From Chamath De Silva, Head of Fixed Income at Betashares

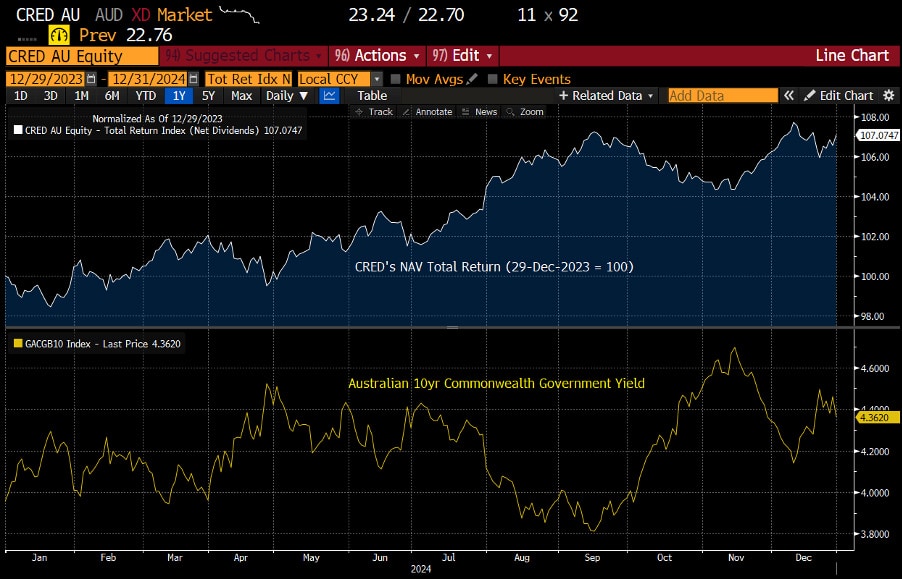

The Betashares Australian Investment Grade Corporate Bond ETF (ASX: CRED) – the largest corporate bond ETF in the country – recently hit a fresh milestone of A$1 billion in assets under management. During 2024 the fund took in $362 million of net inflows and investors were rewarded, with CRED returning +7.05% net of fees and outperforming both the Bloomberg AusBond Credit and Composite indices by 167 basis points and 414 basis points, respectively. The performance came despite another challenging year for traditional fixed rate bonds and long duration strategies.

The rise in long-term Australian Commonwealth Government bond yields over the year (10y +40bps) created a headwind. However, this was more than offset by the generous starting yield (5.60%) and continued credit spread compression, supported by receding US recession risks and the onset of a global easing cycle. Meanwhile, the interest rate-hedged version of CRED’s strategy (ASX: HCRD) delivered an impressive +9.30%, significantly outperforming the most widely followed floating rate credit benchmarks.

Looking ahead, with much of the focus now on the continued rise in global bond yields, CRED is increasingly likely to benefit from duration in the coming years. This is due to a steeper yield curve and the expansion of term premia – the component of government bond yields not explained by policy rate expectations alone. By targeting 5–10-year fixed rate corporate bonds with relatively high credit spreads, CRED’s index methodology is designed to capture multiple sources of risk premia – term, credit, and curve roll-down – to deliver superior long-term returns for Australian bond investors compared to traditional investment-grade benchmark indices.

Also read: Emerging Market Debt in 2025: Stick to Income and Relative Value in a Disruptive Year

The high starting yield of 5.80% should function as a buffer in case benchmark yields continue to rise, while also providing capital gains potential if either the domestic or global economic outlook were to deteriorate further. With the RBA likely to join the global easing cycle over the coming months as domestic inflation pressures continue to ease, and with recession risk expected to remain muted, CRED offers the sweet spot in Australian fixed income.