Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Market Review

Markets settled after the US Presidential elections. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose 1.14%.

Bond markets settled through November, returning to focus on the economic cycle.

Australia’s three-year government bond yields ended the month 11 basis points (bps) lower at 3.91%, while 10-year government bond yields were 16bps lower at 4.34%. Against the current cash target rate of 4.35%, three-month bank bills were up 1bp at 4.43%. Six-month bank bill yields ended 2bps higher at 4.66%. The Australian yield curve flattened modestly.

In a well-trodden path into major market events, a pattern of buy-the-rumour, sell-the-fact for bond markets emerged through the US elections. US President-elect Trump is to start his second term in January, and markets were pricing for the potential policies that have been proposed. As November progressed, some of the extremes have been removed, and markets returned their focus to the economic cycle. The outlook has changed, with the new US President, but central banks continue to solve for existing economic conditions. The US Federal Reserve lowered interest rates, as did a swathe of others. Global inflation is trending lower, and global purchasing manager indices shifted down outside the US.

The Australian bond market continues to price a limited Reserve Bank of Australia (RBA) easing cycle, predicated on sticky core inflation and a solid labour market. Through the month, the labour market eased with fewer than expected gaining new employment, while the unemployment rate was steady at 4.1%. Wage growth for the third quarter was lower than expected, and the annual rate continues to moderate. Monthly inflation, while not yet a complete series, also moved lower. The trimmed mean was steady at 3.5%yoy but there are signs that this will moderate outside regulated prices in the months ahead.

Also read: Markets Embrace Prospect of Smaller Government

Consumers appear to remain sluggish, but are stabilising and confidence has bounced. The trajectory is dependent on the labour market, house prices, which have softened, and certainty regarding the outlook. There are a high number of uncertainties at present. Business confidence was improved slightly, although underlying details were soft. Business investment did pick up in the quarter, although this was centred on warehousing and data centres. ASIC continues to report elevated insolvencies.

Also read: Rebates Slow Inflation But Don’t Expect Rate Cuts

Market outlook

The Australian economy is sluggish, and while no recession is forecast, the pressure of higher interest rates is broadening out across sectors of the economy. Core inflation is moderating slowly from high levels. The RBA needs to balance these risks along their so-called narrow path. The extended period of policy at restrictive levels will slow growth further, rebalance the labour market and subdue inflation. The global economic backdrop remains soft, although there are a myriad of risks which generate volatility.

Our base case is for the RBA to remain on hold at current rates before commencing an easing cycle in Q1 2025. We price a more modest than the historically average easing cycle, of around 110bps, spread across 2025. We presently have no tilt to the high or low case. The low case is for an earlier start, and more easing over the whole cycle. The high case looks for just 85bps of easing. The market has built in an RBA easing cycle, with 70bps priced over 18 months. We believe there is value in targeted parts of the curve which outperform into easing cycles. We continue to hold a long duration position and look to adjust the position through market volatility.

Monthly focus – Tariff Turmoil

A world in which there is less free trade and more barriers to trade entry is a poorer one for Australia, and the world. Changes in the global geopolitical landscape mean that 2025 will be a year in which trade barriers will be raised. The implications for Australia relate more to the crossfire than any direct hits, and outcomes are more nuanced. The headline remains that tariffs are likely to lower economic growth and raise inflation.

US President-elect Trump has reignited the topic, planning to introduce a swathe of tariffs on trading partners as he commences office in late January 2025. The US will not be alone. Tariffs beget tariffs, and reciprocation is likely to be swift. These directly raise the cost of imports in the implementing country. But they also divert resources to less efficient domestic industries, lowering potential GDP and raising domestic production costs. In turn, this lowers demand for imports from third countries, like Australia.

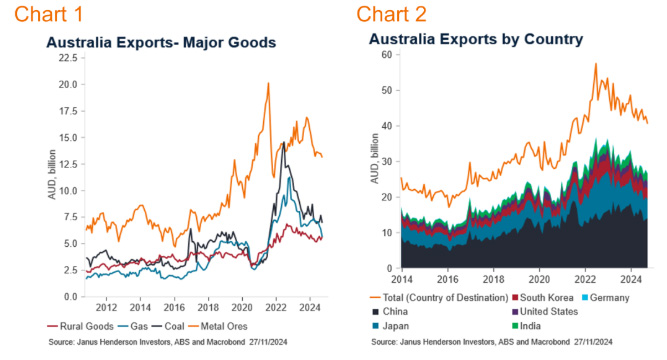

Australia has trade relationships with the US and with China, as well as many other countries. Our trade may benefit from a rotation of demand away from protagonists, but this is not guaranteed and possibly marginal. Australia does not produce many substitutes for what the majors produce. We specialise in natural resources: iron ore, coal and gas in that order (Chart 1), as well as education services. It is not a given that Australian trade will benefit from the deterioration in global trade relations.

McKibbon, Hogan and Noland have modelled the general equilibrium impacts of multiple Trump policies. Taking their assumption of a 10% tariff across all counties, with retaliation, their model shows Australia’s GDP will be lower than without these policies, over the first two years. We fare better than the US, Canada, Mexico and China, not surprisingly, but impacted we are. In turn, our major trading partners China, Japan, South Korea (Chart 2), also experience lower than otherwise economic growth. The modelling also show Australia’s inflation to be higher than otherwise, in the first two years.

There remains a great deal of uncertainty regarding the policies that will, or won’t, be implimented, and how trading partners respond to potential tariffs. We can assume a higher degree of volatility in the rhetoric. Financial markets are responding to the newsflow as a consequence. It might take some time before they become more immune to the odd social media post.

Looking through the inevitable noise, we will need to assume slightly lower economic growth through the trade channel, and slightly higher inflation in the outlook, in response to the global changes. This does not change the RBA profile at this point in time, but it creates a wider probability band around any forecasts.

Views as at 30 November 2024.