tipping point in 2019 as many of the bonds’ prices got closer to their call levels (ie, the pre-agreed price at which the issuer is entitled to buy the bonds, or ‘call’ them, back from the owner).

As BB bonds got closer to this call level, the spread duration was pushed down. While there is a mathematical explanation for this, the intuitive one may make more sense: if a company can buy its bonds back and issue new ones at cheaper interest rates, investors may become less worried about changes in the company’s outlook (because lower borrowing costs are generally correlated with better credit quality) and more worried about the possibility that the company will take them away. The net result is that the sensitivity to changes in the company’s credit outlook declines as attention turns to the will-they-or-won’t-they question – will the bonds I hold be suddenly paid off in full?

Everybody talks about the weather, but nobody does anything about it.”

– Mark Twain

Just like the weather, fixed income indices evolve. Sometimes those evolutions suit investors, sometimes they don’t. And sometimes they provide opportunities that an active manager can exploit. The important thing is to do something about it: to analyse what happened and figure out if the change creates an opportunity.

Today, BB rated high yield bonds are offering nearly four times the spread of BBB bonds – double its historical average – when adjusted for their differences in spread duration. Is this just another unpredictable change in the weather or is it an opportunity?

Also read: What Is A Credit Spread?

Because we now understand better the role that interest rate duration has played in the historical relationship between BB and BBB bonds, we can consider the role the US Federal Reserve (Fed) may play in how their future relationship may evolve. We think the Fed is more likely to raise policy rates from zero than they are to make them negative. And, if the risk in longer-maturity Treasury rates is thus more skewed to higher rates than lower ones, then perhaps the decade-long trend of rising BBB spread durations will fade. Put simply, if lower borrowing costs increased spread duration over the last decade, higher borrowing costs may not lower the spread duration, but they could temper its rise.

Besides the nearly four times spread advantage of BB bonds over BBB bonds, another advantage of favouring BB rated ones in today’s market is the greater prevalence of potential ‘rising stars’ – companies that could see an improvement in their credit rating given the stronger economic outlook, moving them up and into the investment grade corporate bond market.

While picking and choosing among these potential stars does require extensive expertise and research, we take to heart the old tip for chess players: never make a move for fewer than three reasons. If BB bond spreads look attractive on a historical basis and even more attractive on a spread-duration adjusted basis, and the BB universe is sprinkled with potential rising stars, and there may be good reason for BBB spread durations to slow their pace of appreciation, then perhaps one should allow the chess clock to tick for a few minutes longer and consider the potential opportunity that making a move into the BB space could provide.

1The term coupon refers to the agreed periodic interest payments in a bond’s contract. Historically, bond contracts were paper certificates which contained coupons that needed to be detached and physically presented to receive the interest payment. Thus the phrase “clipping the coupon” became shorthand for owning a bond and receiving the regular interest payments because actual scissors were used to clip off the coupons.

2We put ‘risk free’ in quotes because while that is the common way to refer to risk in US Treasuries, the phrase specifically refers to Treasuries’ lack of credit risk, but not a lack of volatility risk.

Glossary

Corporate bonds are bonds issued by a company.

Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage or asset-backed securities may normally be prepaid at any time, which will reduce the yield and market value of these securities. Investing in derivatives entails specific risks relating to liquidity, leverage and credit and may reduce returns and/or increase volatility.

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

High yield bond is a bond that has a lower credit rating than an investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon. They involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Yield is the level of income on a security, typically expressed as a percentage rate. For a bond, this can be simply calculated as the total annual coupon payment divided by the current bond price.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

This article has been republished with permission from Janus Henderson Investors. You can view the original article here.

![New High Yield Earlypay Notes Paying BBSW + [6-6.5%] p.a.](https://www.fixedincomenews.com.au/wp-content/uploads/2022/04/Earlypay-100x70.jpg)