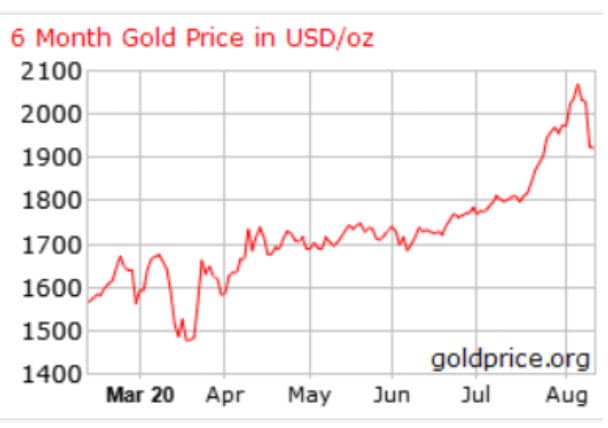

Gold has been having a dream run, performing exactly as it should in stressed markets.

The yellow metal is up around 30 per cent in six months (even allowing for a mid-week swoon on the back of profit-taking ). Six months ago it was trading at US$1,474 per ounce – today it is near US$1,931.

As gold surges, governments are pumping out fresh new bond issues to raise money to support struggling economies. Last month, the Australian Office of Financial Management raised $15 billion in a single issue for the Federal government and expects to raise $4-$5 billion per week for the coming year.

But that is nothing compared to the US government, who this week planned to raise a record US$112 billion.

So, how does gold compare to bonds? Though both are considered safe-haven assets, they have different features and constraints.

Gold is a limited natural resource. Total estimated tonnage is 244,000 tons – 187,000 tons mined and 57,000 tons in underground reserves. Higher demand will lead to higher production and thus curb price increases. Traditionally 50% of gold is used in jewelry production and high prices should also act to dampen demand.

If we exclude gold miners – which is a very different sector to the gold commodity – there is no income. The only way to make money is for the price to increase, then holders have to decide to sell to recoup capital. Investing in the shares or bonds of gold miners will provide an income but exposes you to business risks.

[Related Reading: Eight Reasons to Invest in Fixed Income]

In contrast, government bonds pay an income, albeit a low one at the moment. They also have a defined maturity date when investors know $100 face value of the bonds will be returned to them. Investors don’t ever have to decide to sell.

Outperformance comes with negative market sentiment as demand rises, or declining interest rates, both pushing bond prices higher, potentially offering capital gains to investors willing to sell.

Current low government bond yields offer little future upside price protection.

The Australian 10-year government bond yield is around 0.91 per cent and has been quite volatile in the last six months with yields ranging from a low 0.61 per cent in March to a high 1.61 per cent in the same month.

Traders can still make the right calls and outperform.

Even though interest rates are low, they can go lower as Germany, along with other strong European economies, demonstrates with its negative 0.45 per cent, 10-year government bond rate.

One of the biggest benefits of government bonds is capital protection. The government issuing the bond promises to repay the $100 face value at maturity. Governments can raise taxes and print money and so investors can be confident of getting half-yearly interest payments and capital back at maturity.

Investing in physical gold cannot make that promise, nor can the shares or gold ETFs. Investing in bonds of gold producers makes the same promise but without a government guarantee.

Both gold and government bonds are favoured central bank investments.

According to the World Gold Council’s May 2020 survey of central banks, the three main reasons they invest in gold are: it’s historic position, as a long term store of value and performance in times of crisis.

There’s no right or wrong in which safe-haven asset to hold in your portfolio. You may even decide it’s worth allocating to both, especially when deposit rates are so low and offer absolutely no upside.

A shortened version of this article was published in the Weekend Australian on Saturday 15 August 2020.