BetaShares has two dedicated hybrid ETFs:

- BetaShares Active Australian Hybrids Fund (ASX:HBRD), which is actively managed

- BetaShares Australian Major Bank Hybrids Index ETF (ASX:BHYB), which is a passive fund that aims to track the performance of Solactive Australian Banking Preferred Shares Index

It’s important to note BetaShares’ two hybrid funds track different indices. The hybrid index will include other higher yielding but also higher risk securities compared to the exclusive major bank index.

I recently attended a BetaShares panel discussion with three guest speakers: Chris Joye, Chamath De Siva and Anthony Kirkham. Joye’s company Coolabah Capital manages the BetaShares Active Australian Hybrids Fund (ASX:HBRD) and he commented that he now finds listed hybrids expensive and that the fund has sold down its hybrids and currently prefers to invest in subordinated debt. How interesting that even though the fund is an active ‘hybrid’ fund, it can invest more in other securities.

1. BetaShares Active Australian Hybrids Fund (ASX:HBRD)

The HBRD product disclosure statement states:

The Fund invests in an actively managed portfolio of hybrid securities, bonds and cash. If, and when the hybrids market is assessed to be overvalued or to present heightened risk of capital loss, the Fund can allocate more of the portfolio to lower risk securities, including cash and Australian-issued senior bonds with investment-grade ratings.

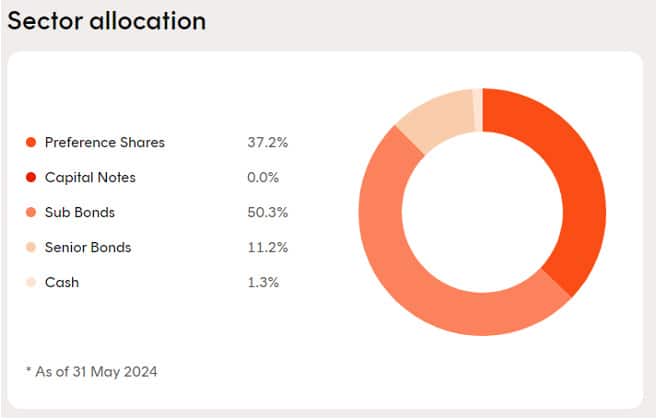

HBRD’s most recent factsheet as at 31 May 2024 shows the fund had 50.3% invested in subordinated bonds, 37.2% in preference shares (hybrids), 11.2% in senior bonds and a small allocation to cash.

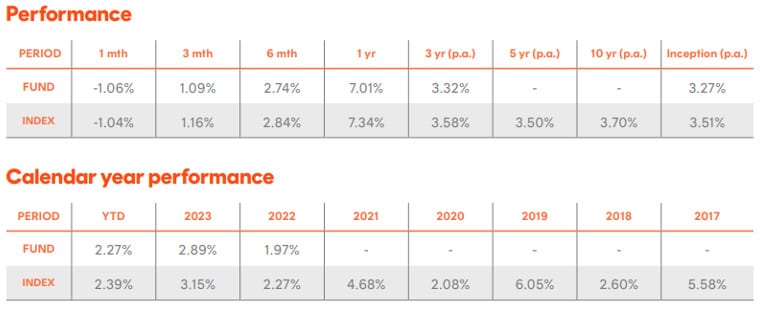

Over the last 12 months to 31 May 2024, HBRD has returned an impressive 7.28%, outperforming the Solactive Australian Hybrid Securities Index, which returned 7.12%. The return since inception in November 2017 is 3.87% and returns have been positive every year, a significant benefit given rising interest rates meant many fixed income funds suffered large losses over the same period.

Also read: The Macro Environment Has Turned Considerably

Encouragingly, the fund has outperformed its benchmark over one month, three months, six months and a year.

Source: BetaShares as at 31 May 2024

Portfolio characteristics as at 24 June show a gross running yield of 6.57%, the anticipated income for the next 12 months including franking credits, with a net running yield of 5.83% which excludes franking credits. Neither yield takes into account gains or losses on sale of securities.

The top 10 securities are worth 40.2% of the portfolio which holds 112 securities.

HBRD fees are 0.45% plus a performance fee of 15.5% of performance over the benchmark. The fund has $2.19 billion in net assets.

2. BetaShares Australian Major Bank Hybrids Index ETF (ASX:BHYB)

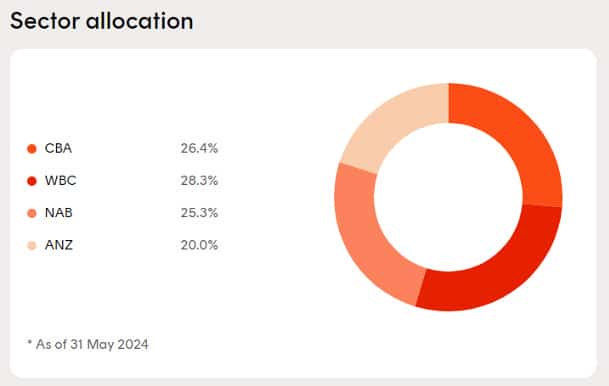

This ETF only invests in major bank hybrids. So, it’s a concentrated fund with just four issuers and 18 securities. The NABPH is the major holding with an allocation of 8.1% followed by NABPI with 6.7% and NABPF with 6.4%. The top three securities, all issued by NAB are worth 21.2% of the portfolio as at 31 May 2024.

Unlike the BetaShares HBRD actively-managed hybrid ETF, this fund is passive. Asset allocation is split between the major 4 banks. Westpac has the highest allocation at 28.3%, while ANZ the lowest at 20%.

BHYB’s return since inception is 3.27%, compared to the index at 3.51%. As BHYB is a passive fund, you would expect it to consistently underperform its index because of fees. Year to date the fund’s return is 2.27% against the benchmark’s 2.39% as at 31 May 2024.

Source: BetaShares as at 31 May 2024

Gross running yield for BHYB is a high 7.16% with net running yield of 5.13% and estimated yield to worst of 6.69%.

Positively, the fund pays monthly income but for a passive fund, with only 18 securities, the fees are relatively high at 0.35 per cent. The fund has $399m in net assets.

This is a passively managed fund with a small selection of securities from just four institutions where margins typically trade fairly closely anyway.

I think this is a good example of a fund that you could replicate. Buying securities direct means you incur trading fees but they are one-off and not ongoing – it’s even better if you trade on a no-fee platform.

In stressed markets, I would expect the hybrid index to fare worse given it holds higher risk securities which would be expected to fall further than the major bank hybrids.

Summary

Under usual conditions where HBRD invests in a full array of listed hybrids and BHYB just major bank hybrids, judging risk and reward would be relatively easy and HBRD would likely be considered higher risk. However, as HBRD now has more than 50% invested in lower risk subordinated debt and some of those issues would be major bank, assessing risk is much more difficult.

If you use yield as a guide, gross running yield is higher at BHYB, but would include more franking credits, which aren’t available to subordinated bond investors. If you can’t claim franking credits, net running yield is higher for HBRD. Which is higher risk? As of 31 May 2024, I’m not sure.

These two ETFs are less comparative than they have been in the past. The most important question to ask before you invest is whether you think you are being paid enough for the risk involved.